Interest rates measure the cost of money, which means they eventually help determine the cost of everything else. In “normal” markets, the cost of money is determined by the market itself. But today’s interest rate market is not normal. Interest rates are now heavily manipulated by central banks like the Federal Reserve. History tells us that manipulation almost always causes dislocations. It also teaches us that market dislocations can lead to big opportunities. This post will examine the opportunity we see developing in the T-year Treasury note options right now.

Interest rates function as both a brake and an accelerator in a normal market-determined environment. A growing economy increases demand for money which causes interest rates to rise. A contracting economy reduces demand for money which causes interest rates to fall. Higher rates act as a healthy governor on rapid growth in a market economy; they will only stop rising when equilibrium is reached. Lower rates that are market-driven provide healthy stimulus in a shrinking economy and will only stop falling when equilibrium is reached.

Problems arise when these adjustments cause economic and political pain, which is something they nearly always do. Change is, by definition, disruptive. Voters and politicians don’t like disruption, so central banks step in to “manage” change, which winds up causing even more disruption. This has happened again and again in the 21st Century.

The Fed kept rates artificially low following the turn-of-the-century “Dot Com” Crash. This helped inflate the housing bubble which burst spectacularly in the 2008 Housing Crash. The Fed did the same thing again, but instead of limiting their intervention to the Fed Funds Rate, also threw in bonds which it purchased by the handful during its Quantitative Easing (QE) campaign. This helped inflate today’s potentially destabilizing stock and bond market bubbles. In each instance, the Fed responses to disruption either directly caused or helped create an environment conducive to even more disruption. It is happening again right now.

The Fed’s “Everything Put” and the Definition of Insanity

If the definition of insanity “is doing the same thing over and over and expecting different results”, then the Fed is certifiable. Jerome Powell and Company have bested all of their predecessors during the current COVID crisis. Not only are helicopters in the air, but fully laden B-52s are carpet-bombing the entire financial landscape with money. The Fed has expanded the Quantitative Easing campaign of the early 2010s to include virtually everything.

It is either buying or indicating readiness to buy Treasury bonds and notes, mortgages, municipal debt, gold, and corporate debt – including the ETFs created with these instruments. Our guess is it won’t take much of a setback in stocks for the Fed to toss them in the shopping cart as well. We call this the “Everything Put.”

The “Everything Put” appears to be working well. The S&P 500 is within spitting distance of new all-time highs while NASDAQ continues to make one new high after another. Fed promises to be the buyer of last-resort, first-resort and every other resort in-between stopped the March meltdown of investment-grade corporate and municipal debt in its tracks. Both markets have risen close to all-time highs since then.

10-Year Treasury Holders Losing Money at Current Yields

Albert Einstein is often credited with the definition of insanity quoted above, but that has been disproven. However, it doesn’t take a rocket scientist to recognize that what the Federal Reserve is doing right now will have consequences – both predictable and unforeseen – that could prove far more disruptive over the long haul than the crisis they are currently attempting to “manage”.

Real Yield on Ten-Year Treasuries

Source: www.multpl.com

The problem with the “Everything Put” is the illusion of stability it creates. Investors get comfortable owning stocks and parking unused cash in low-yielding government and corporate debt. By maintaining the illusion that it will backstop nearly all financial instruments, the Fed incentivizes investors (that may not have needed the cash under normal circumstances) to borrow anyway. Other investors join the Fed and willingly step in to buy this low-yielding debt. They are confident the Fed will bail them out if anything goes wrong, locking in negative real rates of return (see chart above) in the process.

