Do you like volatility? If you do, then you loved October. Volatility was the name of the game in a number of markets, attracting both investors and speculators quick enough to capitalize on fast, exaggerated moves. Investors waiting for a 10% correction in stocks finally got it on October 15th –- but it only lasted a little over an hour. The stock market hasn’t looked back since.

Did you grit your teeth and buy? Very few did, which is why many are chasing the current bounce. We’re not saying the market can’t go higher, but we believe at these valuations the easy money has been made. One thing we are fairly certain of is that we will get another big buy opportunity in VIX.

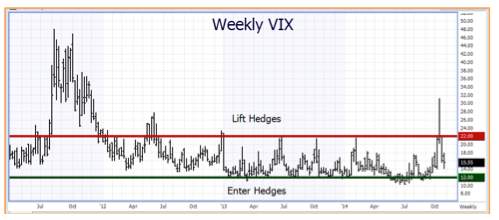

We suggested using VIX futures as a hedging tool since March and released two Special Reports outlining our simple strategy (Click here to read our July Special Report on VIX): buy VIX futures as a hedge when cash VIX drops below 12.00%, and lift those hedges when cash VIX approaches long-term resistance at 22.00%.

We recommended exiting our long VIX futures two days before the October high; a touch early, but still very effective. (Alert #31). We’ll recommend buying again should the cash VIX drop back below 12.00%.

Japanese Yen Sticking to Script

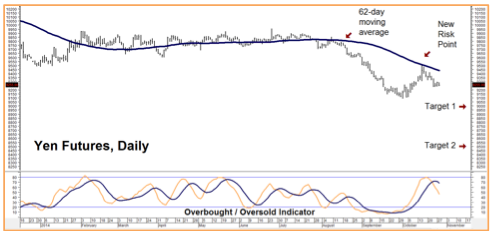

Like stocks, the yen also showed mid-month volatility. It spiked as high as its 62-day moving average before re-establishing the downtrend which has defined it for the better part of three years. We were fortunate enough to take advantage of this spike to re-establish short positions using the March put options in the yen (Alert #32). (Click here to read.)

As the chart below illustrates, the Japanese currency is sticking to the script – at least for now. Let’s use the October 15th high of .009510 as a risk point. We’ll watch for two consecutively-higher closes as a signal of a more serious upward correction in the yen. Our intermediate-term downside targets remain .009000 and .008500 in the front month futures contract.

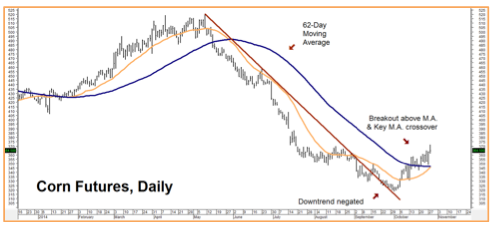

Corn Continues to Surprise Don’t look now, but an important bottom appears to be forming in corn. Turns out the record-setting harvest on the way to grain silos across North America might be more needed than originally thought – especially since drought is threatening the planting season in South America. We explored the possibility of this scenario in our Special Report, Investing in the New Gold: Protein. (Click here to read it again.)

Recent price action in corn has negated its 5-month downtrend and broken out solidly above the 62-day moving average which defined its trend over the past few years. Will there be setbacks? You can count on it. However, let’s use these setbacks as opportunities to add to long-term long positions using deferred call options in corn.

If you don’t have a long-term bullish position in corn, check with your personal RMB Group broker for the latest recommendation. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy we currently recommend, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com.

Is the Pain Finally Ending in Energy?

We certainly don’t get them all right. RBOB gasoline was one we misjudged. We believed the long-term chart told us that $2.50 per gallon was the minimum price refiners were willing to accept as long as crude oil prices remained above $90 per barrel. We figured with all the conflict in the Mideast and on the Russian/Ukrainian border a $90 per barrel floor was a reasonable expectation.

Saudi Arabia had other ideas. Interested in punishing virtually everyone they have a beef with – Iran for being Shiite and vying for power in the region, the US for cozying up to Iran, Russia for supporting Assad and Venezuela for being OPEC’s perennial whiner – the world’s most consequential swing producer decided it would open up the spigots.

The good news for the bulls – if there are any left – is that selling in crude oil appears to have run its course. We expect this to translate into higher gasoline prices. Yesterday marked the first time gasoline closed above a previous day’s high since the selloff began. Couple this with the extremely oversold condition of the market (see chart below) and the seasonally-friendly time for energy that is approaching, and there is still reason for hope.

We are going to hold our under-water March bull call spreads (see Alert #29) for now and see what the market can do. A lot can happen prior to option expiration four months from now. Let’s see if prices can trade above old support within the next 30 days or so. If not, we will re-evaluate and probably recommend exiting our March spreads to cut losses. Time decay isn’t killing us, and won’t for another month.

Winter is Still Coming…

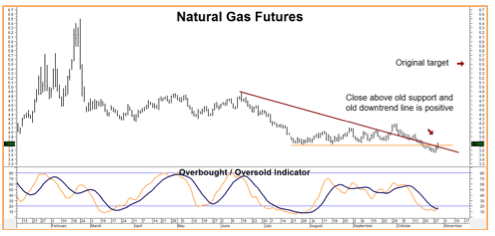

…which is why we are staying with the bullish March natural gas spreads we suggested buying in Alert #28. Like gasoline, yesterday’s close in natural gas was the second consecutively-higher close over a previous day’s high – typically a bullish signal. It also closed above the old downtrend line and old support.

We believe “natty” is extremely oversold and overdue for a big bounce. Weather will determine how high this market rises this winter. Prices could surprise everyone if temps even come close to the bitter cold of last year. If you didn’t take our recommendation in Alert #28 (Click here to read, again) to buy March bull spreads, you can do so more cheaply and with lower strike prices.

Check with your personal RMB Group broker for the latest natural gas trade recommendation. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com.

Hogs Finally Slipping

It’s taken awhile, but hogs look like they are losing their bullish mojo. The December bear put spreads we suggested buying for $460 or less in Alert #25 are almost in the black. With price solidly below the 40-day moving average and the technical picture looking soft, we suggest holding your December bear put spreads for now. Our downside target remains 90 cents per pound.