Many commodities have switched from bear to bull markets over the past 6 months. If you follow us, you know we have been banging the commodity drum for at least the past two years. Our reasons have less to do with individual supply/demand factors – although still very important – and more with the incredible amount of cash being injected into the system by the Federal Reserve and Federal Government to combat the economic effects of COVID-19.

Data Source: Reuters/Datastream

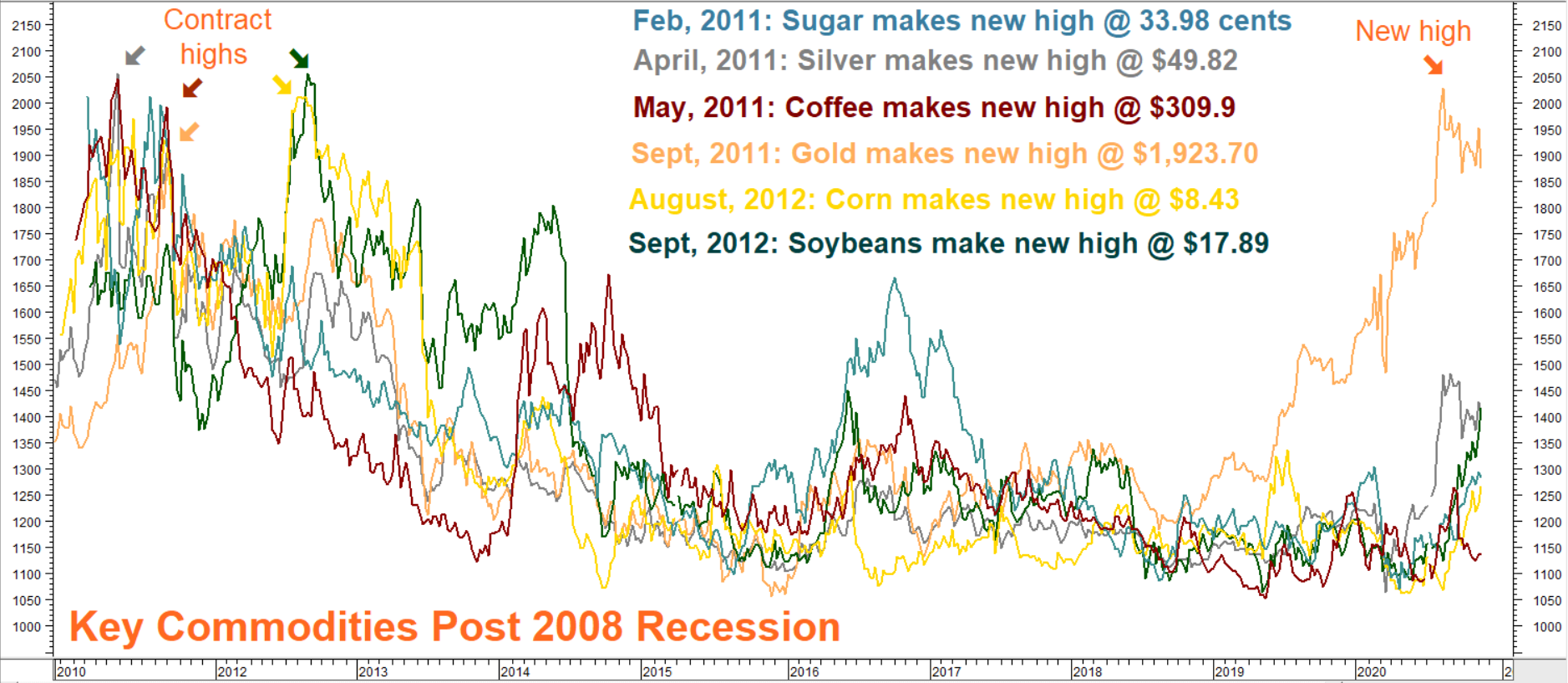

If you’ve read our blogs, you’ve seen this chart before; it illustrates what happened after the last big recession. Commodities soared to new highs on the back of the $800 billion TARP stimulus and massive bond-buying by the Fed. Inflation picked up and so did commodity prices – helped in no small way by troublesome weather in key growing areas of the globe. We believe a similar scenario is unfolding now. But instead of $800 billion, the current stimulus is approaching $3 trillion, with a least a trillion more expected to follow.

All this cash has the potential to juice inflation far above the mild increase after the Great Recession of 2008. It is one of the main reasons we’ve recently recommended long positions in all of the commodities shown on the chart above with the exception of one: coffee (in red). Coffee was a leader of the 2011/2012 commodity comeback. Now it is barely awake. Currently trading at $1.10 per pound, coffee is a full $2.00 below its all-time high of $3.09 in May 2011, making it one of the last cheap commodities on the board right now.

Demand Muted by COVID, But Should Return with Vaccine

A drop in demand due to the coronavirus is responsible for much of the weakness we are seeing in coffee. Fear of the virus is keeping people home and away from coffeehouses and other coffee-fueled social gatherings. Overall demand is forecast to fall for the first time since 2011 due largely to the virus. We expect global demand for coffee will continue its upward trajectory once the coronavirus pandemic is perceived to be under control. A change in government in the US could be a big step in making this happen – especially in coffee-crazy America.

The longer-term demand picture is much brighter. Coffee is the most widely-consumed beverage in the world and the second most-traded commodity after crude oil. Populous, tea-loving Asia has discovered coffee. Starbucks now gets 10% of its revenue from China, following a massive investment in the Middle Kingdom. China seems to have escaped the worst of the coronavirus so it would not surprise us to see demand continue to grow there. Coffee demand in India is also on the rise.

