Fans of the popular HBO series “Game of Thrones” will recognize this phrase. For those unfamiliar with the show, “Game of Thrones” is a multi-plotline story about the battle for power in a mythical land known as “Westeros.” The coming of a cold and potentially deadly winter looms as an ominous backdrop to the affairs of Westeros’ kings, queens and princes who spend much of the show plotting and fighting against each other, oblivious to the threat. Here in the real world we try not to be so dismissive of old man winter – especially when his presence can cause critical commodities like natural gas to heat up.

Fall has barely begun, but winter has already announced its arrival. September saw heavy snow in Colorado’s Front Range and the Dakotas as well as late October-like temperatures in Chicago and the upper Midwest. These events were predicted by AccuWeather.com a month ago. If their prediction holds, we could be in for more. AccuWeather and others are warning of a possible return of last year’s “Polar Vortex” which plunged much of the most populous part of North America into a deep freeze, lasting until early spring. Recent studies have linked the presence of the “Polar Vortex” in the American heartland to climate change, with some predicting the phenomenon could stick around awhile.

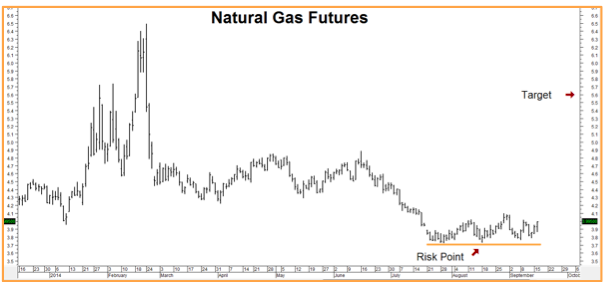

Will another “Polar Vortex” wreak havoc on American population centers this year? Mother Nature knows, but she’s not talking. However, like the fans of “Game of Thrones,” we know that winter is coming. As the spike in price last winter suggests (see chart above), natural gas could be a big beneficiary if this winter is anywhere as cold.

We are approaching the end of the inventory-building season for natural gas as colder temperatures increase heating demand. More importantly, we are entering this heating season with lower stockpiles than last year. Analysts are predicting inventory levels will fall short of the 3.8 trillion cubic feet recorded last year. As of a week ago, gas in storage was 14% below average for this time of year.

We also like natural gas from a technical perspective. “Natty” is forming a nice basing pattern right above the $3.70 level – providing us with an opportunity to construct a bullish position with close and readily-identifiable risk parameters. As a result, we are recommending our trading customers consider two potential strategies using March natural gas options:

Our first and most aggressive strategy costs roughly $1,600 (plus transaction costs) and has the potential to be worth as much as $10,000 should natural gas hit our $5.50 price target prior to option expiration. Natural gas needs to rally 8% to put this position “in the money.”

Our second strategy costs a little over $600 (plus transaction costs) and could be worth as much as $5,000 if natural gas hits our target price prior to option expiration. The lower cost of this play is no accident. It requires gas to rally much further in order to show a profit than the first play, so it has a lower probability of success. However, a big cold snap this winter could send natural gas prices up to our $5.50 target in a hurry.

March natural gas options don’t expire until February 24, 2015, keeping us long through the teeth of the coming winter. We’ll use two consecutively-lower closes below old swing lows at $3.70 as a signal that we are wrong and will probably recommend exiting positions at that time.

Prices in this market can change quickly so RMB Group trading customers should check with their personal RMB Group broker for the latest. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy that we are currently recommending, give us a call at 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com.

IMPORTANT YEN & EURO UPDATES! – Yesterday’s Fed meeting turned out to be not as dovish as expected. While Janet Yellen & Company did not remove the much-debated “for a considerable period…” phrase from their statement, they did make their next moves much more data-dependent, increasing market uncertainty. The result was good for our bearish positions in both the euro and the yen.

The yen came within 32 points of our .9200 downside objective in aftermarket trading yesterday so we would not object if our more conservative trading customers choose to exit their remaining bearish positions here, looking to re-establish them on a bounce. More aggressive traders may want to hang on for a potential move down to .9000.

The euro dropped as low as $1.2850 putting it 100 points away from our second long-term downside objective of $1.2750. RMB Group trading customers holding bearish positions in the euro may want to consider the same course of action suggested above should the common currency drop a little closer to our $1.2750 target.