Silver is known as “the poor man’s gold” because it has always been cheaper than its yellow cousin due to its relative abundance. There is approximately 19 times more silver in the earth’s crust than gold. Back when both metals were money, it took 16 to 25 ounces of silver to buy one ounce of gold. This relatively tight relationship ended when President Nixon pulled the US out of the Bretton Woods Agreement in 1971 and severed gold’s connection to the US dollar.

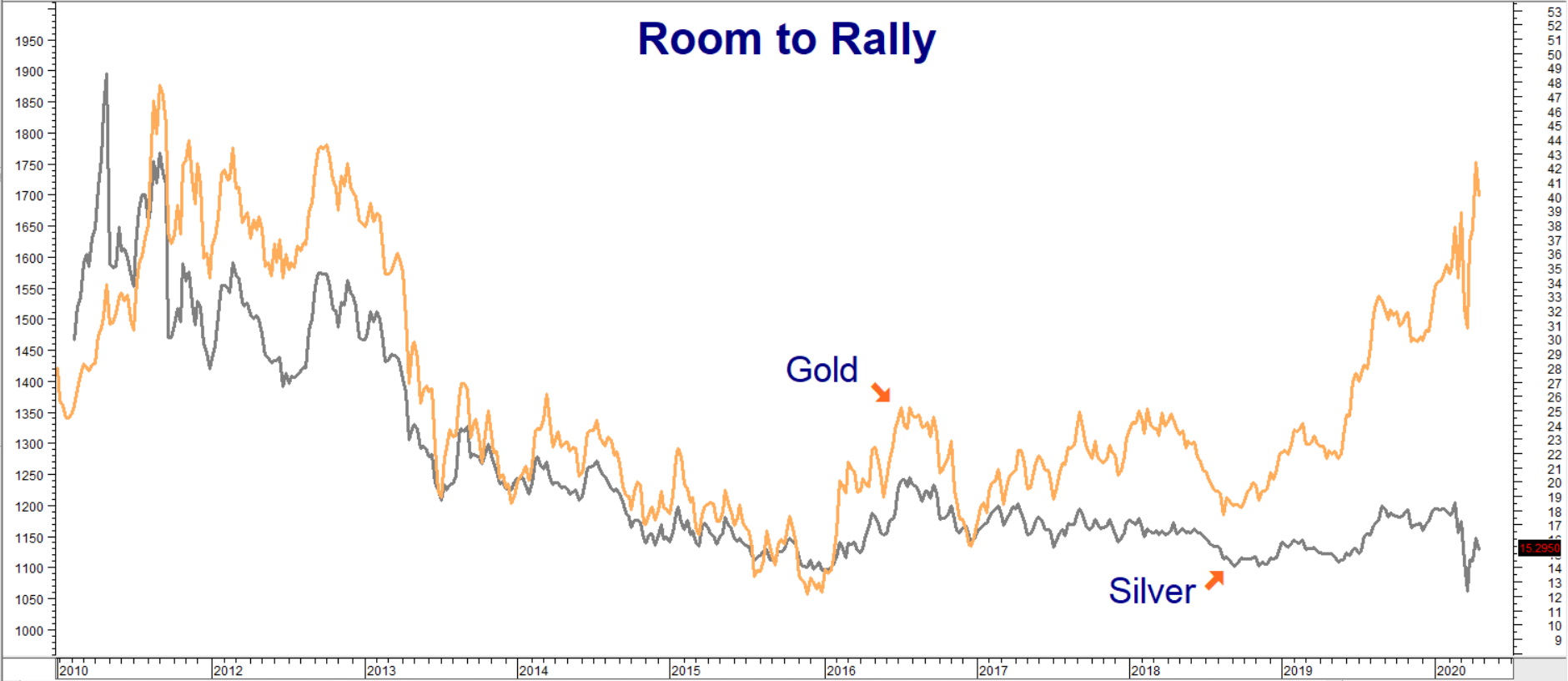

The chart below shows the ever-changing relationship of silver and gold going back to 1975. Silver is more volatile than its richer cousin. It tends to rise faster in bull markets and fall more quickly in bear markets. Because of this, the gold / silver ratio tends to be inversely correlated to the overall trend in precious metals: it has a history of peaking at the bottom of precious metal bear markets and of bottoming at the peak of bull markets.