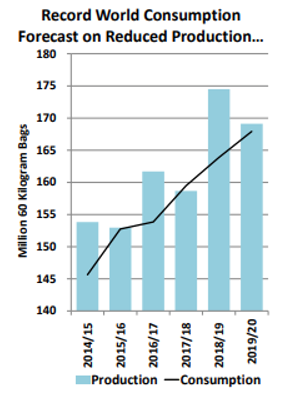

The chart above (courtesy of the USDA) shows the steady growth of coffee consumption overlaid against rising production. Production has been able to keep pace with demand so far, but not by a lot. Brazil is responsible for 40% of the Arabica beans that make up coffeehouse coffee. Arabica beans are preferred by Americans and American coffeehouse companies like Starbucks and make up most of the beans consumed globally. It wouldn’t take much of a disruption in Brazilian output due to unfavorable weather to severely impact supplies and disrupt the balance currently imbedded in prices.

Coffee Poised to Percolate Back Up to $1.40 per Pound

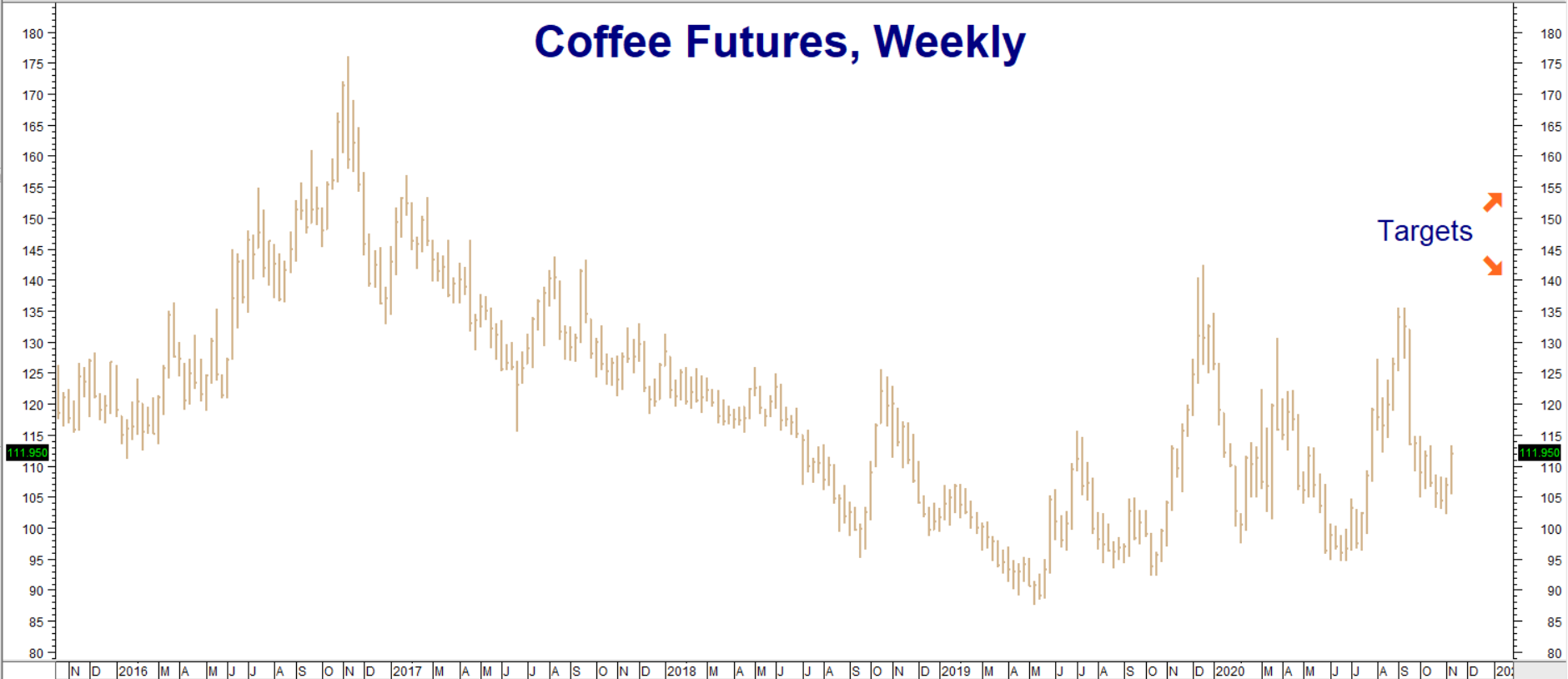

Coffee spent the last the past year tracing out a large trading range marked by support at 95 cents per pound and resistance at $1.40 per pound. Recent price action is signaling another potential test of the high side of this trading range. Big rallies in corn, soybeans, gold, silver and sugar are telling us something is brewing in commodities. Will it include coffee? Only time will tell. The trade suggested below gives us a fairly low-cost peak at a move back to resistance at $1.40 per pound. Take out old swing highs just above $1.42 and our second objective of $1.55 per pound comes into play.

Data Source: Reuters/Datastream

RMB Group trading customers may want to consider buying March $1.25 ICE coffee calls while simultaneously selling an equal number of March $1.40 ICE coffee calls for a net cost of $750 or less, looking for a move up to $1.40 resistance prior to option expiration on February 10. Your maximum risk is the net cost of the trade plus any transaction costs.

This “bull call spread” has the potential to be worth as much as $5,625 at or above our $1.40 per pound target prior to option expiration. Consider exiting this position in its entirety if and when our $1.40 objective is hit.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.