Data Source: Reuters/Datastream

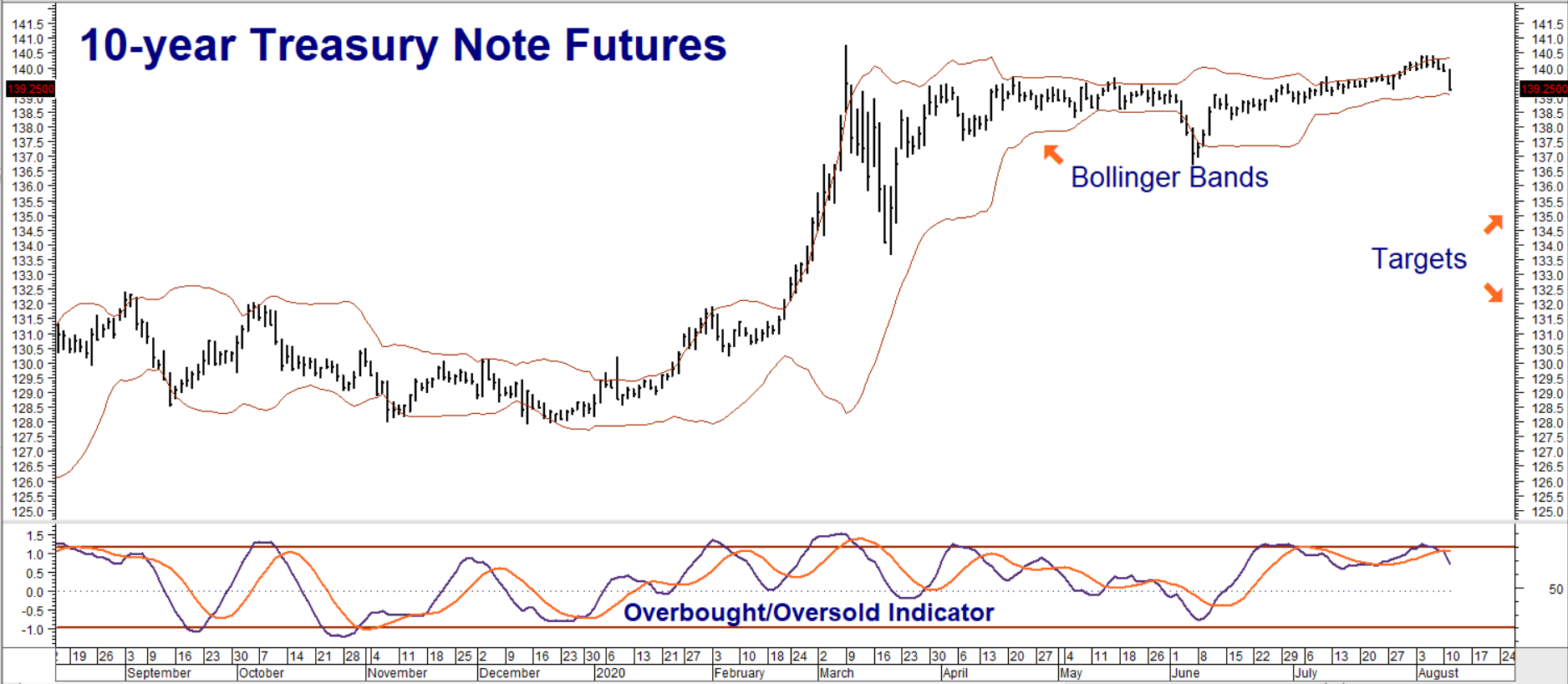

Bollinger Bands measure a trading range encompassing 2 standard deviations above and below a given market. The rapidly narrowing Bollinger Bands in Ten-year Treasury note futures (above) show how fast volatility has declined as the market becomes more comfortable with the notion that the Fed will step in to support it following the March COVID crash.

Like bonds, ten-year Treasury note prices move the opposite of yields: the lower the yield, the higher the price, the higher the yield, the lower the price. Prices haven’t moved much higher because the 0.63% yield is already close to zero. Since the Federal Reserve has rejected negative nominal interest rates, the upside is rather limited.

The downside is a different story. Any change in the current deflationary narrative could cause a rather significant spike in yields, leading to a big dip in T-note prices. A coronavirus vaccine, a continuation of the current FOMO (fear of missing out) melt-up in stocks, and/or a meltdown of the dollar due to loss of confidence caused by a potentially disruptive and chaotic American election could be catalysts for such a move – one that virtually no one is expecting.

T-Note Put Options Are Inexpensive

T-note futures are already reacting to the ongoing FOMO rally in stocks, testing the bottom of their current trading range as we write this. With an implied volatility of 4%, close-to-the-money December 138-00 T-note futures put options are inexpensive. RMB Group trading customers should consider buying these puts, paying no more than $735 for each. This plus transaction cost is your maximum risk on the trade.

135-00 and 132-00 are our downside targets. Our puts will be worth at least $3,000 each should the market decline to 135-00, and $6,000 each should it decline to 132-00 prior to the expiration of our puts on November 20, 2020.

T-note puts may also prove an effective hedge for a bond-heavy portfolio and would work for municipal and corporate debt holdings, providing protection past the election. Each T-note futures option covers $100,000 in T-notes so consider purchasing 1 put for each $100,000 in long-term bond holding you want to protect. Effective hedges can also be constructed with the cheaper December 137-00 puts. Prices can and will change, so contact your RMB Group broker for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.