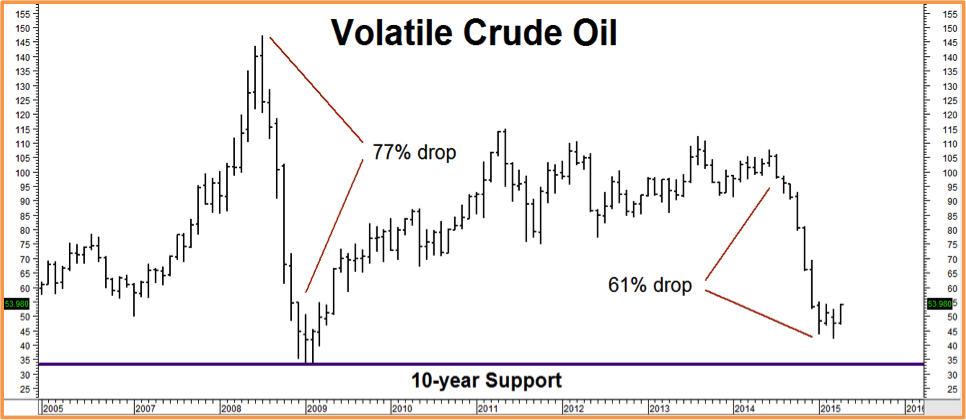

Crude oil is a notoriously volatile market. The past decade has seen two steep declines that devastated prices. Bears point to the fracking revolution which is responsible for a massive increase in US oil production and note it has yet to spread to other parts of the globe. The prospect of American fracking technology in the hands of Russia, China or Saudi Arabia has oil bears licking their chops because it unlocks oil reserves that were once unavailable.

The millions of barrels currently clogging American tank farms aren’t helping matters either. Some bearish analysts are calling for a drop of $20 per barrel – another 62% lower. However, history and experience tell us that bullishness is never as great as it is near the highs and bearishness is never as strong as it is at the lows.

Data Source: CQG

Data Source: CQG

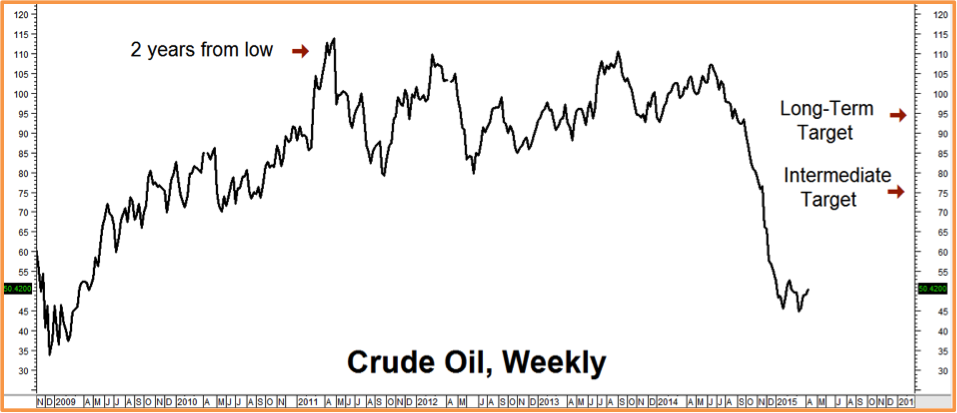

Both of crude’s big declines began during periods of excessive bullishness. We expect the current decline to end with a flood of rampant bearishness, much like what we are seeing in the financial press now. Hardly anyone is predicting a meaningful rally in crude anytime soon.

Extreme bearishness also dominated the market when crude hit $35 per barrel in late 2008. That massive 77% meltdown lasted 6 months. (See chart above.) March of 2015 marked the sixth month of the current decline. Coincidence? Perhaps…however, one can’t deny that the chart patterns of both crashes are eerily similar.

