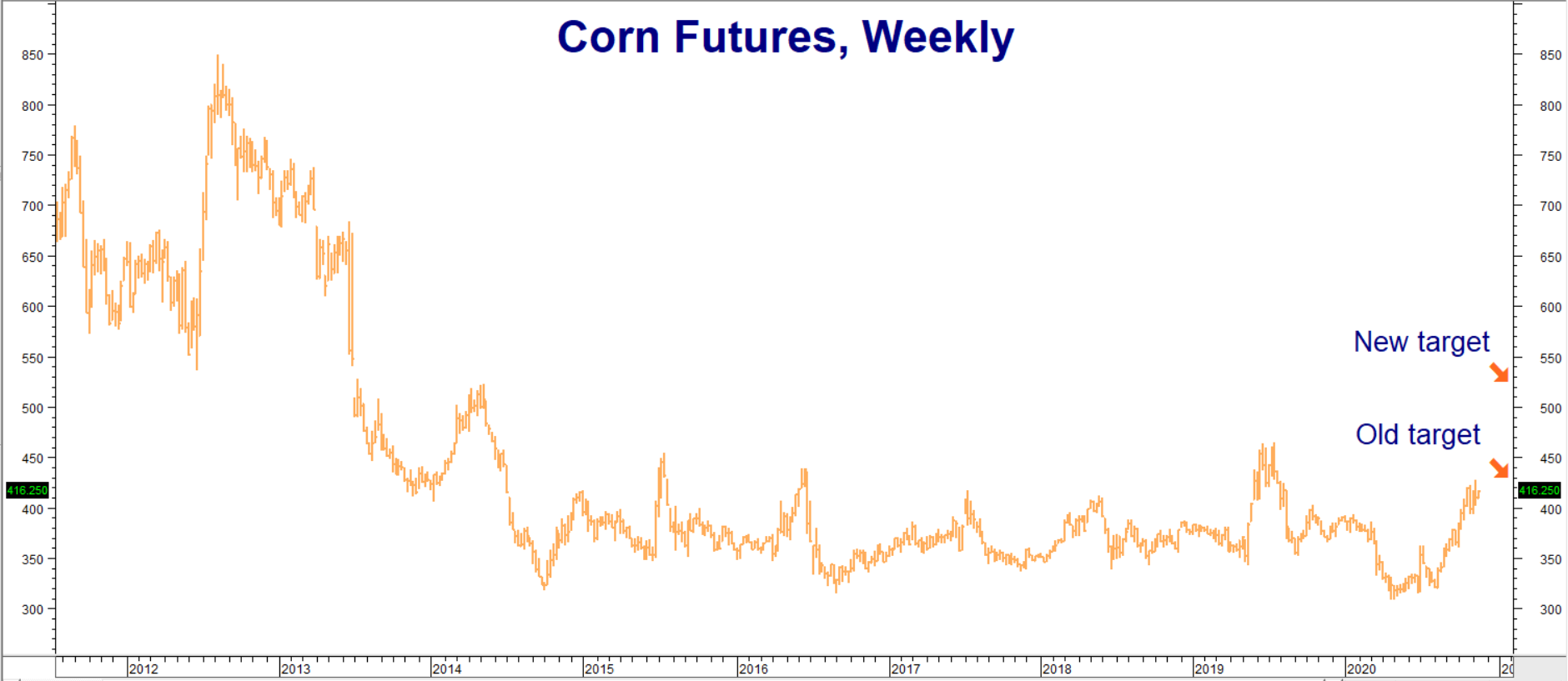

Soaring from a low of $3.09 per bushel on Fed stimulus and Chinese demand following March’s coronavirus outbreak, corn came within 7 cents of our upside objective of $4.35 per bushel last Thursday. The US Federal Reserve is talking about a new stimulus (targeted to workers most affected by the virus) to counter the potential for gridlock in the new American government while Chinese demand remains strong. It doesn’t look like either of these factors is going away anytime soon.

China’s pig crop was decimated by African Swine Fever (ASF). Feeding the new piglets necessary to cover losses requires lots of grain. A poor Chinese corn crop is forcing the Middle Kingdom to turn to the US to meet demand. The Chinese economy is also in the midst of an impressive recovery, rebounding 4.9% year-over-year. We expect consumer optimism will lead to bigger appetites in pork-loving China, further increasing demand. Lower corn yields due to unfavorable late-summer weather in the American heartland are helping prop up price as well.

Data Source: Reuters/Datastream

The December $3.60 corn calls we suggested purchasing for $650 on August 31 settled yesterday at $2,800. That’s the good news. The bad news is these options have 3 days left until they expire. Holding them to or beyond the November 20, 2020 expiration date means they will be probably be exercised and replaced by a futures contract. We are not interested in owning December corn futures contracts – especially with the delivery period right around the corner.

RMB trading customers still holding December 2020 $3.60 corn calls should consider exiting all of them immediately. Consider using part of the proceeds you receive to purchase an equal number of March 2021 $4.40 calls. These settled for roughly $700 each yesterday. RMB trading customers not holding December $3.60 calls may also want to consider purchasing March $4.40 corn calls.

We believe corn’s ability to rally in the face of seasonal harvest pressure is a signal of higher prices ahead. Our new upside target is a climb to $5.20 per bushel in the March contract. March $4.40 calls will be worth at least $4,000 should the yellow grain hit our $5.20 per bushel target prior to expiration on February 19, 2021. Maximum risk is the cost of this call plus transaction costs.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.