The short side of the Japanese yen was one of our favorite trades of 2014. The Japanese currency may be a lot lower now, but almost all the factors that fueled our bearishness 12 months ago persist. We believe the yen will go even lower – perhaps much lower –if the Land of the Rising Sun has any hope of returning to solvency.

Japan’s huge debt load – stubbornly stuck at 250% of GDP – was the main factor behind our bearish yen stance in 2014. Mathematically too big to pay off through economic growth alone, Japan needs inflation. Rising prices encourage consumers to get out and spend. A cheaper yen also makes Japan’s debt load smaller in real terms.

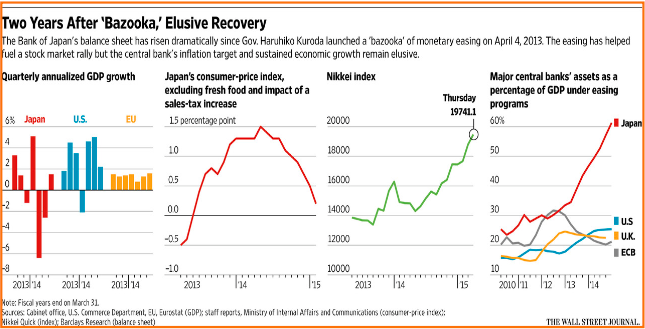

But Japanese Prime Minister Shinzo Abe and Bank of Japan (BOJ) President Haruhiko Kuroda have a big problem. Japanese inflation has collapsed despite last year’s extended, BOJ-engineered selloff in the yen. This means even more financial engineering could be on the way. The Wall Street Journal’s headline “Japan’s Zero Inflation a Setback for Abenomics” on March 27, 2015 says it all. Japanese CPI has collapsed, giving back all of last year’s gain and more.

The bump in Japanese CPI was almost totally undone by April’s 3.8% nationwide sales tax increase. This illustrates just how deep Japan’s deflationary mindset is. An unprecedented 30% decline in the yen was completely undone by a simple tax increase. To shock consumers back to the market and re-ignite inflation, we believe the BOJ will have no choice but to encourage another leg down in the Japanese currency. The recent collapse in oil will make this easier to stomach.

But inflation isn’t the only bearish factor. Three Japanese Pension funds responsible for roughly 3 trillion yen ($249 billion) have decided to join the massive Government Pension Investment Fund (GPIF) and reallocate their investments out of Japanese Government Bonds and into stocks, both domestic and foreign. That requires selling a fair amount of yen to acquire the foreign currency necessary to make these investments.

The Japanese stock market may be exploding, but so is the Bank of Japan’s balance sheet. What this means is the BOJ is piling on even more debt despite stagnant Japanese GDP growth and the return of deflation. Something’s gotta give soon. We think it will be the yen.

Data Source: Reuters/Datastream

What We Are Doing Now

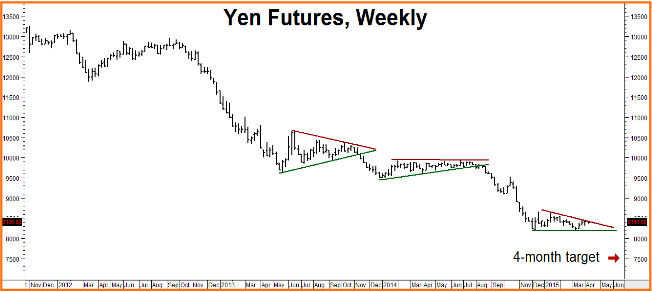

The yen has been trading sideways for the past 20 weeks, totally alleviating the oversold condition that prompted us to close out our short bearish positions in the 4th quarter of 2014. The last two legs down in the yen were preceded by similar periods of flat market action. While this is no guarantee it will happen again, the current sideways price action reduced volatility substantially – and along with it, the price of Japanese yen options.

We are suggesting our trading clients consider buying September bear put spreads targeting .007500 in the September yen futures contract. These spreads are going for approximately $775 as we write this with a potential to be worth as much as $6,000 should the yen finish at or below our .007500 target at option expiration on September 4, 2015. Our fill price plus transaction costs is the most we can lose on this position.

Prices can and do change so check with your personal RMB Group broker for the latest on this or alternative protective strategies and get up-to-the-minute pricing and advice. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.