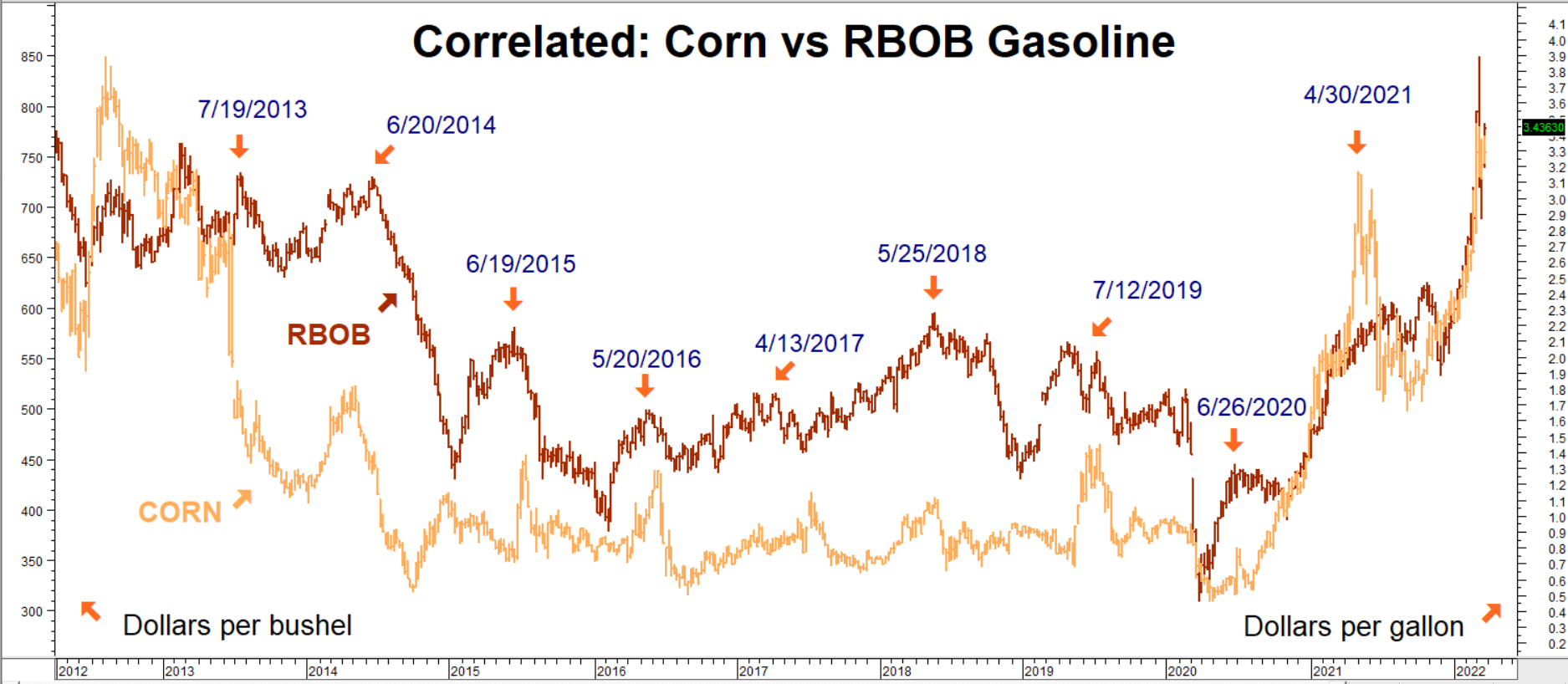

Weather and war are fueling powerful bull markets in corn. Huge amounts of North American corn are used to produce ethanol which is mixed into gasoline. What really intrigues us right now is the relationship between the prices of corn and gasoline and what it could be telling us about the future. Both markets share similar seasonal tendencies.

Unleaded gasoline tends to rise into late spring in anticipation of the summer driving season and fall once it is underway. Corn tends to rise during the same timeframe due to uncertainty. The South American harvest is in the bins and accounted for. But the North American harvest is just being planted and subject to unknown weather conditions. This uncertainty results in a “risk premium” that tends to disappear once the crop is in the ground.

Data Source: Reuters/Datastream

As the chart above illustrates, corn and gasoline are correlated both in terms of overall price direction and seasonality, with major peaks occurring in late spring and early summer. One bushel of corn produces 2.7 to 2.8 gallons of ethanol. Corn makes up 65 to 75 percent of the cost to produce ethanol at prices exceeding $4.00 per bushel. Most automobile gasoline sold in the US is a 10% ethanol mix. This means a lot of corn is mixed into gasoline. It’s part of the reason why these two commodities tend to track one another.

Seasonals, Demand Destruction & the End of Globalization

Will these seasonal tendencies hold up this year? Only the market knows for sure. The war in Ukraine has the potential to push price in either direction. Cutting Russian energy from the global economy has the potential to ignite further rallies. But it also has the power to curtail demand. The old traders’ saying, “the best cure for high price is high prices,” applies here. Expensive gasoline means people will drive less. Expensive corn may cause refiners to blend less of it into gasoline.

Macroeconomic factors also come into play. The war in Ukraine marks a violent end to the age of globalization, the decline of which was already in motion due to Covid. Globalization led to efficiencies that were friendly to growth. The end of globalization reduces or eliminates many of these efficiencies. Growth suffers. So does global GDP. Slower growth eventually reduces demand for most everything.