Date Source: FutureSource

A high gold / silver ratio tends to correspond with low silver prices. A low ratio tends to correspond with high silver prices. Its low of 17.5 occurred during the top of the infamous Hunt brothers rally in 1980. Its old high of 97 matched up with silver’s fall below $5.00 per ounce in 1991. This fairly reliable relationship was totally upended in March 2020 when COVID-19 fears caused a massive liquidation in silver that blew the top off the gold / silver ratio. It took 124 ounces of silver to buy one ounce of gold in late March. Silver is still massively undervalued vis-à-vis its historical relationship to gold as we write this.

Silver Has Been Frustrating for Bullion Holders

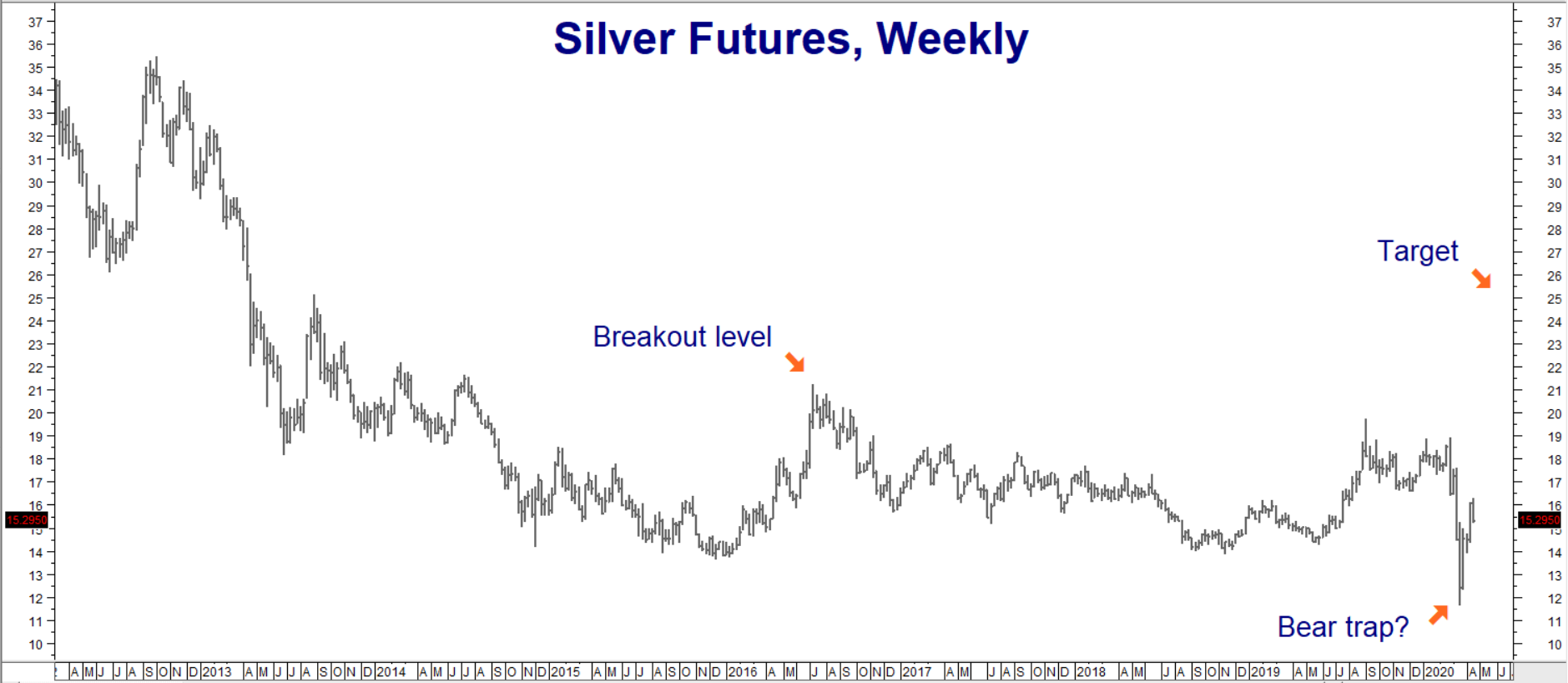

The last five years of sideways price action have been frustrating for silver bulls. The coming months could make silver equally frustrating for the bears. Bull markets in silver are almost never caused by traditional supply / demand concerns. Investment demand and hoarding are the catalysts behind nearly every silver bull market. Investors tend to buy “the poor man’s gold” because it is a cheaper alternative to its richer cousin. The cheaper its relationship to gold, the more attractive silver becomes.

