2016 was a year of transition. The election of Donald Trump and the success of the Brexit movement in the UK were just the most visible manifestations of a backlash against globalization and changing social mores that has been simmering beneath the surface for quite some time. We expect the desire for change that marked 2016 will become actual change in 2017– the scope and nature of which could ignite a number of “Big Moves” as the New Year progresses. Hold onto your hats folks; we may be in for a wild ride.

Our methodology for sniffing out big moves relies on the markets themselves. We believe that price action itself does a good job of signaling of potential big moves in markets. The trick is knowing where to look. We will be watching all sectors closely but will place special emphasis on the US dollar. It is the globe’s primary reserve currency and, as such, plays a part in the pricing of most asset classes including stocks, bonds, metals and nearly every important commodity.

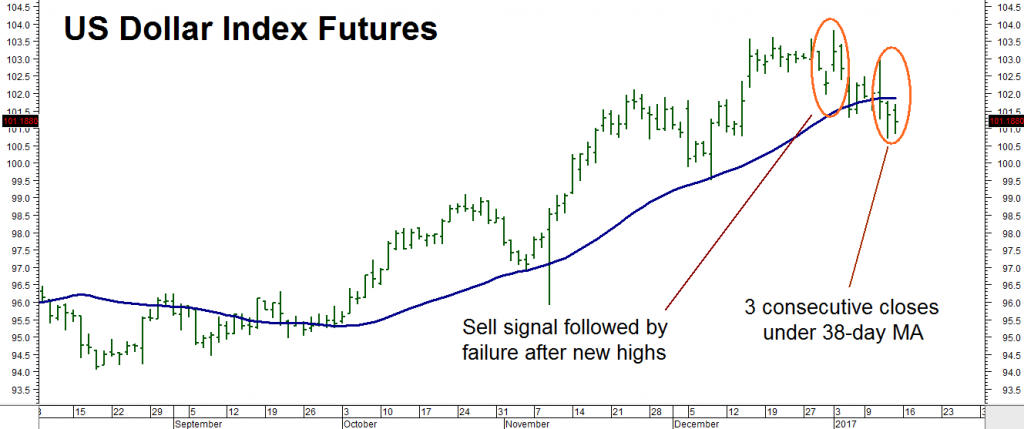

Higher interest rates in the US have made it the place to be for global capital. Nearly every analyst we’ve read assumes a continuation of this American advantage and, by extension, the bull market in the dollar. When everyone starts thinking the same way, we get nervous. The chart below is telling us it may be time to fade the bullish consensus in the dollar.

Data Source: Reuters/Datastream

The big, bad buck has been on a tear since the election of Donald J. Trump as president of the United States but the back of the bull market may have been broken by late December’s price action. Two consecutively lower closes in the US Dollar Index futures contract were followed immediately by a failure after making new highs. This failure was confirmed by three consecutive closes below the key 38-day moving average. This is indicative of a tired market. The trend is still up but price action is telling us that greenback is a market that closer to a trend reversal than a significant move higher.

Nearly every major commodity is priced in US dollars. All else being equal, a stronger dollar means lower commodity prices, while a weaker dollar translates into higher prices. The 3-year bull market in the dollar has helped keep a lid on commodity prices. A change in direction of the dollar will be supportive of higher commodity prices. A weaker dollar means more of them will be required to purchase an equivalent amount of corn, wheat, soybeans, sugar or crude oil. Ditto for gold, silver, palladium and platinum.

Low Risk Short Dollar Play

Placing a low risk wager on a weaker dollar now could give us a head start on a turnaround in a number of commodities later on in the year. This morning’s sharply lower opening in the dollar appears to have confirmed the sell signal we identified in the first chart.

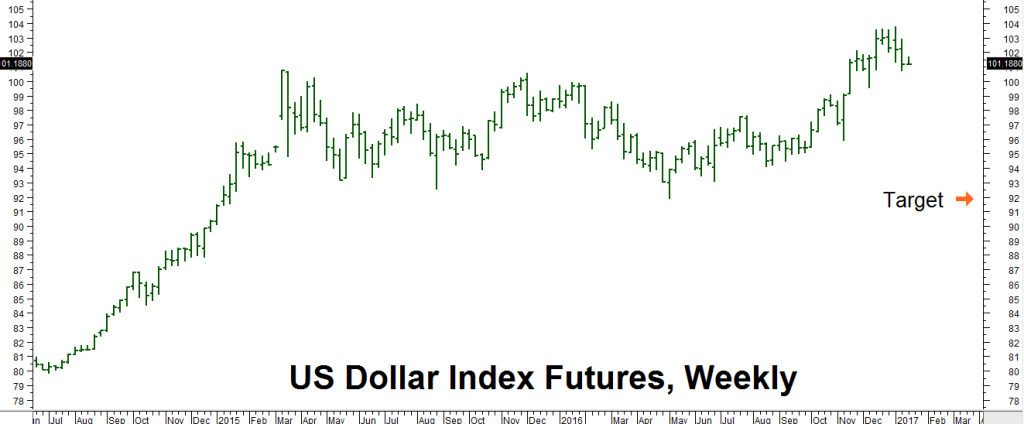

Consequently, we are asking our trading costumers to consider purchasing June 2017 puts on the US Dollar Index futures. The trade we are looking at right now costs roughly $750 and could be worth as much as $5,000 should the US Dollar Index fall to the bottom of its 2-year trading range prior to option expiration on June 9. $750 plus transaction cost is the most we suggest risking on a bearish dollar position.

Data Source: Reuters/Datastream

Other Dollar-Driven Markets Worth Mention

There are other reasons RMB Big Move Alerts intend to take a close look at certain dollar-relate commodities in 2017, including many we have positions in already. Some of these are:

- Corn and soybeans: 4 years of bumper crops have teamed up with the strong dollar to hold back the price of these key commodities. However exploding global demand means that the world could be just one bad harvest away from much higher prices. With a population of 7.3 billion and a growing preference for meat in Asia, it won’t take a whole lot of bad weather news to move these markets much higher.

- Sugar: the sweet stuff was our best performing trade of 2016. The sugar market is in its second year of deficit due to El Niño-relation weather disruptions in Brazil – the world’s largest supplier. This market is in the midst of a correction that could present us another big buying opportunity.

- Cotton – we have been patiently long cotton for a while. A sideways market nearly 3 years old means options are cheap. We’ll be looking to roll our long calls shortly.

- Silver and gold: these dollar-dependent commodities are already on the mend. Both could surprise – especially during the seasonally friendly first half of the year.

- British Pound – this morning’s announcement by British Prime Minister Theresa May indicating a “hard” Brexit should have been pound negative. It had the opposite effect. The pound is soaring as we write this. We intend to “roll” our existing March bullish to June positions shortly.

- Platinum – 6 years of supply deficits mean this market could be among the most potentially explosive on the board. Lack of a liquid options market means we’ll have to make a bullish play using the futures. Sufficient margin capital will be required.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.