The Cure for Low Prices Is Low Prices

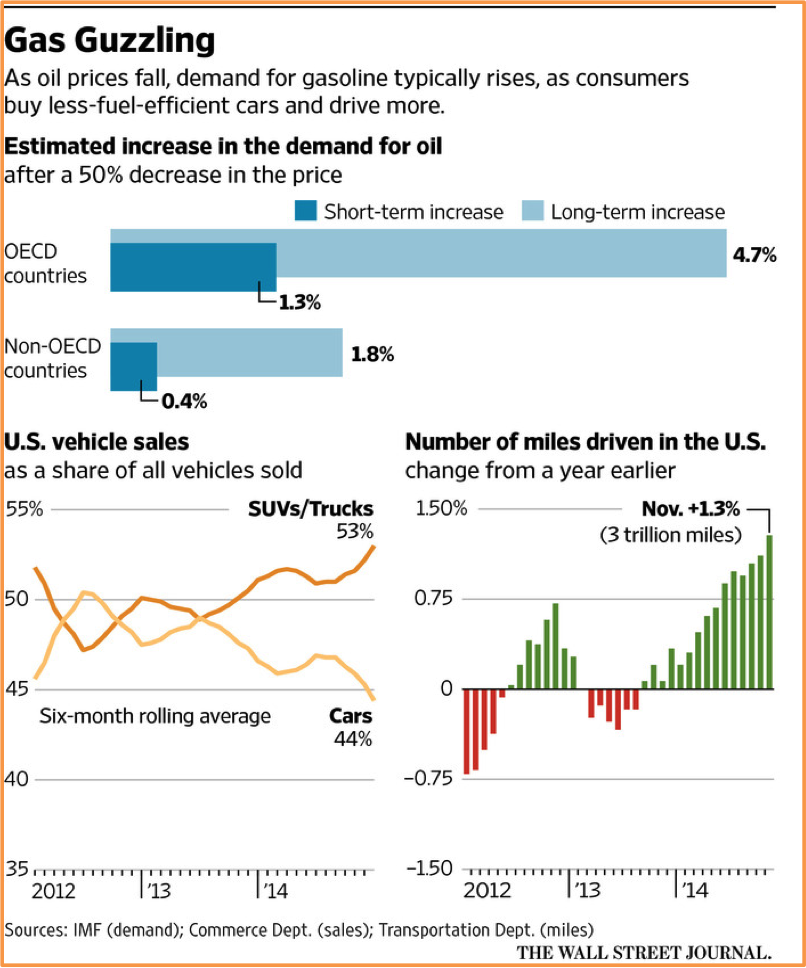

This traditional traders’ saying pretty much sums up our feeling about crude oil at these levels. Green energy technology has made great strides, but the world still runs on crude oil. Today’s low prices are helping to increase demand and cut production – two factors we believe will ultimately lead to higher prices down the road. It’s Economics 101, and it is occurring at a surprisingly rapid rate.

Let’s start with demand…gasoline below $3.00 per gallon means America is driving again. Not only are consumers back on the road, they are driving new vehicles. Most new cars today are not cars at all; they are gas-guzzling light trucks and SUVs. 53% of the new vehicles sold in the 6 months ending January 2015 were in this category – the largest in over a decade. Americans love their trucks, and cheap gas is making it easier to own them. American fuel consumption should rise as a result.

