The key to finding “alpha” (performance above and beyond major averages) is to find an asset class that is undervalued, get long that asset class and wait. That can be a problem in an environment where virtually nothing is cheap.

A decade of artificially suppressed interest rates has forced investors far out on the risk curve in search of alpha, driving the prices of stocks to stratospheric levels. Inexpensive equities of any sort have become difficult, if not impossible to find, even after the recent destabilizing correction. Not so with agricultural commodities…

Five years of bumper crops have kept a lid on prices. However, the huge stockpiles one might expect have not materialized. Solid demand growth from China and the rest of Asia have kept pace with big crops, making the world just one bad crop away from a major food crisis. Recent dryness in soybean-producer Argentina has lit a fire under the market. A less-than-stellar crop in North America could turn up the heat.

Data Source: Reuters/Datastream

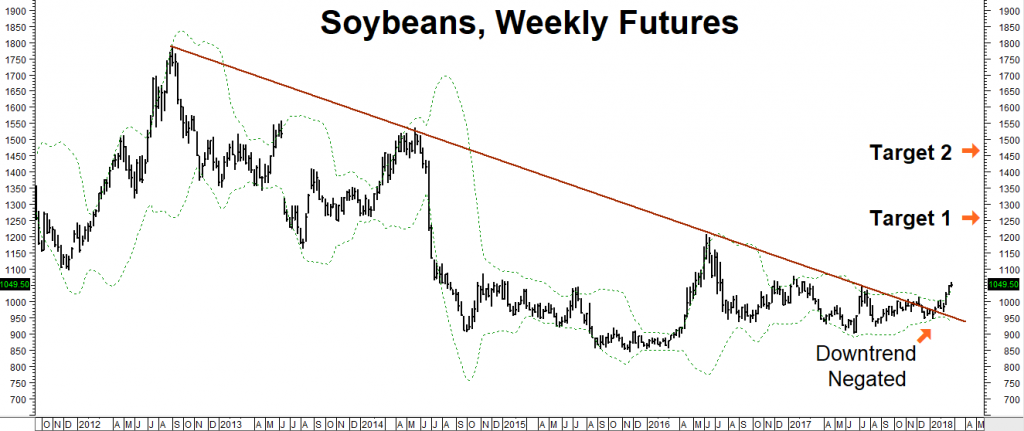

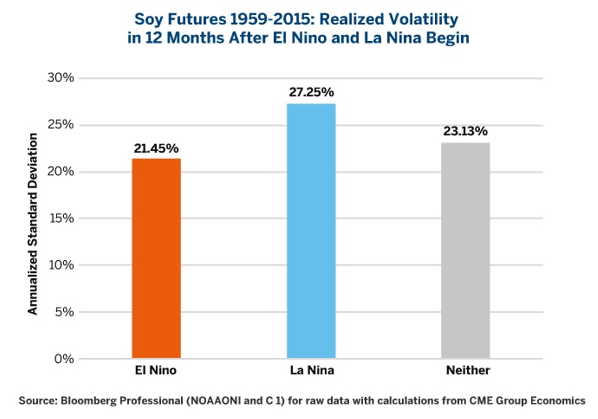

Soybean prices broke out of 6-year downtrend in February and appear poised to rally further. Our two upside targets, based on Fibonacci projections, are $12.50 and $14.50 per bushel. The good news for option traders is implied volatility is relatively low. The July at-the-money strangles are pricing in a move of no more than 7% over the next 105 days. This is exceptionally low, especially considering that this in a La Niña year. Consequently, long premium strategies in soybean options would be advised. Contact your personal RMB broker for his or her recommendations.

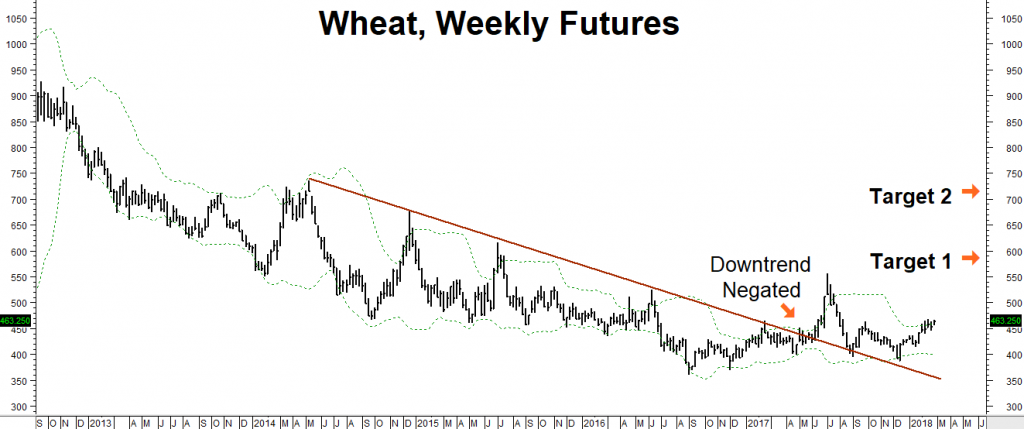

The situation is similar for wheat. Drier-than-expected conditions in the American high plains has left the winter crop without adequate snow cover, increasing the risk of crop damage due to a freeze. Wheat negated its downtrend early this year and appears to be building a base for a move higher. Our upside projections for this market are $5.80 and $7.00.

