Humans are hard-wired to make predictions about the future. It is one of the mechanisms that help us learn. These predictions are often based on events in the past. For example, a child that has just touched a hot stove will likely avoid that in the future. Similarly, early hunter-gatherers who found food at a certain spot in the forest were most likely to return the next day with the expectation they would find it again. Psychologists call this “recency bias.”

This same kind of bias occurs in markets. Traders extrapolate the recent past into the future with the expectation that the past will repeat. Many of the computer algorithms being blamed for the recent sell-off in stocks (and the accompanying explosion in volatility) are just super-fast numerical representations of this same human trait.

Stocks have been in an incredible bull trend since 2009. The trend continued for so long that both individuals and computers bought each and every decline. At the same time stocks were soaring, volatility was declining to historically low levels. Traders sold every little spike in the VIX and were rewarded for it – at least until 6 days ago.

Both long stocks and short volatility got too crowded when Mom and Pop investors rushed to the bullish side of the boat in response to the Tax Bill – their skepticism finally overcome by fear of missing out. Their weight caused the boat to capsize. Volatility sellers – big winners for nearly all of 2017 – gave all their gains back, and more, in a matter of hours. Volatility buyers reaped windfall gains in a very short timeframe.

Agricultural Commodities Exhibiting Low Volatility

Like last week’s stock market, certain agricultural commodities are exhibiting extremely low levels of relative volatility. While low volatility itself is not necessarily a reason to enter a market (low volatility in the stock market persisted for a long time), it does offer option traders lower cost opportunities that would not be available in “normal” markets. This is especially true when those markets are agricultural commodities which are extremely sensitive to the capriciousness of weather.

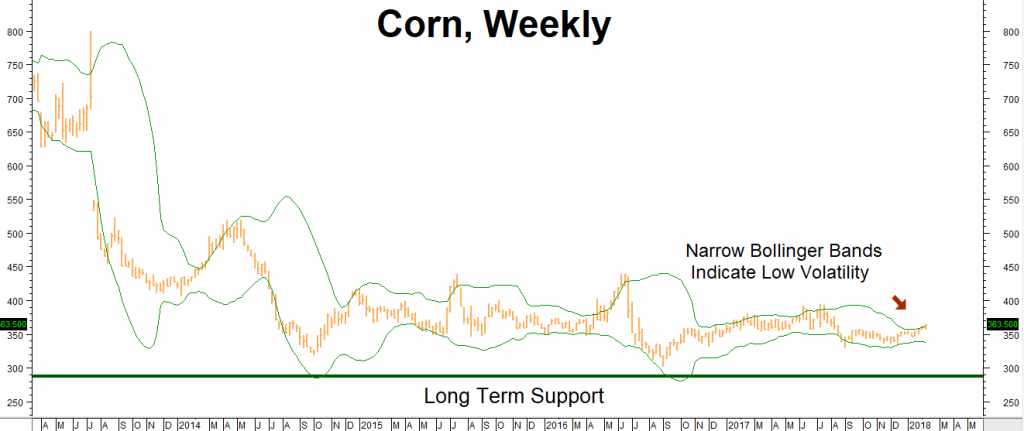

Last fall we covered two agricultural markets exhibiting abnormally low relative volatility: sugar and corn. While volatility has ticked up a bit since our October recommendation to buy December corn calls, we still consider corn volatility to be ridiculously low – especially given the possibility of a disruptive weather event in a year that has already been marked by a number of them. RMB Group trading customers who haven’t purchased at-the-money December call options may want to consider doing so.

Data Source: Reuters / Datastream

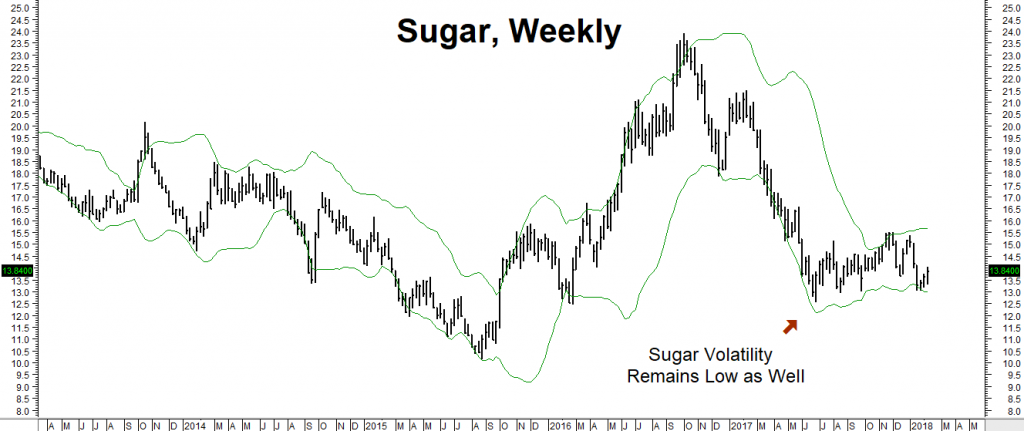

Sugar volatility is also low. Unlike corn, which shows all the signs of establishing a base, sugar could break out in either direction. Holders of the May 15-cent call / 13 cent put “strangles we suggested buying last October may want to consider swapping them for October strangles with identical strike prices – buying an additional 153 days of time in the process.

