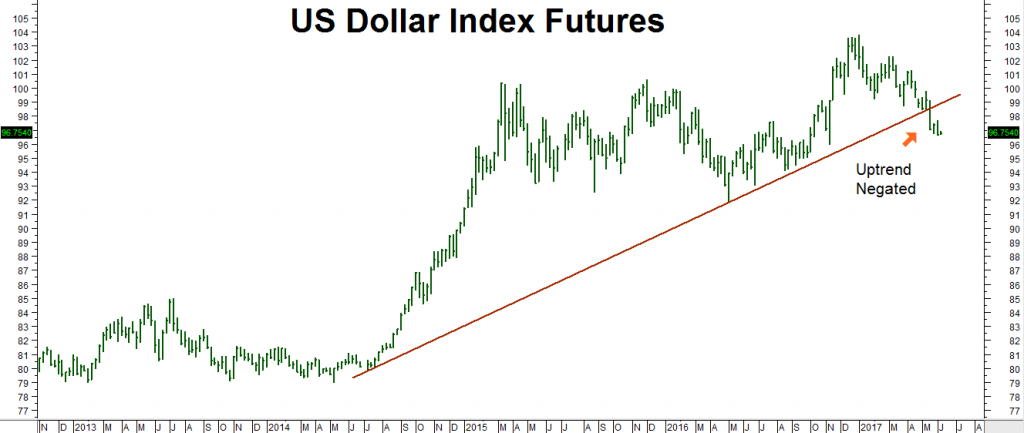

Last Friday’s close in the US Dollar Index was the third consecutive weekly close below its 3-year old uptrend line. This puts a continued dollar rally in doubt. What fascinates us most about the chart below is that, with the exception of a brief run to new highs in the first week of 2017, the greenback has essentially been moving sideways for the past two years despite its huge interest rate advantages over Europe and Japan.

With the Fed on course to raise rates again later this month, these advantages could grow. But the dollar doesn’t seem to care. Markets that move in a direction opposite those suggested by underlying economic fundamentals are either mispriced or acting as a precursor to a change in those fundamentals.

While the dollar has not entered bear market territory yet, recent weakness could signal a change in the fundamental picture. With a fully-priced stock market and the isolationist wing of the White House in ascendance, the US is in danger of losing ground to Europe and emerging markets in the fight for global capital. This could reduce the bullish pull of its high relative interest rates – and perhaps negate them altogether.

A continuation of the current bearish pattern, marked by a series of lower highs and lower lows, since the beginning of the year is threatening to turn this tired dollar bull into a bear. As we outlined in our first “Big Move Trade Alert” of the New Year, it could have big bullish implications for a number of key market sectors – including agricultural commodities, energy and precious metals. The slipping dollar is a big reason behind our recent long-term bullish positions in silver, cocoa and coffee.

Most commodities are priced in dollars. A weaker dollar means it will take more of them to purchase the same amount of gold, silver, energy products or grain. We’ll have an update on our open recommendations soon, along with potential entry levels for new recommendations in corn and soybeans. We believe the latter are two of the cheapest commodities on the board right now.

The Good and Not-So-Good News for Our June 97 Puts

The good news is the June 97 US Dollar Index puts we suggested purchasing for $750 or less in mid-January are finally “in-the-money” as of last night’s futures close of 96.745 in the June US Dollar Index contract. The not-so-good news is they expire this Friday. Do we hold them longer looking for a move lower…or do we sell them for a small loss now? With just four days of life left, it’s a tough call. Our technical work shows near-term downside support at 96. Monday’s close in the lower half of the daily trading range tilts the odds slightly in favor of a lower opening on Tuesday.

However, the Dollar Index is also oversold (both daily and weekly) and overdue for a bounce, making our decision doubly difficult. Selling our puts now would be the prudent move, especially if we get a lower opening in the Dollar Index on Tuesday. Aggressive traders may want to give it one more day. It may also make sense to exit this trade in the futures market depending on option liquidity and price levels. RMB Group trading customers looking to exit their puts should contact their personal broker for pricing.

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or click on Education Tools and scroll down to find the report.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.