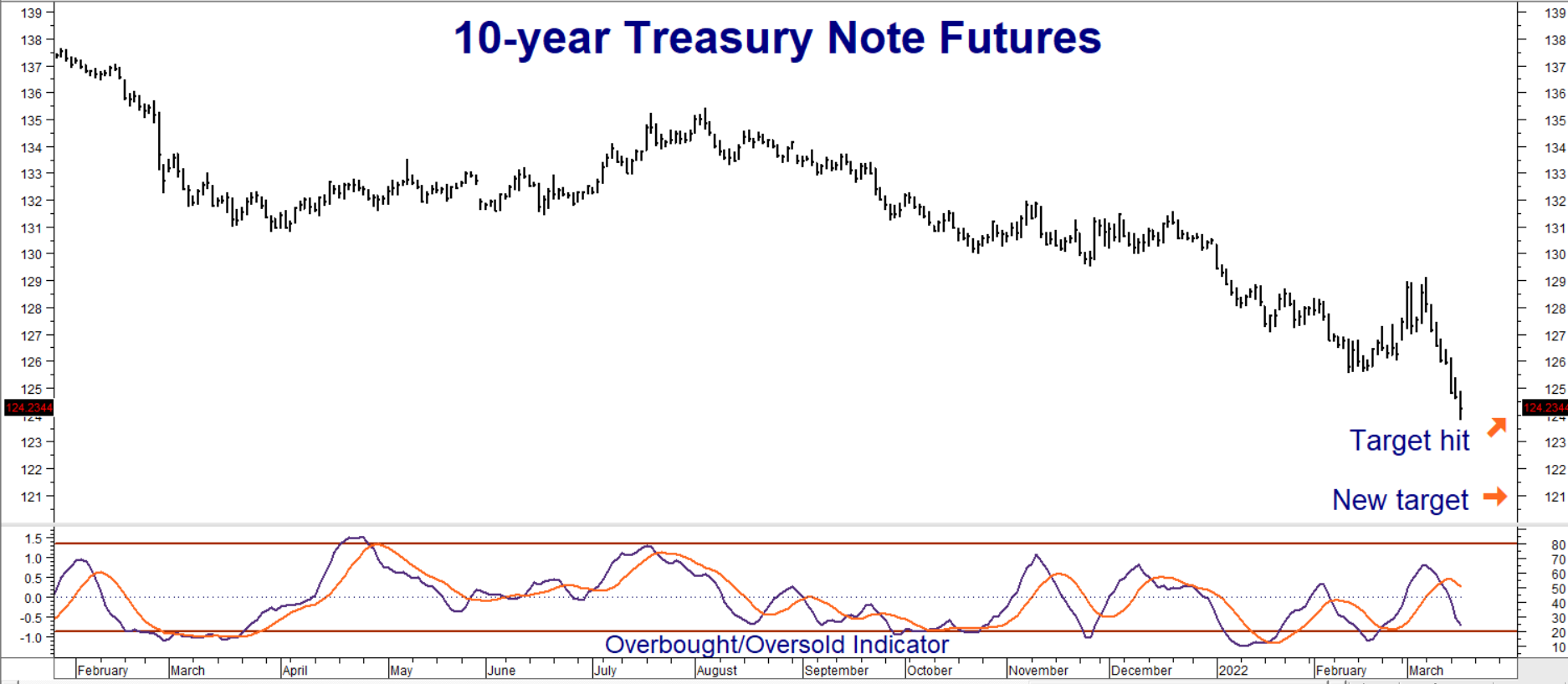

The luck of the Irish came a day early yesterday. June T-note futures hit and then dipped below our most recent downside target of 124-00 before recovering after the Fed’s announcement of a 25-basis point rate increase. Can T-notes fall even further? Certainly. The Fed is now officially in tightening mode. The punch bowl is gone. The party is over.

The depressive economic effects of the war in Ukraine is often cited as a reason the Fed won’t tighten as much as investors fear. But the war is also causing supply shortages which increase inflationary pressure. The UK just announced another rate increase. The European Union shouldn’t be far behind. T-notes are in a bear market so our bias will remain bearish.

Data Source: Reuters/Datastream

Use a Corrective Bounce to Re-establish a Bearish Position

But that doesn’t mean we won’t see some impressive corrective rallies along the way. We’ll wait for one and use it to establish new bearish positions. T-note futures are rapidly approaching oversold territory, so it wouldn’t surprise us to see a bounce soon. Our new Fibonacci-derived downside target for T-note futures is 121-00 in the front contract.

RMB Group trading customers who took our suggestion to buy April 126-00 puts and who haven’t already exited their positions, should consider doing so immediately. Our April 126-00 T-note puts settled yesterday for $1,812.50. They are going for $1,500 as we write this. Consider placing a new order to buy June 124-00 T-note put options for $656.25 or less as a replacement.

Your maximum risk is your entry price plus transaction costs. June 124-00 puts will be worth at least $3,000 should the market hit our new 121-00 objective prior to option expiration on May 20, 2022. We’ll need a bounce in T-notes to get filled on this trade. Prices can and will change so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.