Population-rich China is a major importer of energy and grain. Its efforts to control Covid are failing. Rapid spread is forcing the Middle Kingdom to impose a staggered lockdown on Shanghai, an economic powerhouse containing 26 million people. Covid could just be ramping up in China. This would mean more lockdowns and demand destruction in the second largest economy in the world.

The fact that Covid is rampaging the world’s most populous country at the same time as the beginning of a seasonally “toppy” period for corn and gasoline is intriguing. We believe it to be a reasonable argument for a low-risk contrarian short position. Russia’s apparent decision to scale back its objectives in Ukraine and focus on the Donbass is another.

It’s planting season in Ukraine. Ukraine is the globe’s 5th largest wheat exporter. A ruined crop could mean famine in many parts of the world – especially the Mideast. We doubt that, with all of its image problems, Russia wants to be blamed for global famine too. Spring in Ukraine also means soggy ground, making it even more difficult for Russian mechanized columns to maneuver. They become “sitting ducks” for Javelin anti-tank missiles. We expect a cease fire soon. This will put pressure on a number of commodities.

Consider Low-Cost Bear Put Spreads for Contrarian Corn Play

We would love to take a low-risk bearish in gasoline, but high volatility premiums and lack of liquidity in the RBOB gasoline options make it difficult, if not impossible. Corn options are far more liquid and, in our opinion, offer better risk-to-reward tradeoffs than anything on the short side of the energy sector right now.

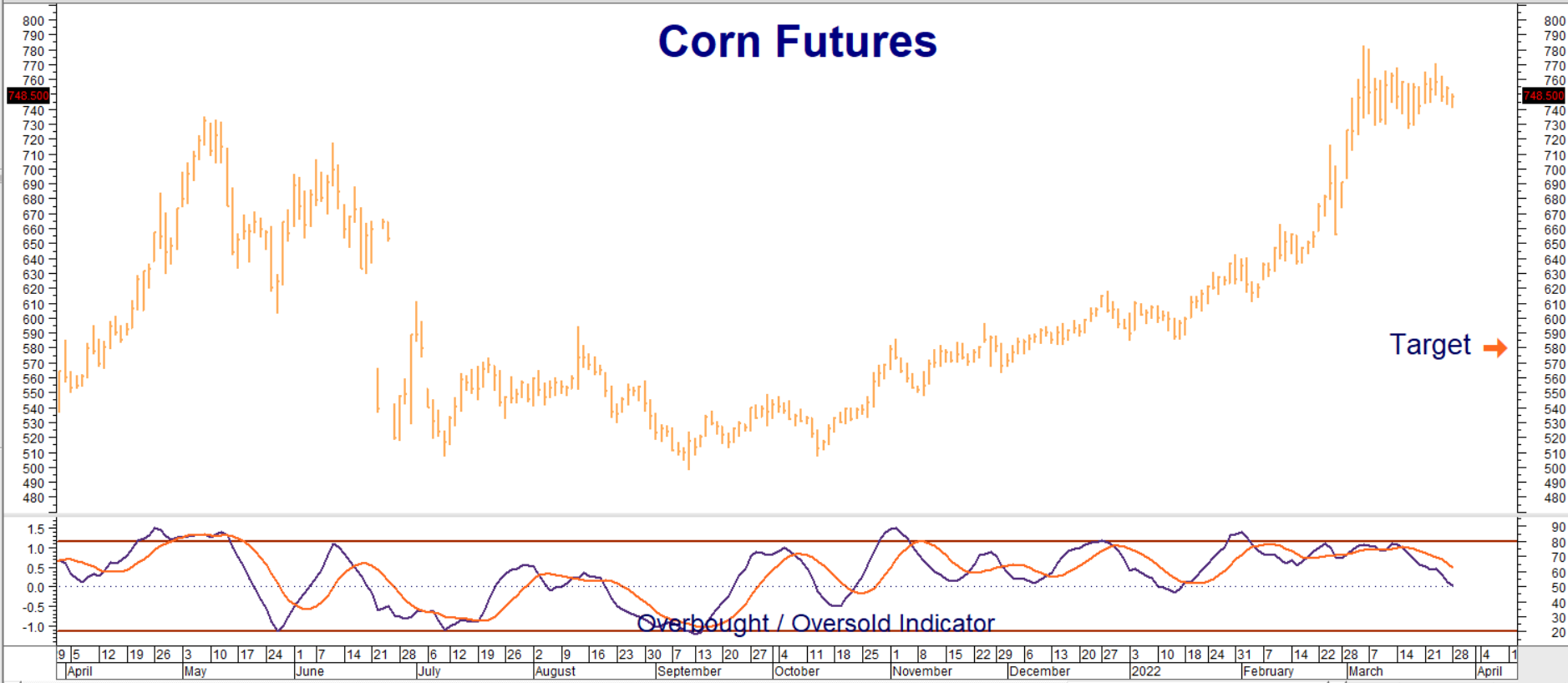

Data Source: Reuters/Datastream

RMB Group trading customers may want to consider buying July 2022 $6.50 corn puts while simultaneously selling an equal number of July 2022 $5.80 corn puts for a net cost of $650 or less. Look or July futures to hit our Fibonacci-derived $5.80 target prior to option expiration on June 24, 2022.

Your maximum risk is the net amount paid for these spreads plus transaction costs. Each spread has the potential to be worth as much as $3,500 should July futures finish at or below $5.80 at option expiration. Consider exiting all positions if and when our $5.80 downside target is hit. Prices can and will change, so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.