Data Source: Reuters/Datastream

Stuck in a sideways pattern since 2014, silver has been oscillating between support at roughly $13.50 per ounce and resistance at $21.00 per ounce – making it “dead money” despite the rollicking bull market in gold. Investors owning a substantial amount of physical silver are not only paying storage and insurance costs, they are not earning interest on their silver holdings. They are losing both money and opportunity as silver trades back and forth in a multi-year range.

What if there was a way to keep upside exposure to silver without the costs of storing and insuring it? We’ll explore such a strategy later in this report and show you how it’s possible to “rent” silver for pennies on the dollar, freeing up capital to earn returns elsewhere. But before we get to this strategy, let’s take a look at why silver is so cheap, both on an absolute basis and in its relationship with gold.

Why Is Silver So Cheap Versus Gold?

While they have come down substantially, central bank interest rates in the US are still higher than those in most of the developed world. Higher relative interest rates increase the opportunity cost of holding physical silver and gold (which earn no interest). Higher interest rates in the US also help to prop up the US dollar. Capital will chase the highest returns, so demand for the dollar has been strong.

A strong dollar impacts the poor man’s gold directly because it takes fewer dollars to buy the same amount of silver. Silver may have stabilized versus the dollar – but it has soared in Turkish lira, Russian rubles, Iranian rials, Argentine pesos and Brazilian reals. Those currencies have collapsed due to financial mismanagement, US sanctions, or a combination of both.

Another factor could be the proliferation of easy-to-trade gold ETFs. These allow smaller investors to take positions in gold for less than the cost of gold coins or bullion. It is possible that gold ETFs could be siphoning smaller investors who would have been traditionally priced out of the gold market and turned to silver. Because of gold ETFs, they need to no longer.

But gold’s dramatic outperformance during the COVID-19 crisis has also created a scramble for physical metal as investors pile into gold ETFs. Most of these ETFs are backed by physical gold. Huge ETF demand, combined with large purchases by central banks, means physical gold is getting harder and harder to come by. We wonder how long it will take for some of the more popular ETFs to reduce their gold backing given the current supply issue. Silver stands to be a huge beneficiary if and when this occurs.

Silver’s Split Personality

Unlike gold which is mostly a financial metal, silver has a split personality: it is both an industrial and a financial metal. How investors see silver nearly always determines its fate. It tends to do poorly when viewed as the former and to do well when viewed as the latter. Roughly 60% of silver demand comes from industrial uses. This split personality makes silver hard to value by traditional means.

Stockpiles of gold held in warehouses and by central banks are fairly easy to calculate because gold tends to stay put. Industrial demand makes stockpiles of aboveground silver nearly impossible to pin down. Gold may be 19 times rarer in the earth, but some estimates peg aboveground gold as 5 to 7 times more abundant than aboveground silver.

Silver is not as liquid as gold which means each rush of new buying has an outsized effect. This lures even more investors into the market in a positive feedback loop that causes silver to rally faster and further than gold in well-established bull markets. The same dynamic works in reverse in precious metal bear markets.

The more silver is seen as a precious metal and alternative to gold, the higher it tends to go on a percentage basis. This is why the gold / silver ratio is so important. It tells us exactly where this dynamic is at any given point in time. “Room to Rally” (chart below) is another way to look at the relative price dynamic between gold and silver. Gold’s price is on the left. Silver is on the right. Will the poor man’s gold finally catch up to its richer cousin? It needs to clear $21.22 and break its sideways pattern first.

Data Source: Reuters/Datastream

Notice how closely gold and silver tracked until early 2017, and how much they have diverged since then. This coincides with the start of the tariff war. Gold broke out of its 5-year trading range in late June and appears to be consolidating for a move higher. Silver has a long way to go to do the same. The market is still viewing silver negatively as an industrial metal which could suffer from a global slowdown. Silver’s late-March COVID-19 breakdown to $11.50 per ounce put an exclamation point on this.

