Gold hit our $1,920 per ounce target in overnight trading, slicing through its old highs of $1,923.70 in the process. This sets the stage for an assault on our next target of $2,180. Gold’s two-year bull market is picking up momentum as the inflationary implications of the Fed’s “everything put” and the trillions of additional Fiscal stimuli the market believes will soon be forthcoming. Gold (and silver!) are exploding because, for the first time in a decade, meaningful inflation is not only possible, but expected.

Data Source: Reuters/Datastream

We have been recommending long gold positions for the past two years and continue to do so. The Fed just recently added corporate bond ETFs to their growing shopping list so we don’t see the Jerome Powell and Company backing off their purchases of major financial assets anytime soon. We expect the Fed will continue to buyers of last resort, first resort and every other resort in between until the current crisis has either ended or their actions boomerang back in the form of inflation or economic exhaustion as the virus continues to gain the upper hand. Gold should continue to perform in this environment.

Here are the “Cliff Note” versions of bull and bear cases for gold:

The Bull Case

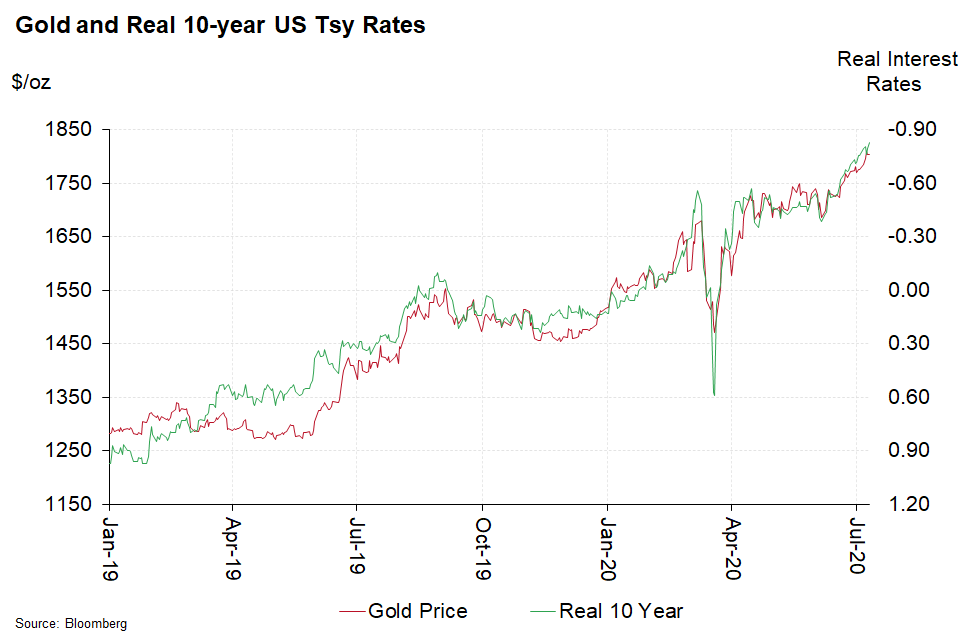

Low interest rates have reduced the opportunity cost of holding physical gold to less than zero in some cases. Negative interest rates in Europe mean it is possible to get paid to borrow euros and then use that money to buy gold.

Global currency debasement makes gold a critical financial hedge. Gold cannot be printed ad hoc. Investors wishing to protect their buying power are buying gold as a hedge against the shrinking real value of fiat currencies.

America’s $4-trillion COVID-19 stimulus will probably grow by at least another $1 trillion and probably closer to $2 trillion of additional stimulus before it is all over. Unlike the TARP bailouts of 2009 which were funneled exclusively through the banking system, a good chunk of the COVID bailout is going directly into the pockets of the American consumer. It will probably be spent, not on buying back stock, but on actual goods and services. This increases the potential for traditional price inflation once the threat of the virus has passed. The sooner the globe recovers, the more inflationary this stimulus could be.

The age of globalization is on indefinite hiatus. COVID-19 is likely to go down as one of the defining episodes of modern culture much like the assassination of John F. Kennedy, the September 11 attacks on the World Trade Center, and the 2008/2009 recession. The supply-chain disruptions caused by the Coronavirus will likely cause business to source their parts and labor closer to home. This will effectively remove a lot of the efficiency responsible for past two decades of subdued price inflation, giving price inflation a potential toehold.

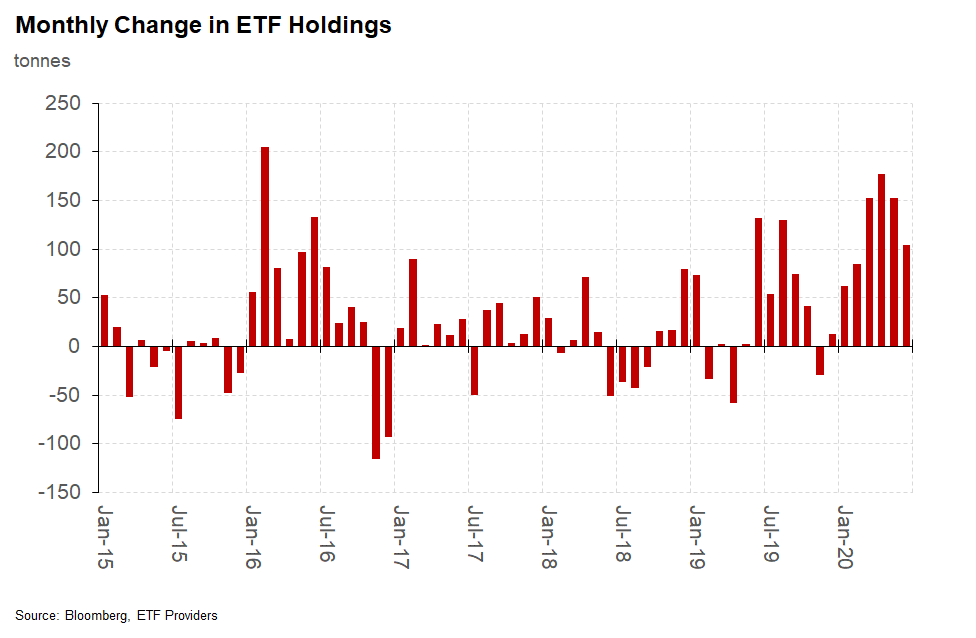

ETF demand is exploding, requiring more physical gold to back positions.

