Soybeans were a bargain when we wrote about them in early March. We believe they still are. Soybeans have labored under the deflationary conditions plaguing the rest of the agricultural commodity sector. COVID-19 is just the latest of many bearish demand shocks which have included African Swine Flu (ASF) in Asia and the ongoing US/Chinese trade war.

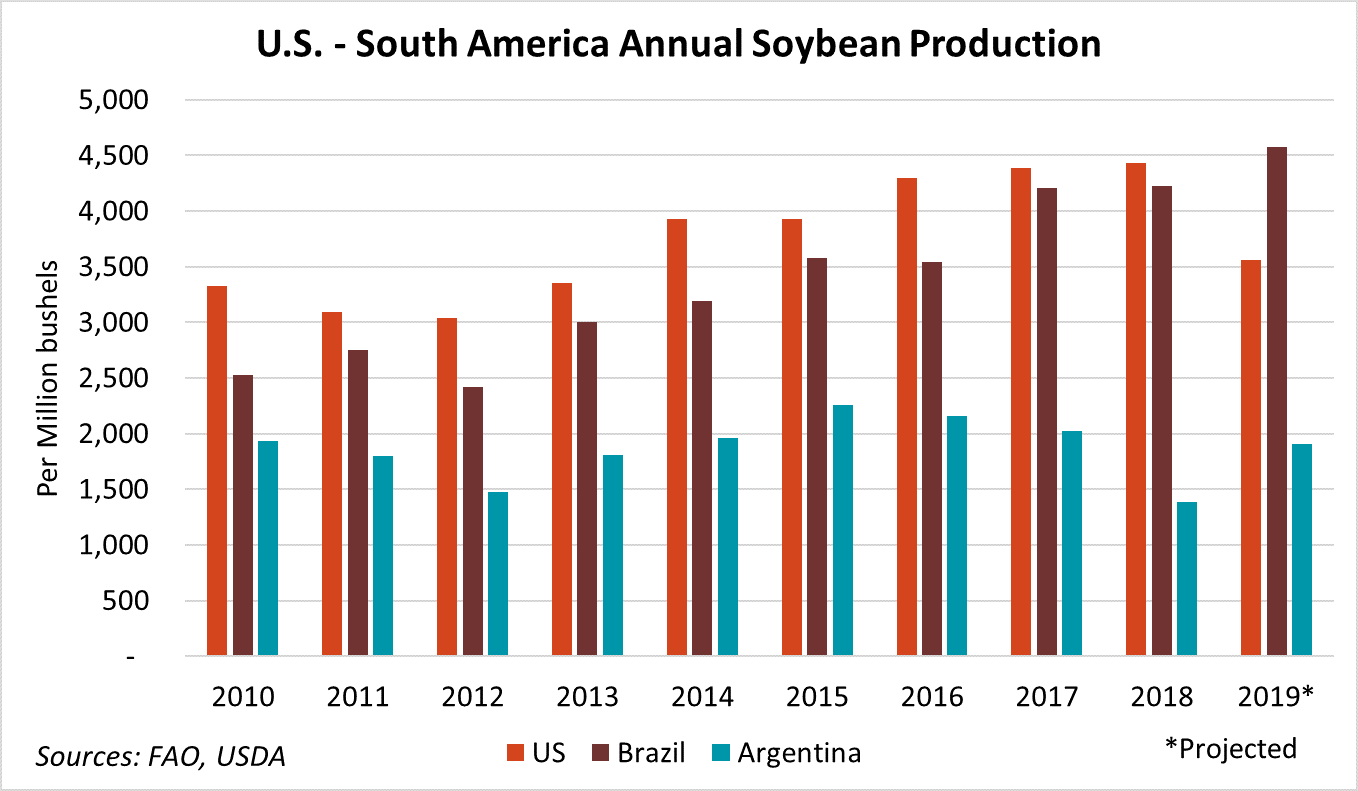

ASF decimated the Asian hog population, reducing the need for grain-based feed. The trade war caused China – the biggest importer of American soybeans – to slap retaliatory tariffs on US beans and turn to South America for their import needs instead. Chinese demand has made Brazil the biggest producer of soybeans, dethroning the US for the first time in 2019. Trade wars have casualties. American market share was one of them as the chart below illustrates.

Source: Farm Progress

Brazil cleared so much land to meet post-tariff Chinese demand that this year’s crop is expected to set a record despite losses due to dry conditions. This cleared land will probably not be allowed to revert back to jungle anytime soon. This means Brazil will probably own the title of “the world’s largest soybean producer” for some time.

Brazil’s weak currency doesn’t help matters. One dollar bought 4.03 reals at the beginning of this year. It now buys 5.71 reals. Brazilian farmers’ costs are in reals. This enables them to accept fewer dollars to get the same, bottom-line result. Argentina’s currency is even weaker, encouraging price pressures there as well.

