Heading to Europe this summer? You may be in for a pleasant surprise; the euro is on sale. At just 109.00 to the dollar, the euro is approaching lows made during the 2020 Covid collapse. Currently yielding 2.78%, US 10-year US Treasury notes pay out far more than the 10-year bonds of any of the major European nations. This makes the US dollar one of the most attractive currencies on the planet. That could be changing.

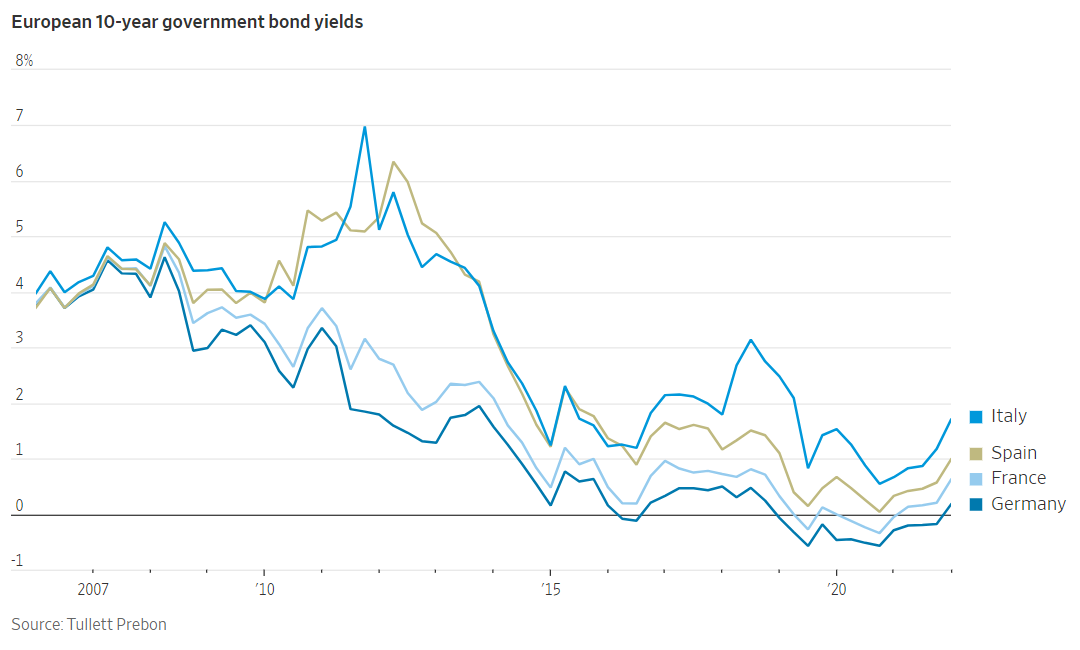

After months of trading near or below zero, 10-year European bond yields are starting to climb. With year-over-year eurozone inflation now 7.5%, the path of least resistance for European yields is now to the upside. The chart below shows the beginning of this upward trend across major European economies.

Compare this with the one-way explosion in US Treasury yields. (See chart below.) We believe this move is a bit ahead of itself and that the huge spike in yields and huge sell-off in US 10-year note prices are overdue for significant corrections. Combine a correction in US yields with a renaissance in European yields and you get the formula for a rally in the euro.

Source: Yahoo Finance

War in Ukraine a Double-Edged Sword for the Dollar

The war in Ukraine is friendly for the dollar because as the world’s reserve currency, it is considered the safest place to be. Most global commerce is conducted in the greenback and for years has been the only way to pay for energy and many key commodities. This is what is supporting the dollar now.

However, these benefits can have a darker side. Russia, one of the top suppliers of crude oil, can no longer receive dollars for its crude oil and is currently accepting rubles and potentially Chinese Yuan as payment. At 1.6 million barrels per day, Russia is China’s second largest supplier of crude. At 1.76 million barrels per day, Saudi Arabia is China’s first largest supplier. Saudi may soon accept yuan for their oil as well – especially if sanctions are imposed.

Most of the world’s population centers – think China and India – have vested interest in keeping energy spigots open to feed their growing economies. Both have chosen not to take a side in the War. This is no accident. Our guess is China and India will not hesitate to use a currency other than US dollars to pay for energy if it is in their interest. This threatens the standing of the greenback as the world’s “go-to” currency and its lofty price level as well.

Euro Nearing Long-Term Support

We prefer using euro futures as a proxy for the dollar because their options are generally more liquid than dollar index options. The euro makes up most of the currency basket that defines the dollar index (DX) and moves opposite the dollar index. A strong dollar tends to correspond with a weak euro, and vice versa.

