Platinum is rarely cheaper than gold for a number of factors. We outlined some of these reasons last month in our Special Report: “Platinum Is Significantly Cheaper than Gold for Just the 2nd Time in 24 Years.” (Click here if you haven’t read it yet or wish to read it again.)

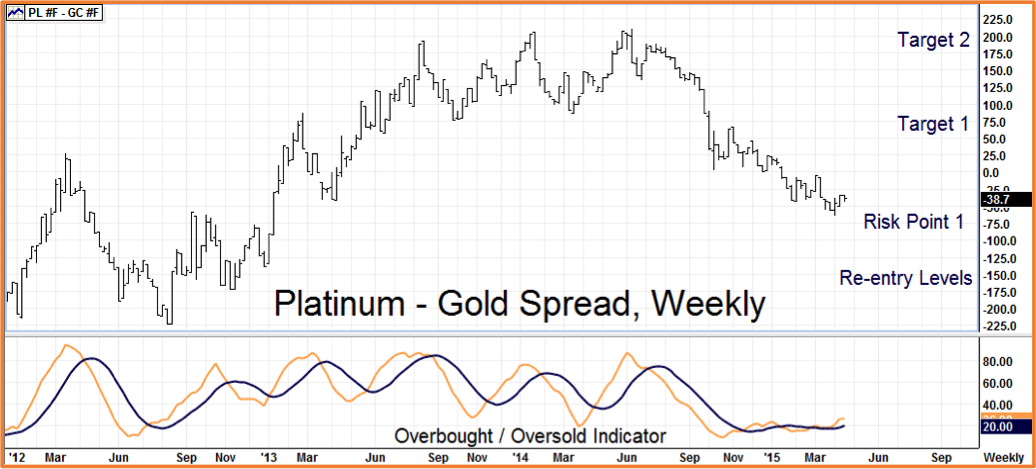

In the report, we outlined two scenarios that would cause us to be fairly comfortable recommending a long platinum / short gold position for our trading customers with a higher risk profile and sufficient funds to back such a position. The first was a dip in the spread to minus $100 per ounce or lower (platinum $100 ounce cheaper than gold). The second was a series of two consecutively higher weekly closes over a previous week’s high.

The market gave us the second signal on Friday but did it subtly. Big weakness yesterday caused us to hold off a day because we wanted to see some stabilization in the spread first. We got that on the close. Gold lost $7 per ounce to platinum causing the spread to widen by $7 at the close of pit trading in New York on Tuesday.

Data Source: Futuresource

Data Source: Futuresource

What We Are Suggesting Now

Consider buying two contracts (COMEX futures) of platinum and simultaneously selling 1 contract (COMEX) of gold with an initial upside target of $75 platinum over gold and a second target of $200 platinum over gold You can either use the liquid front contracts or the October contracts — a contract month both gold and platinum share. Check with your personal RMB broker first. Liquidity could be an issue.

Use two consecutive, daily closes under -$70 as a signal to exit and cut losses. Your risk will be the difference between you fill price and your exit price. The October Plat/Gold spread closed today at minus $40. That means if you were filled at today’s close and “stopped out” at our -$70 risk point your loss would be $3,000. Similarly your gain would be $11,500 if filled at -$40 and the market reached our +$75 objective without being “stopped out.”

These are just examples and your fill price will probably not be the same. Re-read our original Special Report to get a better handle on the futures contract sizes as well as the potential risks of this trade.

Editors’ Note: We will probably consider re-establishing a long platinum / short gold position even if our first attempt at bottom picking should fail and look to re-establishing similar positions on a dip below minus $100. We think minus $150 is a great entry level. We will be monitoring this spread closely in any case. Market anomalies like this do not last forever.

Prices can and do change so check with your personal RMB Group broker for the latest on this or alternative protective strategies and get up-to-the-minute pricing and advice. This is a futures trade and has higher risk than long option recommendations, so use your personal RMB broker as a resource.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.