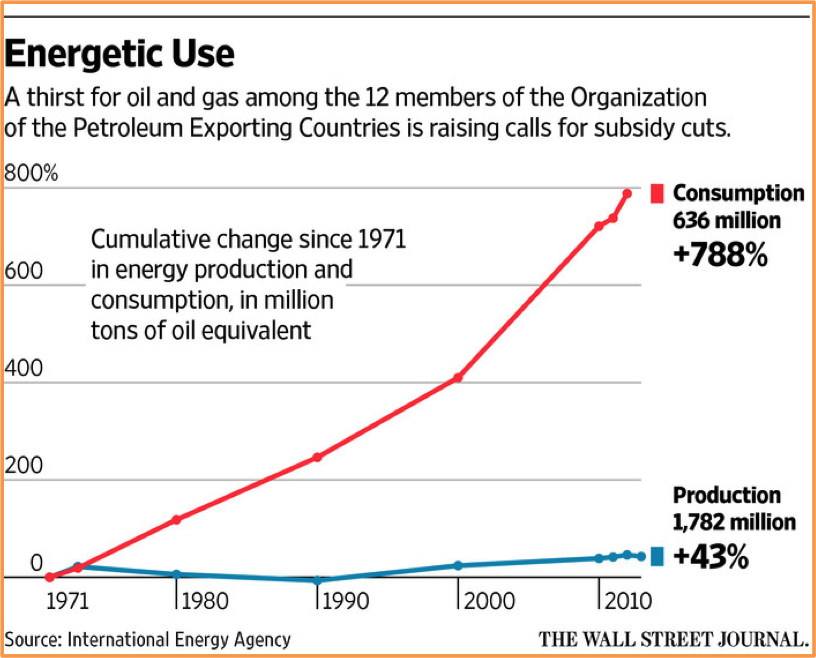

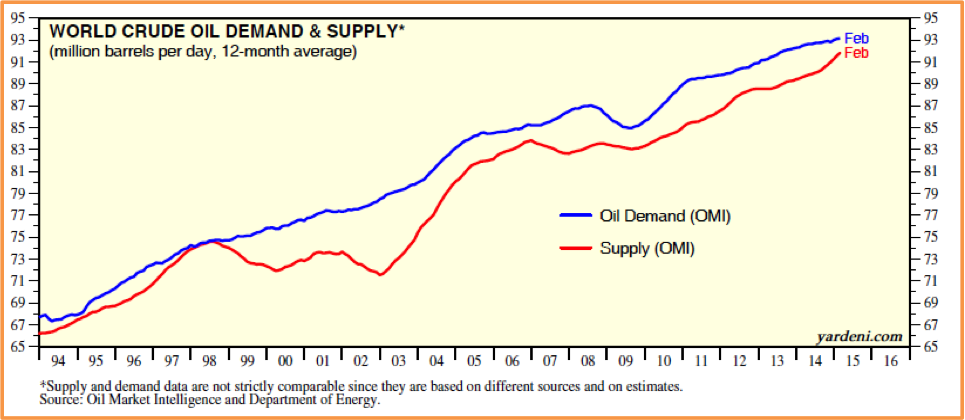

But Americans are not the only ones. One of the biggest sources of demand for OPEC oil are the OPEC nations themselves. OPEC consumption has jumped sixty-fold in just the past decade. OPEC has only half of China’s population, but it is now consuming just as much oil.

The reason? Low prices. Gasoline costs 45 cents per gallon in Saudi Arabia. In fact, nearly every OPEC nation subsidizes their domestic energy needs. Even Iran, hamstrung by sanctions and unable to refine its own gasoline, has cheap fuel.