Data Source: Reuters / Datastream

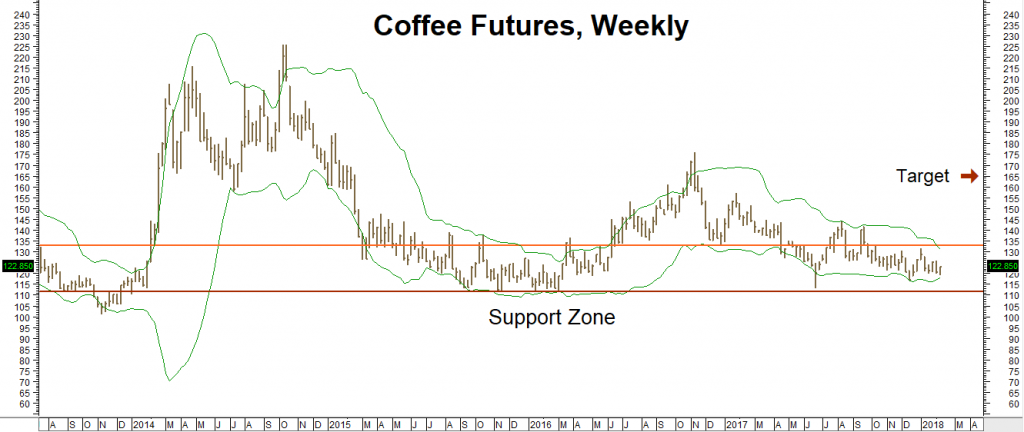

Coffee Also Marked By Abnormally Low Volatility

We never thought we’d be writing a headline like the one above. Aside from being the second most heavily-traded commodity on the planet (crude oil takes top honors), coffee is also one of the most volatile commodities. After rallying as high as $1.76 per pound in December of 2016, coffee retreated – declining as low as $1.13 per pound before setting up shop in a seemingly ever-narrowing trading range.

Data Source: Reuters / Datastream

This sluggish price action is perplexing when you consider the demand for coffee, especially from Asia, is growing rapidly. A higher standard of living in China and the rest of Asia has led to the emergence of coffee-house culture. This is the one of the reasons coffee-giant Starbucks plans to expand rapidly in the Middle Kingdom.

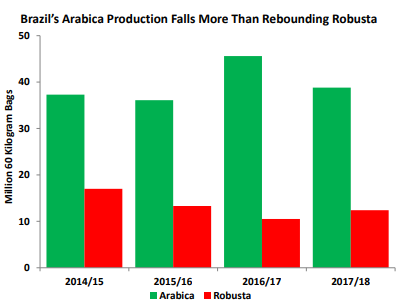

The failure of coffee to mount a sustained rally is largely due to adequate supplies. However, one wonders if these supplies are already baked into the coffee “cake”. Brazil is the world’s number one producer of coffee, benefitting from a bumper crop last year. USDA estimates for the current year show a decline in Brazilian Arabica coffee production despite the small increase in Robusta production.

The failure of coffee to mount a sustained rally is largely due to adequate supplies. However, one wonders if these supplies are already baked into the coffee “cake”. Brazil is the world’s number one producer of coffee, benefitting from a bumper crop last year. USDA estimates for the current year show a decline in Brazilian Arabica coffee production despite the small increase in Robusta production.

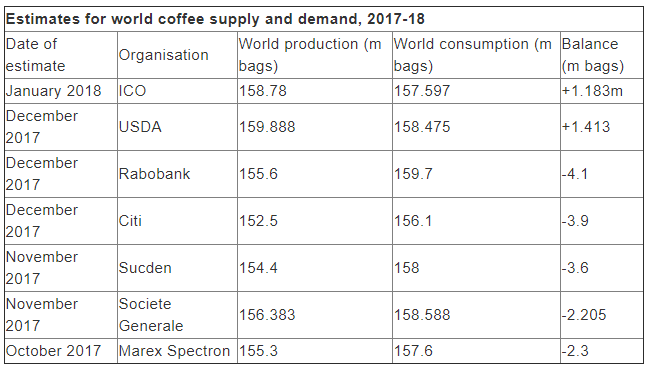

Source: Agrimoney

While coffee supply and demand remain in balance for the time being, forecasts for 2018 vary. It shouldn’t take much of a supply disruption to change this market’s volatility profile rapidly. Adequate supplies are priced into coffee much the same way the benefits of the tax bill were priced into stocks. Current sideways action gives us an opportunity to take a long-term bullish position for a surprisingly reasonable cost.

What To Do Now

RMB trading customers should consider buying December 2018 bull call spreads in coffee. The trade we are looking at right now settled last night at a cost of $836.25 and would be worth as much as $5,625.00 should coffee reach or exceed our $1.65 per pound price objective prior to the expiration of December options on November 9, 2018. Your maximum risk is the amount paid for the trade plus transaction costs.

Check with your personal RMB Group broker if you do not understand the trade and/or are interested in any other currently inexpensive, fixed-risk option plays in the commodity sector. He or she can help you design a strategy to fit both your budget and risk tolerance.

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more about this trade.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2018 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.