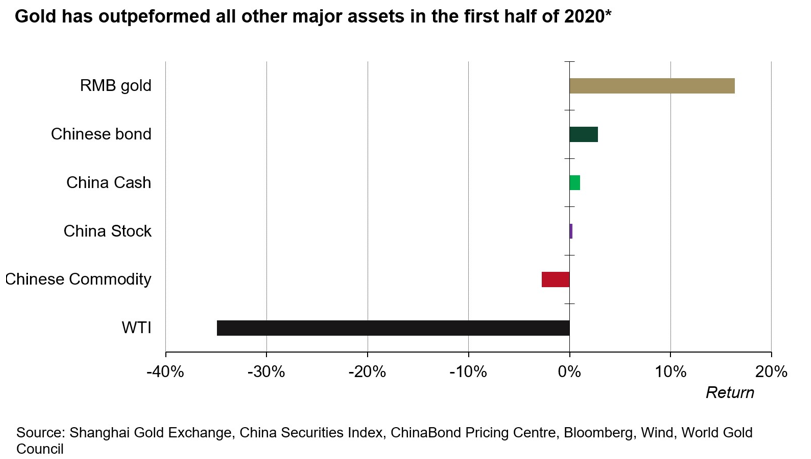

Chinese demand is surging. Gold is one of the best performing investments in China.

Gold is a classic hedge against global chaos which could also make it an effective hedge against the possibility of a disruptive US election this November as well.

Massive central bank and Fiscal stimulus matched with a corresponding slowdown in both factory output and productivity (due to COVID) could lead to overall price inflation.

The Bear Case

Gold is a crowded trade.

It is overbought in all timeframes.

Not much room left on the downside of interest rates, especially with the Fed essentially taking negative nominal rates off the table for now. Higher rates will increase the opportunity costs of owning gold.

Crypto-currencies like Bitcoin could provide stiff competition as financial hedges as they become easier to use.

Global economy could collapse despite massive central bank and Fiscal stimulus resulting in a crushing Depression. All potential outcomes priced into financial markets have assumed that a coronavirus vaccine and/or effective COVID treatment will be available soon. Failure to develop either could swamp all stimulus efforts. Gold would be just one of many asset classes that would suffer in this scenario.

Exit Existing Positions

We find it interesting that gold finds itself at this point now, less than three months from the American election. What it does over the next three months will most likely determine whether gold stays on the path toward our third, longer-term objective of $2,550 per ounce or flames out altogether.

RMB customers holding bullish option positions based on our $1,920 per ounce target should consider exiting immediately. Consider using half of the proceeds to re-establish long positions using $2,180 and $2,550 as upside targets. Keep the other half of the proceeds in reserve to take advantage of lower prices due to a correction. Gold is very overbought. Bull markets can stay overbought for a long time.

Bull Call Spreads Well-Suited for Current Environment

Relatively high levels of volatility are making it challenging to construct long positions without taking on what we believe to be undue levels of risk. We believe the most effective way to get relatively low-risk bullish exposure to gold at this point in time is to consider establishing close-to-the-money bull call spreads using December 2020 call options which expire on November 24, 2020 –3 weeks after the American election. Your risk is limited to the net cost of the transaction if gold fails to rally or declines prior to this date.

Purchasing December 2020 $2,050 per ounce COMEX gold calls while simultaneously selling an equal number of December 2020 $2,200 COMEX calls pairs the right to be long 100 ounces of gold at $2,050 per ounce with a corresponding obligation to sell 100 ounces of gold at $2,200. Selling the $2,200 call helps offset the cost of the long $2,050 call in exchange for limiting upside potential to $2,200 per ounce or $15,000 per spread. Fair value for these $2,050 / $2,200 COMEX bull call spreads is currently $2,900. Prices will probably change by the time you read this, so contact your RMB Broker for the latest.

Exit Remaining July 2021 $21.00 / $25.00 Bull Spreads in Silver

Gold is not the only metal starting the week by riding a rocket. Silver is soaring as well, outperforming its yellow cousin in today’s trading. July 2021 silver futures contract have hit our $25.00 per ounce target many months sooner than we expected. We believe silver is either getting ready to explode even higher or is in the midst of a blow-off, similar to that that marked the bottom of the current move. A correction from here could send prices tumbling back to old breakout levels just above $21.00 per ounce.

Data Source: Reuters/Datastream

We do not want to be left without a position if the first scenario comes to pass and we certainly don’t want to be overly committed in the second scenario. RMB Group trading customers should consider establishing scaled-back long positions in silver using a just portion the proceeds collected from exiting your July 2021 bull spreads and/or the bullish strategies we suggested exiting in last week’s blog post. Hold cash in reserve to take advantage of any significant correction in silver.

The July $21.00 / $25.00 bull spreads we suggested purchasing at prices between $2,050 and $2,500 have a theoretical fair value of $9,735 each as we write this. Our new upside targets in silver are $31.00 and $42.00 per ounce. Check with your RMB Group broker for the latest pricing and for our latest fixed-risk strategies designed to take advantage of these targets.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.