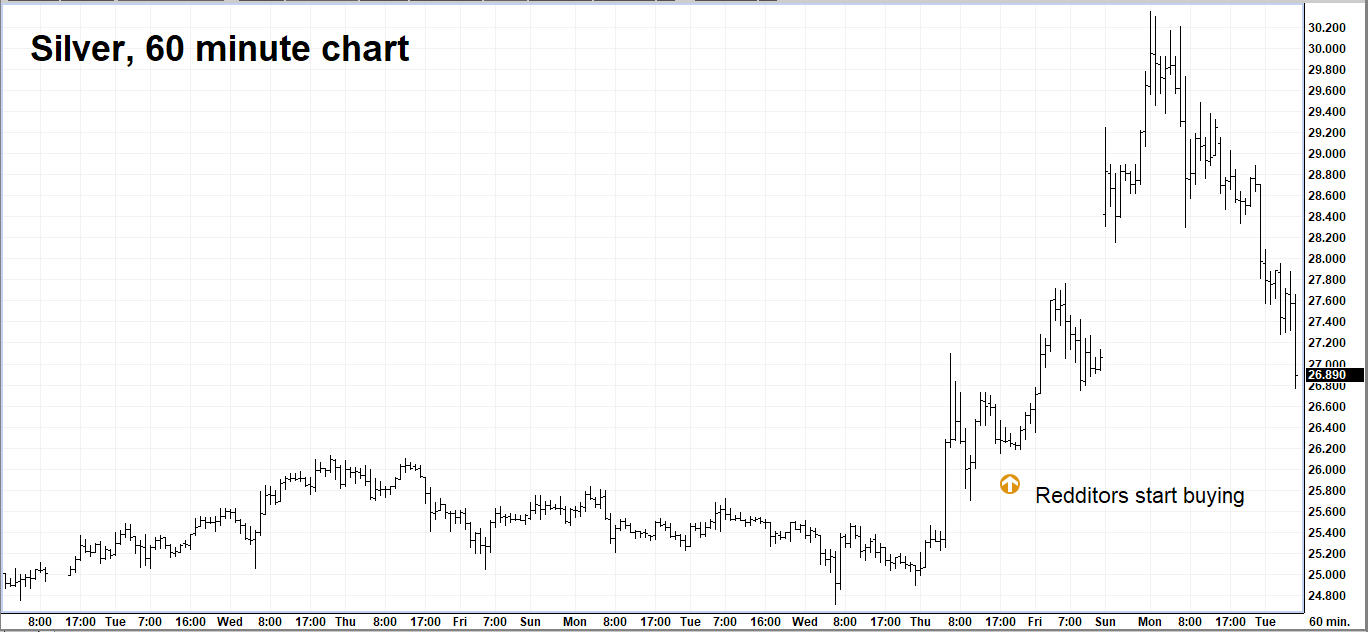

The Reddit revolutionaries may have leveraged the Internet to change the investing game in heavily-shorted shares like GameStop (GME), but they bit off too much when it came to silver. Small traders flooded bullion dealers and the popular online trading app “Robinhood” with buy orders on Friday and Monday. Then they watched silver give up nearly all those gains on Tuesday. Further declines could provide us with an opportunity to re-enter this market from the long side.

Data Source: FutureSource

Why didn’t the tactics that worked so well in heavily-shorted stocks fail so quickly with silver? Let’s start with the simplest explanation: silver is not a stock; it is a commodity that is extremely difficult to buy and sell outside of the futures market. Coins and bullion are subject to the same inventory constraints as a popular toy during the Holidays. Bullion dealers were caught flat-footed without inventory to meet surging demand.

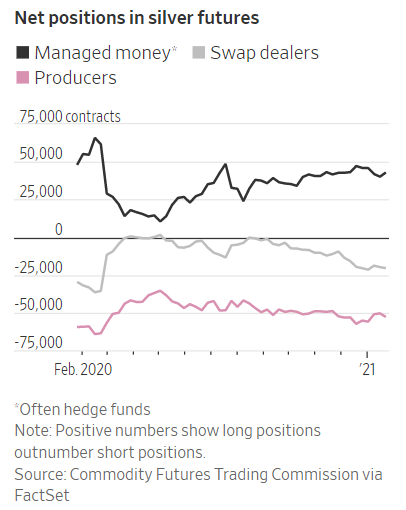

Attempts to squeeze silver using the SLV ETF were also doomed to fail because SLV is not contractually obligated to deliver physical silver to holders. The belief that hoarding shares of SLV would force the fund into the physical bullion market and jack up prices was, at best, misguided. So was the notion that by squeezing silver, the Reddit revolutionaries would be “sticking it to the man.” The “man” in this case were fund managers and they were long. Some of them probably used the Reddit run-up to take profits.

The Futures Advantage

There are only a few ways to own physical silver. One is to buy it directly through a dealer, but this can be thwarted by inventory issues. Dealers also mark up inventory when demand is high, often demanding big premiums over actual cost. The opposite can occur when it’s time to sell. A glutted market for physical silver often means retail holders looking to sell receive less than market price. Liquidity is not the strongest attribute of many bullion and coin dealers.

The cheapest and most liquid way to trade (and own) physical silver is through the futures market. Holders of long futures contracts can accept delivery of actual, assayed, pure silver bars after the delivery date of their futures contracts. Holders of short futures contracts are required to make delivery of the silver covered by their short futures contracts prior to expiration. The vast majority of futures contracts are offset prior to the delivery period, but the fact that delivery can and does occur keeps prices of futures extremely close to the price of physical bullion.