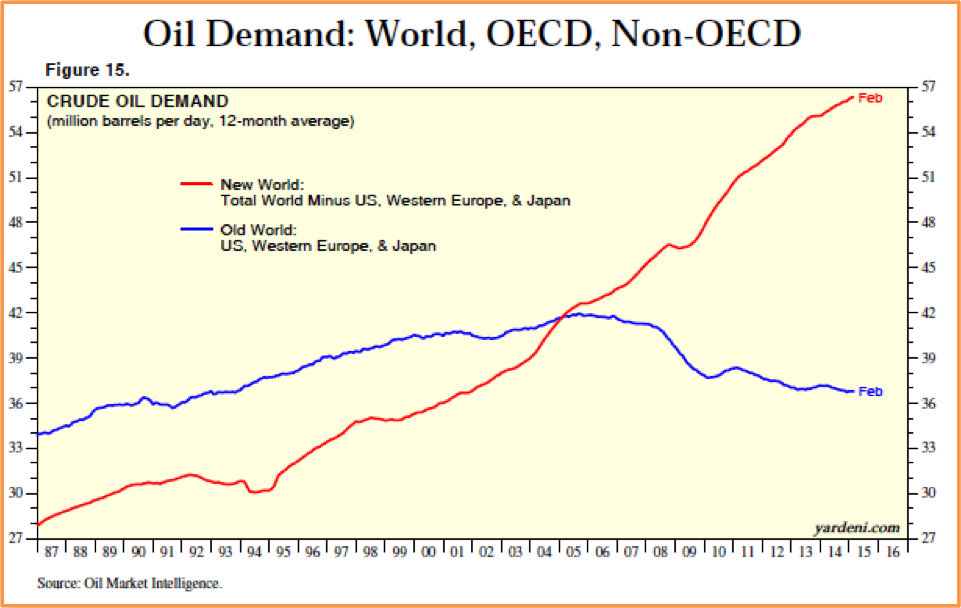

And let’s not forget China and India. These are the most heavily populated nations on earth. Richer and more affluent than ever, the Indians and Chinese will be driving more (and probably bigger) cars. Economic activity may be slowing in China, but it is still growing much faster than the developed world. China will probably expand its GDP by roughly 7% this year despite all the talk in the financial press of a slowdown. India is just starting to get going.

The math is fairly straightforward. More and more people live in the developing world. Flat to declining demand in OECD (developed) nations is being more than made up for by increasing demand in developing nations. As long as China, India and the rest of Asia stay on their growth path, they will use more oil. China, in particular, cannot afford not to grow. We expect they will do anything to keep progressing because domestic peace depends on it.

Global supply and demand have tracked each other pretty closely for the past 20 years. Contrary to what some of the “peak oil” doom and gloomers were forecasting a few years ago, the world is not in danger of running out of oil anytime soon. Improvements in drilling technology, such as hydraulic fracturing (fracking), have expanded supplies. Advanced, satellite-guided drilling rigs sail the seas searching and finding oil in places previously thought inaccessible.

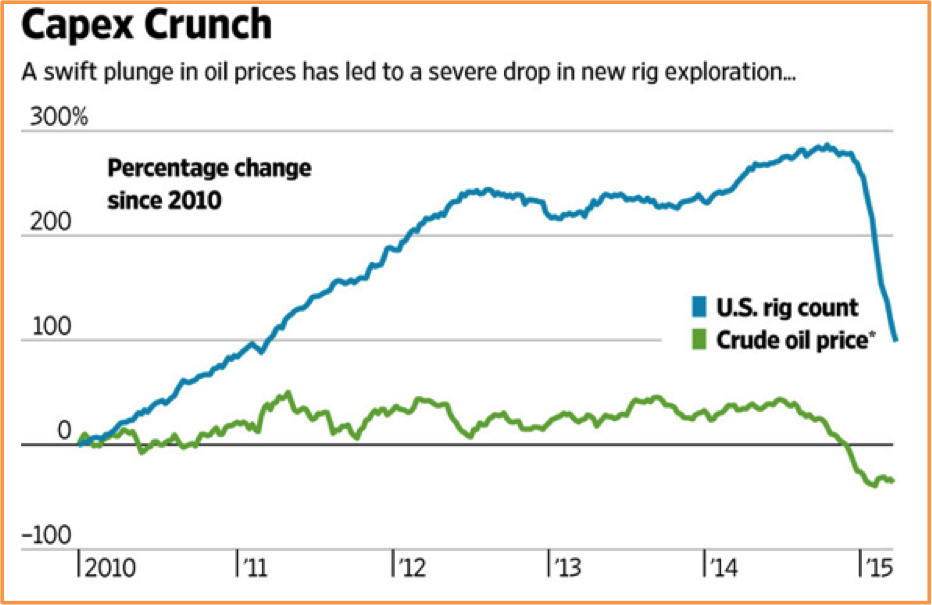

But these new technologies are not cheap. The world may not be running out of crude oil, but it is running out of cheap crude. The cost of finding and recovering new supplies keeps rising. It’s why we do not expect the current slide in price to last. Shale oil fracking not only costs more, it requires much more upfront investment in equipment. Traditional oil producers like Saudi Arabia know this, which is why they’ve driven the price of crude below the price needed to making “fracking” profitable. The Saudis are worried about losing market share to shale. Shut down shale, even for a short while, and demand for OPEC crude will rise.