Data Source: Reuters/Datastream

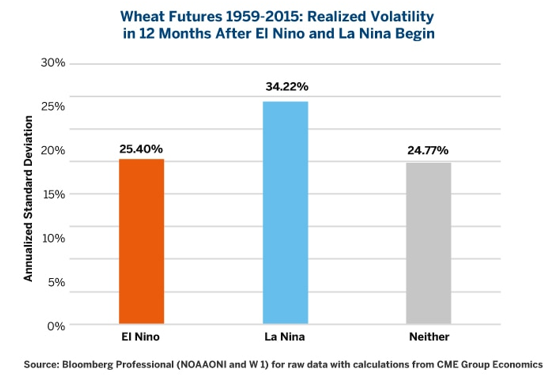

Like soybeans, volatility in wheat is surprisingly low. July strangles (the cost of buying an at-the-money put and call) are currently pricing in a move of no more than 11% which, like soybeans, is extremely low. Remembering what just happened to the stock market as a result of abnormally low volatility, we favor long premium strategies here as well.

Higher standards of living in population-heavy Asia have consumers eating more meat which requires significantly higher amounts of corn. With big crops just barely keeping pace with demand, any shortage due to disruptions caused by the current La Niña or any unforeseen weather event could have an outsized effect on price.

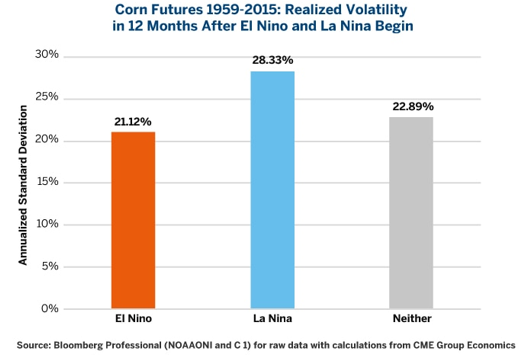

Corn option sellers usually demand a hefty premium to cover the potential for adverse weather – but not this year. Realized volatility of 28% is the norm during a La Niña year. July strangles have priced in a move no bigger than 8.5%. December strangles are pricing in a move of no more than 13.5% over the next 259 days, which is far lower than normal.

5 Reasons We Like Long-Dated Corn Calls

- Agricultural commodities are one of the only cheap assets left.

- Demand keeps rising due to global population growth and changing diets.

- Five years of bumper crops are threatened by La Niña.

- Like gold, this “protein gold” benefits from a weaker dollar.

- Corn pricing has an abnormally low, 259-day implied volatility of only 13.5%.

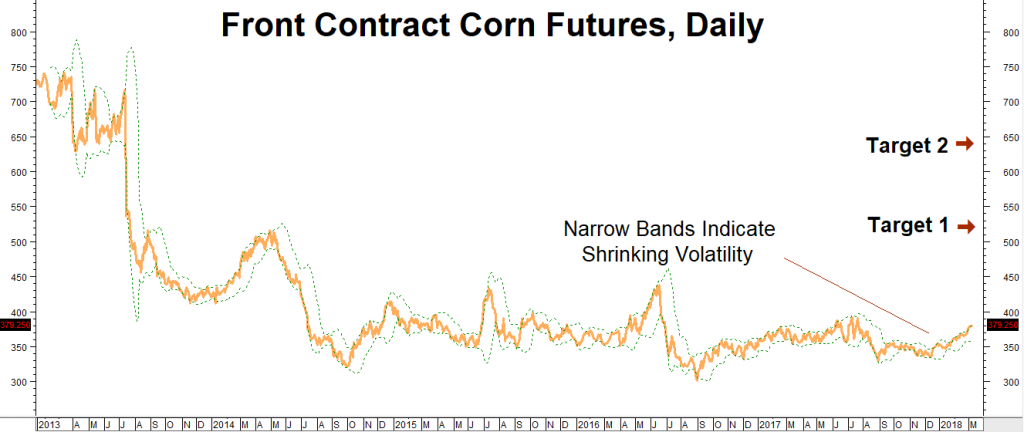

RMB Group has been banging the drum for long-dated corn calls since October and our patience appears to be paying off. As the chart below illustrates, corn has a history of making big runs after extended periods of sideways action. It looks like it may be in the early stages of a breakout now.

Data Source: Reuters/Datastream

What to Do Now

Consider buying close-to-the-money December 2018 $4.20 CBOT corn calls for $1,100 each or less, looking for “protein gold” to rally to $5.20 per bushel (a gain of 28.4%) from current levels – as high as $6.40 (a gain of 58%) – prior to option expiration on November 23, 2018. Your maximum risk is $1,100 plus transaction cost. Your $4.20 calls would be worth $5,000 at our $5.20 objective and $11,000 at our $6.40 objective.

Data Source: FutureSource

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) to for more information and/or to open a trading account. You can also visit our website www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2018 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.