Spring has barely sprung and March is living up to its reputation by going “out like a lamb” – at least where commodities are concerned. Nearly the entire sector – including grains, precious metals and energy – has chopped sideways since last summer. This may not make for an exciting story, but we believe it will set up a number of low-cost trading opportunities for those who are patient.

Sideway markets reduce participants’ expectations of volatility. Since volatility is a big component of option price, low volatility tends to reduce the price of both put and call options. The longer a market goes nowhere, the cheaper options get. Eventually they reach a level that screams “buy me!” Markets do not go sideways forever. Like a coiling spring, the longer and tighter they wind themselves up in a trading range, the bigger the potential breakout. Combine this with cheap options and you get the key ingredients for a “big move” trade.

One market that fits this bill nicely is corn.

Data Source: Reuters/Datastream

The yellow grain has a fairly consistent history of trading sideways for multi-year periods, typically bouncing around its lows. These sideway periods tend to be followed by big upside price breakouts. Consecutive years of bumper crops in the US – the world’s biggest supplier – and a record crop now hitting the storage bins in South America have kept corn under pressure. At the same time, soaring global demand due to changing diets in population-heavy Asia has prevented prices from plummeting below long term support. This has kept the yellow grain locked in a fairly tight trading range since the summer of 2014.

History tells us this sideway trading range won’t last forever.

Global demand for corn has grown to a point where the market needs a consistent supply of bumper crops – especially from the US – to maintain equilibrium. Any unexpected weather event has the potential to disrupt this supply and send corn higher in a hurry. In this era of global climate change, unexpected weather may be the new normal. With the price of corn currently below the cost of production, adding to our existing bullish positions in anticipation of unforeseen weather is getting more tempting.

If you own the hedged long futures position RMB Group “Big Move Trade Alerts” recommended last August (click here to read report again), stay with it for now. Corn has a seasonal tendency to bottom in late spring before drought and excessive heat become concerns.

If you don’t own a position in the market, stay tuned. We are patiently waiting for the volatility premium imbedded in the December call options to decay a bit further. We believe a technical buy signal could come any day – and will let you know when we feel it’s time to pull the trigger.

We Caught a Break – and Perhaps a Bottom – in Cocoa

Markets anticipate. This is characteristic of most markets. Fortunately, it is working to our advantage in cocoa right now. We suggested using December 2017 call options to create a bullish position in our February blog (click here to read again) because we noticed that the chocolatey stuff had gotten crushed and was resting against long-term support. We were also aware that global demand was growing and the market had just flashed a “buy signal” by closing twice consecutively above its previous day’s high. Call options were also ridiculously cheap.

Less than a month after establishing our bullish position, The International Cocoa Organization released some of the most bearish supply numbers we’ve seen in some time. Cocoa prices fell, but did not break the 9-year support level we recommended buying against. We consider it extremely encouraging that cocoa was able to rally in the face of bearish news. That cocoa has closed above both its 38-day moving average and nearly year-long downtrend is good news too. RMB Group trading customers should continue to hold their bullish December call option positions.

Data Source: Reuters/Datastream

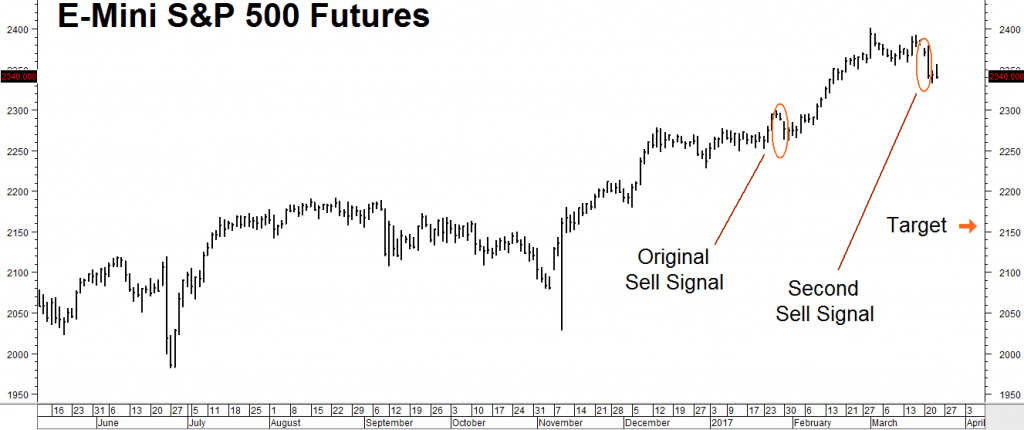

Swing and a Miss, but Only “Strike One”

It turns out we were a bit early on our suggestion in late January to fade the “Trump Bump.” Our sell signal did not work out, but we didn’t risk much either. The maximum risk for our March 2017 put recommendation was around $350 plus transaction costs. If you followed our advice to exit on two consecutive closes over old highs your loss was even less. If you still own the June 2100 / 2200 bear put spreads suggested in the same issue, we recommend staying with them for now.

At 29, the Shiller PE ratio for the S&P 500 remains in nosebleed territory. It was a little over 30 just prior to the 1929 crash. It also appears less and less likely that Donald Trump will get the kind of tax cuts and infrastructure spending the stock market was counting on. If something doesn’t break Trump’s way soon, the market will begin pricing both of these out.

Stocks flashed another sell signal on Tuesday. Consider buying June 2150 / 2250 bear put spreads for $650 or less. Your maximum risk is $650 plus transaction costs. These spreads have the potential to be worth as much as $5,000 should the E-mini futures hit our 2150 target at or prior to option expiration on June 16, 2017.

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find the report.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.