US Rig Count Collapsing

The Saudi effort is succeeding. The number of rigs drilling for oil in the US has collapsed from roughly 1500 rigs on December 27, 2014 to roughly 800 now – nearly a 50% drop in just 3 months. Multi-millionaire, oil-patch icon T. Boone Pickens, interviewed in a March 30th Wall Street Journal article, forecast this factor alone would be enough to push prices back to $70 per barrel by the end of this year, and perhaps as high as $100 per barrel by the end of 2016.

Source: The Wall Street Journal

Source: The Wall Street Journal

So why is crude oil still weak? It takes time for the current shutdown to work its way through the system. Many producers were forced by their loan covenants to hedge the price of their oil. Because their production was hedged as high as $90 per barrel in some cases, it made sense for drillers to sell their physical crude into an already weak market while lifting their profitable hedges. The effect was the same as selling physical crude for the higher price.

A lot of these hedges will expire soon. Meanwhile, the cost of similar hedges at current (in many cases, unprofitable) prices has soared. Unable to hedge production profitably, more and more drillers are no longer drilling. The flood of new oil that gushed into the market this spring could dry into a trickle this fall.

Won’t producers start pumping again if prices rise? The more efficient, low-cost operations probably will, but it will take prices much higher than $50 per barrel. It’s a lot easier to shut a well down than to start it back up. Some rigs will probably come online when and if prices rise, but it will be a much slower process than the carnage caused by Saudi Arabia’s supply bomb. Saudi has started raising prices in Asia which suggests to us they are declaring victory in their war against American shale oil producers.

But low prices and the crippling of the American shale oil industry are not the only reasons to expect a bounce in black gold. The Mideast appears to be on the verge of a region-wide civil war while Russia, Venezuela and Iran desperately need higher prices to stave off economic collapse.

4 Bullish Factors for Crude Oil

- Proven reserves have declined to 78.6 billion barrels of oil equivalent. This is a reduction from 80 billion barrels – the steepest falloff since 2008.

- Widening of Sunni / Shia proxy war. Add Yemen to the mini civil war in the Mideast. The oil market will probably keep ignoring this conflict until it no longer can. Prices could skyrocket on any threat to Saudi supplies. Much of Saudi Arabia’s oil infrastructure is close to major population centers, making it a potential target.

- Strong gasoline demand in the US. Americans are driving more and refiners are making money hand over fist, making them more willing to pay up for crude.

- The Iran nuke agreement is not a done deal by a long shot. Both Congress and Israel are intent on torpedoing this deal and could succeed. Iran is also making bigger demands. Even if the deal gets done, it will take until late 2015 at the earliest for Iranian oil to make it to market.