However, things are looking up on the industrial side. One of silver’s main sources of industrial demand came from photographic film. Film use declined rapidly in the digital age, denting demand for silver. This demand is now being replaced by the growing market for solar panels.

Silver Should Shine in the Green Economy

One of the best electrical conductors known to man, silver is a key component of solar panels. Each panel uses roughly 20 grams (2/3 oz.) of silver. Solar silver demand dropped in 2019 due to “thrifting” by solar panel manufacturers attempting to reduce the cost of their panels. We expect this drop to be temporary as the demand for solar panels continues to rise. Solar power is already cheaper than coal and petroleum-fueled power. It will soon be cheaper than natural gas. Couple this with big advances in battery technology due to come online soon, and the demand for solar panels could explode.

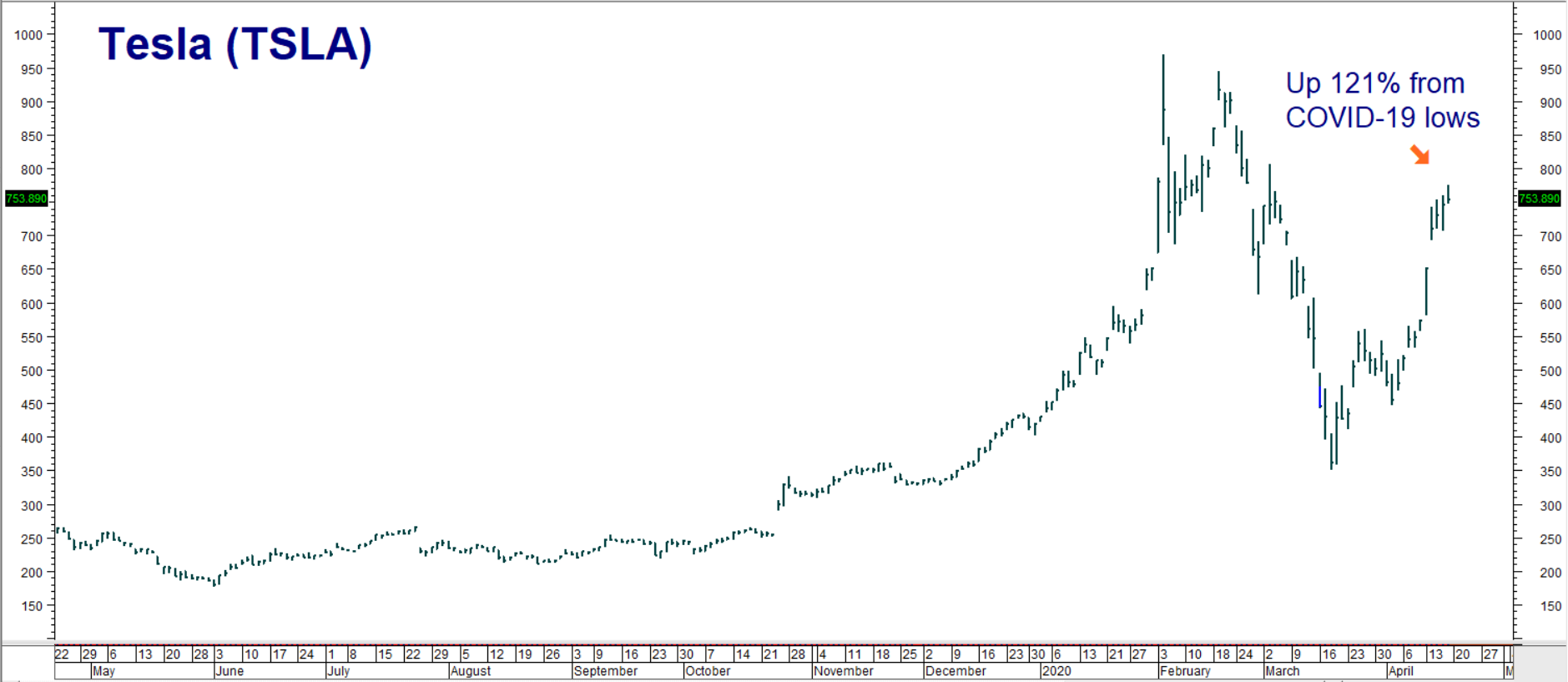

Green energy should continue to be one of the hottest market sectors. Photos of crystal-clear air in normally be smog-choked cities across the globe are circulating on the internet. They are a small window into what the world would look like with an electrified transportation system. Electricity from renewable energy sources is the future. It is the reason why electric car maker Tesla’s stock is one of the hottest on the board – up 121% from its COVID-19 lows as of this writing.

