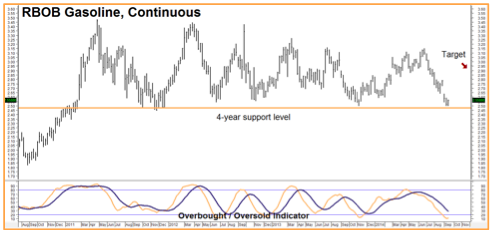

Classic chart watchers (known as “technicians”) believe that everything you need to know about a market is revealed in price. We aren’t that extreme. However, we do know that charts can reveal a great deal. Take the weekly chart of RBOB gasoline futures below. We believe it’s telling us that the minimum price refiners are willing to accept for their gas is around $2.50 per gallon, and that the maximum price consumers are willing to pay before cutting back on driving is around $3.15 per gallon. This tendency has lasted four years and persisted through all kinds of geopolitical environments.

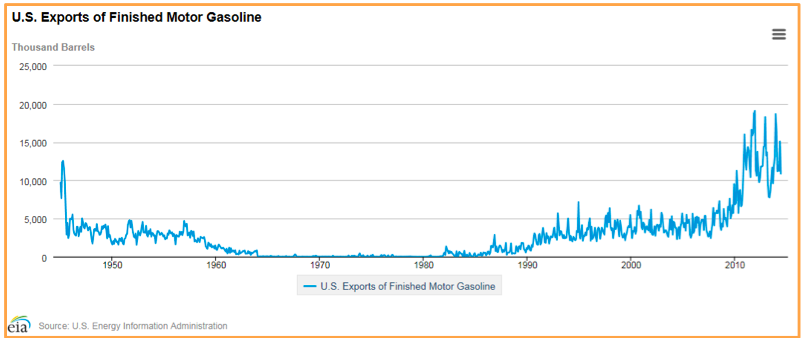

Refiners need a certain price to cover their costs and support infrastructure spending. They have a number of tools they can use to support price – such as announcing “maintenance” in key refineries and reducing supply to key markets. Gasoline does not have the same export strictures as crude oil, so refiners can also export gasoline and reduce inventories that way. Not surprisingly, US exports of gasoline have exploded since 2010 (see second chart below), corresponding nicely with the trading range in RBOB gasoline itself.

Prices have recently tested the bottom of this range – falling as low as $2.4950 before bouncing and providing traders with a nice opportunity to take a low-cost long bullish position. What could go wrong? Gas prices will fluctuate with the cost of the biggest cost input (crude oil). Consequently, a complete collapse in crude oil would cause prices to fall out of this trading range to the downside. However, we don’t think crude is going to collapse any time soon – especially with Russia and nearly every nation in the Mideast dependent on higher prices to keep their societies running – but it could.

That’s why we use options. We are currently suggesting our RMB Group trading customers consider constructing bullish option strategies in March and April RBOB options. Right now, we are looking at a bull spread with a maximum cost and risk of roughly $550 plus transaction costs. It has the potential to be worth as much as $4,200 should gasoline climb back to our $2.90 per gallon objective by option expiration on February 24th.

Like natural gas, prices in this market can change quickly, so RMB Group trading customers should check with their personal RMB Group broker for the latest. They may have an alternate recommendation more tailored to your individual needs.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy we are currently recommending, give us a call at 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.