Futures contracts cover large amounts (1,000 and 5,000 ounces) of silver putting them out of reach of most Redditors. However, silver tends to do best when individual investors jump on board. It’s why it’s called “the poor man’s gold.” The attempt at a short squeeze may have failed, but it has focused a lot of new attention on the silver market. This could pay off once the backlash to the Redditors’ failed short squeeze subsides.

New Targets for The Poor Man’s Gold

RMB Group trading customers and followers of this blog know we have been bullish silver for a long time. We continue to like silver for all the same reasons – and one new one: 1) it has a pronounced tendency to outperform gold in bull markets; 2) it responds better than gold to inflation; 3) Jerome Powell and the Federal Reserve continue to keep rates at “zero” virtually eliminating the opportunity cost of owning the metal; and 4) the odds that the Biden Administration will pass another huge (and potentially inflationary) stimulus plan get better by the day.

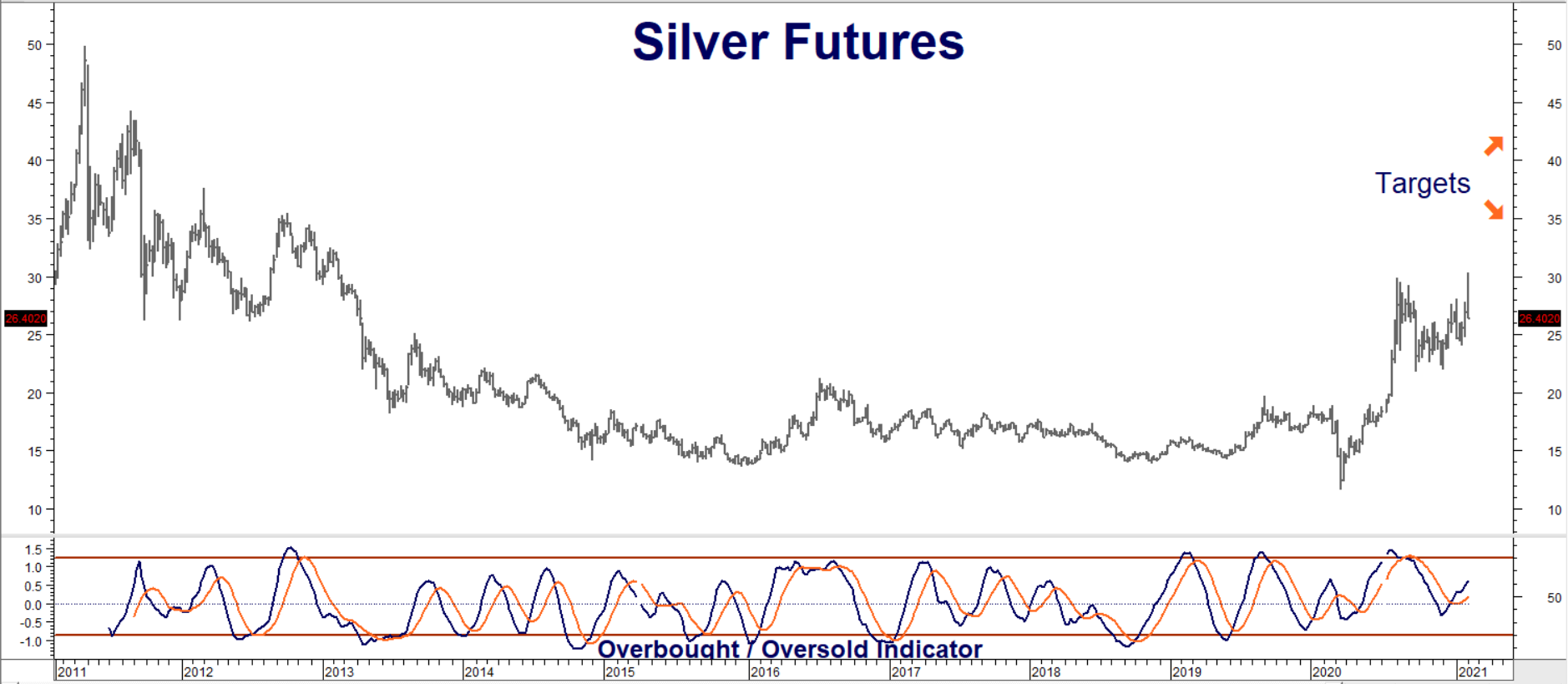

Silver has hit nearly every upside objective we’ve set since we began taking long positions over a year ago. Big volatility and expensive options have kept us out of the market since our $25.50 per ounce target was hit (in July) and our December 2020 futures options expired in December. However, the current selloff may be providing us with another opportunity to get long using the fixed risk option play we tend to favor in volatile environments.

Data Source: Reuters/DataStream

Three months of sideways price action has removed the overbought conditions of last summer. And while this week’s short squeeze breached $30 per ounce in the overnight market, the effect was not enough for an upside breakout. A true breakout would have involved a series of closes above this level. Will it happen? It is certainly possible and would set the stage for a run to $35, and potentially as high as $42 per ounce. Time will tell.

In the meantime, let’s see if we can use this Reddit reversal as an opportunity to re-establish long positions in silver. RMB trading customers may want to look at May 2020 $32 / $35 bull call spreads for $1,500 or less. Your maximum risk is the amount you pay for your spread plus transaction costs. Each spread has the potential to be worth $15,000 at option expiration. Prices can and will change rapidly in this post-squeeze environment, so check with your RMB Group professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.