Data Source: Reuters/Datastream

Tesla is much more than a car company. It is also the global leader in battery technology – especially big, industrial batteries that can charge with solar power and then release energy back into the grid when the sun goes down or during peak demand. This could make gas-fired “peaking plants” obsolete within a few years.

Like him or hate him, Elon Musk has changed the trajectory of vehicle transportation and power generation. TSLA is here to stay. So is solar and the green economy. Silver demand should rise accordingly.

Silver’s Financial Side May Be Helped by Weaker Dollar

The buck has been stuck between resistance at 104 and support at 91 for the past 5 years. This chart is almost a mirror image of the “Sideway Silver” chart earlier in this report. It indicates just how much closer silver tracks the dollar than its richer cousin, which keeps making new swing highs in dollars. The dollar exploded in spectacular fashion during the initial coronavirus scare, but quickly reversed itself. We believe the immediate rejection of this new high by the dollar has all the technical markings of a classic “bull trap.” We would be surprised to see 104 broken any time soon.

Data Source: Reuters/Datastream

The Trump Administration has been clear on its preference for a weaker dollar. The Fed played along in 2019 and 2020, cutting rates multiple times despite a strong American economy and record-setting stock market. With US interest rates now at “zero”, the huge interest rate differential responsible for much of the dollar’s strength is gone. At the same time Europe’s negative interest rates seem, oddly enough, to be getting less negative by the day.

Noted monetary policy dove Mario Draghi (architect of the EU’s negative interest rate policy) has been replaced by pragmatist “owl” Christine Lagarde. Ms. Lagarde witnessed firsthand the relatively paltry effects of ECB monetary policy on European prosperity while chief of the IMF. Now as president of the European Central Bank, she has decided to call for fiscal stimulus by EU member nations instead.

Election and Potential Inflation Not Priced into Silver

The potential that the upcoming election will be extremely divisive and negative for the global image of United States is high. The delayed American response to the virus is not helping America’s reputation either. The greenback is still the globe’s largest reserve currency and the Fed seems willing to do anything to forestall economic collapse. This is keeping the dollar strong for now. However, fiat currencies are valued on trust in the nation backing them. The US is in danger of losing that trust.

We believe the inflationary implications of trillions of dollars currently thrown at the US economy by the Fed and the US Treasury have been largely ignored – and not priced into either the dollar or silver. The vast majority of economists and analysts expect the coming recession to be extremely deflationary. Many are even calling for a big “D” Depression on par with the one which followed the 1929 crash. Either one of these scenarios may wind up panning out.

But what if, after testing finally comes up to speed, it is discovered that far more people have antibodies to COVID-19 than expected? What if a treatment for the coronavirus is discovered that can buy time until a vaccine becomes available? Either scenario could put the economy back online a lot faster than today’s estimates, making current stimulus measures more inflationary than expected. Both together could be a game-changer.

Six Reasons to Like Silver

- A continuation of the powerful rally in the gold market. Silver is tethered to gold, and like a rubber band stretched too far, could snap back suddenly. As the “Room to Rally” chart illustrates, silver has a lot of catching up to do. Gold broke out of its 5-year trading range a long time ago. Our $25.00 per ounce target could be just the beginning should silver do the same and finally break above its old swing high of $21.22 per ounce.

- The temporary truce in the trade war is holding, and China appears to be recovering from its COVID-19 slowdown. Not only is China the world’s biggest consumer of commodities, it also the biggest manufacturer of solar panels. More solar panels will require more silver.

- The political “civil war” in America is escalating. This has the potential to damage American credibility and the dollar, helping silver in the process.

- The huge interest rate differential favoring the dollar has been mostly eliminated by Fed rate cuts.