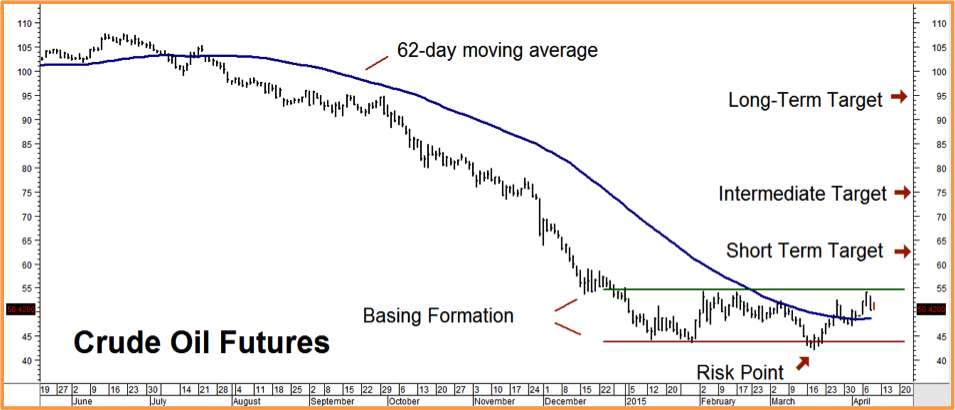

Potential Price-Base Forming

Crude oil is has been trading sideways for the past 4 months and is finally showing signs of basing after closing numerous times over the 62-day moving average. It has done a fantastic job of keeping crude oil trend-followers honest. A couple of consecutively higher closes above resistance at the old highs of $52.25 per barrel could propel the black, sticky stuff to our short-term upside target of $62.30 barrel. This sets the stage for a potential move higher into the end of the year.

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

All of our price targets are derived from Fibonacci projections generated by a breakout from the current trading range. Strangely enough, they correspond pretty closely with T. Boone Pickens’ call for $70 oil by the end of this year – and $90 to $100 per barrel prices within two years.

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

As you can see from the weekly chart above, this won’t be the first time crude oil rebounded smartly from a market crash. $35 per barrel oil at the end of 2008 became $100 oil by the end of 2010, proving the old market adage about “low prices being the best cure.” Will it happen again? We believe conditions are ripe for a small bet that history will repeat, or at least rhyme.

What We Are Recommending Now

We are currently asking our trading customers to consider bull call spreads in crude oil futures expiring in two separate timeframes: December of 2015 and November of 2016.

STEP 1: January 2016 bull call spreads expire in mid-December 2015. We are looking at a strategy that costs $640 and targets $75 per barrel. It could be worth as much as $5,000 if crude oil hits our $75 objective on or prior to option expiration on December 16, 2015. Our fill price plus transaction cost is the total risk on this leg of the trade.

STEP 2: We are also suggesting buying long-term bull call spreads on the December 2016 futures contract targeting our long-term objective of $95 per barrel. These spreads are currently trading for $400 and could be worth as much as $10,000 each should crude oil hit our $95 long-term objective on or prior to option expiration on November 16, 2016. Our fill price plus transaction cost is our total risk on this leg of the trade.

Combining the two gives us a position with a maximum risk of approximately $1,100 plus transaction cost and the potential to make as much as $15,000. Best of all, we can “set it and forget it.” If we are wrong, we lose a small amount. Call your personal RMB broker for the specific details of this trade.

Getting Started

If you are not an RMB Group trading customer and want to know more, please give us a call toll-free at 800-345-7026 or 312-373-4970 (direct) or email suerutsen@rmbgroup.com. We’ll be happy to answer any questions you may have. RMB Group members have been helping their trading customers navigate the futures and options markets since 1984. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to learn more about the RMB Group and open an account online.

Why Two Trades in Two Different Timeframes?

Front month crude oil futures contracts tend to lead the market up and down – falling more than the back months in bear markets and gaining more than the back months in bull markets. This has to do with storage and relative scarcity of supplies. (This relationship could be the subject of an entire in-depth report all by itself.)

The current decline means front month crude oil contracts are much cheaper than back month contracts. This encourages speculators to buy physical oil, store it and sell back month futures contracts against it to lock in gains. This is what is happening right now and is partially responsible for today’s big glut in supply. The process reverses itself in bull markets. Eager to lock in supplies, crude oil users buy front month futures contracts to guarantee delivery of physical oil, causing them to rise faster than the back months.

Since our work tells us that crude oil could be transitioning from a bear market to a bull market, we want to combine a shorter term position with a longer term one to take advantage of the tendency of front contracts to rise faster in a bull market.