Big Supplies Factored Into Price, But Weather Isn’t

We believe the worst has already been factored into soybean futures. With global population continuing to rise, and more mouths to feed every year, soybean demand for human and livestock consumption is not going away. American meatpacking plants will eventually re-open and the Chinese pig crop will be replaced. With the South American harvest nearly behind us, the next focus of traders will be North American planting and early growing-season weather.

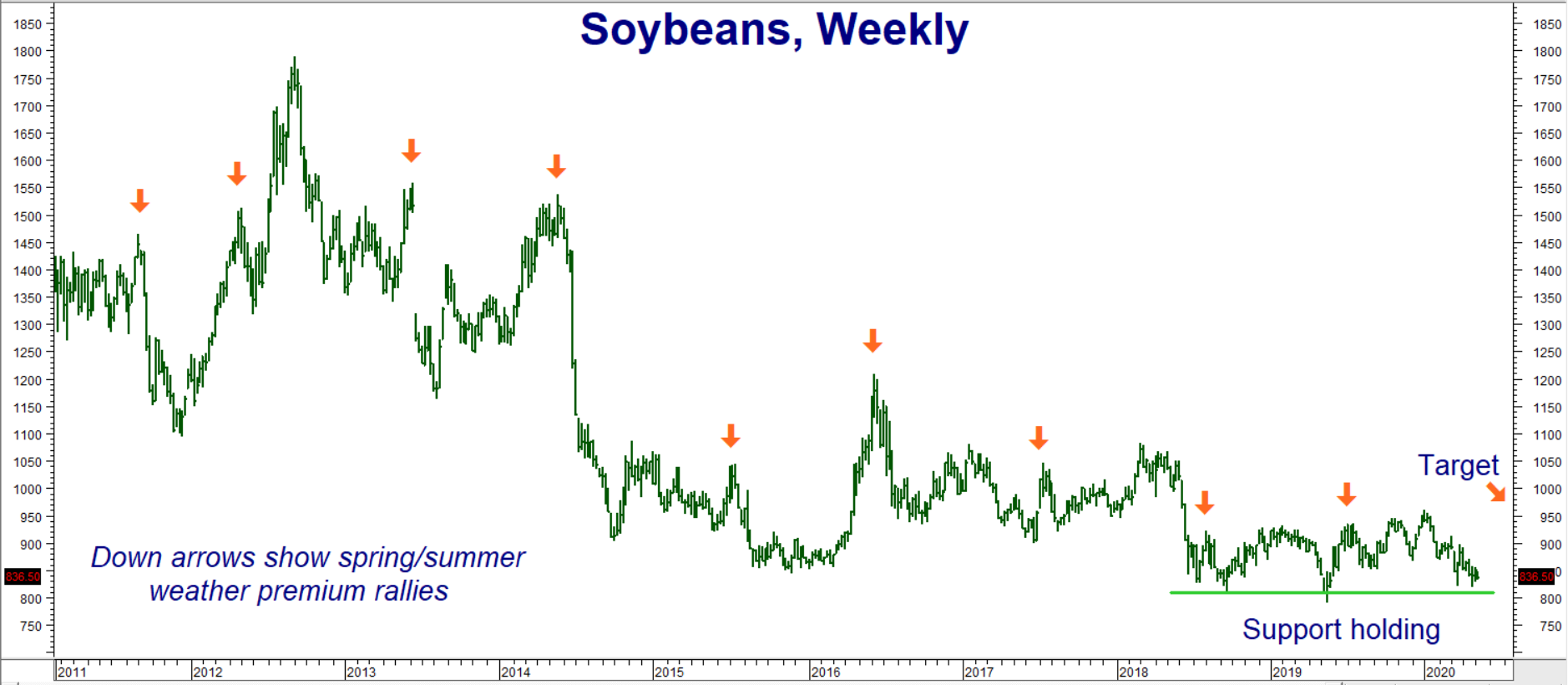

Weather trumps everything when it comes to the price of soybeans. One bad crop in either hemisphere could have an outsized effect on price. Soybeans (and corn) prices tend to rise during spring and summer months to reflect potential loss of yield due to weather. This can be seen clearly in the chart below. And while there is no guarantee this premium-building price action will occur again this year, there is no premium for potentially bad weather built into this market at all.

Data Source: Reuters/Datastream

Low price, the lack of a weather premium, and the ability (so far) of soybean futures to hold support at $8.00 per bushel led to our mid-March recommendation to purchase November $9.00/$9.60 bull spreads which were trading for around $650 each. They are going for roughly the same price now. Soybeans are testing 10-year support at $8.00 per bushel again. RMB Group trading customers who did not take advantage of the opportunity to get long at these bargain-basement levels six weeks ago may want to consider doing so now.

Our target remains the top of this market’s multi-year trading range at $9.60 per bushel. Adverse weather conditions could send this market even higher. Your maximum risk is the amount you pay for your spread plus transaction costs. Each spread has the potential to be worth as much as $3,000 at our $9.60 objective.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.