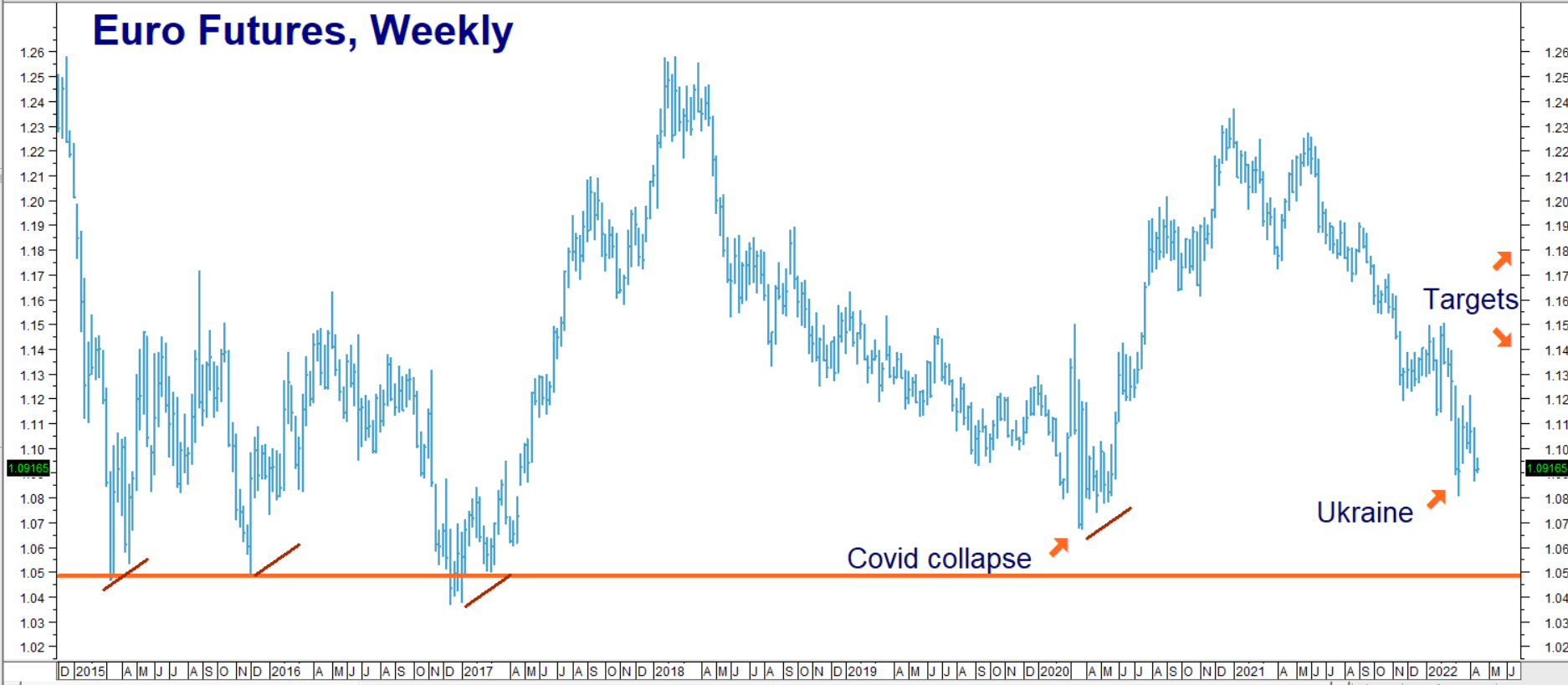

Euro futures are testing long-term support just above the low made during the Covid collapse of 2020. The War in Ukraine is responsible for much of this decline, but we believe the economic drag imposed by the war on Europe is already largely discounted in its price. Eurozone inflation is picking up rapidly, aided by exploding energy costs resulting from Europe’s dependence on Russia. Inflation will soon be the next enemy the EU will have to face.

The euro is also nearing support on a long-term basis. Euro futures tested the $1.04 level four times in the past seven years. It bounced sharply every time. It is in the process of testing it for a fifth time. Will it bounce again? Only the market gods know for sure. However, given the current levels of inflation in the eurozone and the need of the European Central Bank to act soon to control it, we are willing to make a fixed risk bet that it will.

Data Source: Reuters/Datastream

Two Targets, Two Timeframes

As the chart above illustrates, upside reversals in the euro can be impressive. We have two targets: the first is resistance at old swing highs of $1.14 and the second is our ultimate Fibonacci-derived goal of $1.18. Wartime conditions mean a reversal could begin at any time. RMB Group trading customers may want to consider taking a flyer on our first target by purchasing the June 2022 $1.11 Euro calls traded on the CME. These settled Monday for $675. Pay no more than this.

Your maximum risk is the price paid for your call options plus transaction costs. June $1.11 calls with be worth at least $3,750 should our $1.14 target be hit prior to option expiration on June 3, 2020. Our second target will take longer. We’ll wait and see what the euro does during what could prove to be an interesting spring for Europe. Prices can and will change so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.