- Coordinated multi-trillion dollar Fiscal and Monetary stimulus has the potential to be far more inflationary than the 2008/2009 TARP stimulus package. Unlike the TARP bailouts which were funneled exclusively through the banking system, a good chunk of the COVID-19 bailout is going directly into the pockets of the American consumer. It will probably be spent, not on buying back stock, but on actual goods and services. This increases the potential for traditional price inflation once the threat of the virus has been mitigated. The sooner the economy recovers, the more inflationary this stimulus could be.

- The age of globalization is on indefinite hiatus. COVID-19 is likely to go down as one of the defining episodes of modern culture much like the assassination of John F. Kennedy, the September 11 attacks on the World Trade Center, or the 2008/2009 housing crisis. The supply-chain disruptions caused by the coronavirus will likely cause business to source their parts and labor closer to home. This will effectively remove a big chunk of the efficiency responsible for the past two decades of subdued price inflation.

Silver snapped back quickly after taking out all stop-loss orders during its liquidation crash in March. This move corresponded perfectly with the dollar’s quick spike to, and equally as fast reversal, from 104. The move down to $11.50 per ounce has all the makings of a “bear trap.” All of the weak hands are now out of the silver market. Everyone who needed to sell already has.

Data Source: Reuters

Use COMEX Call Options to “Rent”

Silver for Pennies-on-the Dollar

We expect a series of closes over the 2016 high of $21.22 per ounce to set the stage for an assault on our 18-month upside target of $25.00 per ounce. The strategy described below is designed to give RMB trading customers upside exposure to silver for a lower cost and risk than purchasing the metal outright, freeing up capital to generate a return somewhere else. Our strategy also insulates holders from the type of volatility that forced most long futures holders out of the market in late March.

We are using 5,000-ounce COMEX silver options to create our “pennies on the dollar” strategy. Each option covers 5,000 ounces of silver, making each $1.00 per ounce move worth $5,000 and each 1-cent per ounce move worth $50. Buyers of silver call options pay money, known as a “premium,” for the right but not the obligation to be long silver futures at a specific price for a specific period of time.

Call option buyers are not buying the market; they are merely buying the right to be long that market. When you buy a call option, you are essentially “leasing” the right to profit from higher silver prices. The key phrase is “but not the obligation.” Should silver decline or fail to rally before the option expires, the option buyer will simply not exercise the right to buy the futures contract. All the silver call option buyer risks is the premium paid plus any transaction costs.

Silver call option sellers receive money in exchange for the obligation to sell silver futures for a specific price for a certain timeframe. Notice how this definition is the exact opposite of call option buyers. Think of it this way: if you are an employer, you pay money to your employees. This gives you the right to tell them what to do. As an employee, you receive money from your employer, obligating you to do what your employer tells you. Options work the same way.

We can lower the cost and risk of our bullish position by combining long silver options with short silver options. Our upside target on silver is $25.00 per ounce sometime within the next year. What we want to do is put ourselves in a position to capitalize on a breakout over $21.00 per ounce with our $25.00 upside target in mind.

One way we can do this is by purchasing a July 2021 call option with a strike price of $21.00 per ounce, while simultaneously selling a July 2021 call option with a strike price of $25.00 per ounce. This “bull call spread” pairs the right to buy 5,000 ounces of silver at $21 per ounce with the obligation to sell 5,000 ounces of silver at $25 per ounce.

This spread cost 48 cents or $2,400 as of the close on April 19, 2020. Compare this to the roughly $78,500 it currently costs to buy 5,000 ounces of silver outright. You get many of the benefits of a big silver rally for a fraction of the cost, leaving you with plenty of dry powder to take advantage of other crisis-driven opportunities.

July 2021 silver options expire on June 24, 2021. This gives us time for the trade to work. We will lose the amount we pay for this spread plus any related transaction cost should silver fail to rally above $21.00 per ounce prior to this date. Since selling the $25.00 call obligates us to sell silver at $25.00 per ounce, we cannot participate in any rally above this level.

The most our bull call spread will be worth is the $4.00 per ounce difference between the two strike prices times the 5,000-ounce contract size or $20,000 – not a bad potential outcome given our $2,400 plus transaction cost risk. Prices can and will change, so contact your RMB Group broker for the latest. Your RMB Group broker will work with you to match a strategy with market conditions.

Please be advised that you need a futures account to trade the options referenced in this report. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.