Who doesn’t like chocolate? While some may not be susceptible to its seductive charms, global demand for chocolate and its raw material, cocoa, has exploded. Western consumers eat 286 chocolate bars per person, per year. Rising standards of living in India, China and the rest of Asia mean that the population-heavy East is joining Europe (the world’s biggest consumer) and America in a global craving for decadence. No surprise, the cocoa industry forecasts a 30% increase in global demand by 2020.

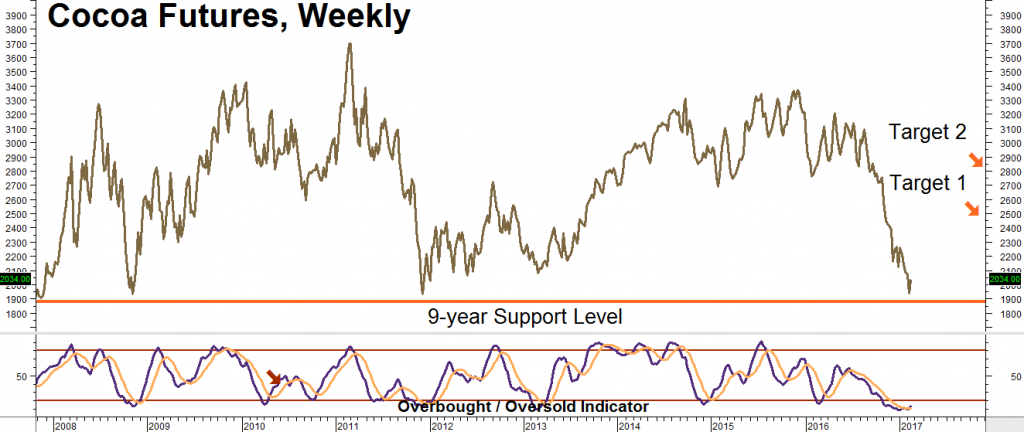

But cravings alone are not enough to keep demand high. Chocolate also needs to be affordable. Cocoa rallied 28.5% in 2015, soaring to a high of $3,429 per metric ton in December of that year and demand began to wane. This set the stage for the current decline which has taken prices as low as $1,890 – a drop of 43.5%. Cocoa is now testing a support level which has held for the past 9 years. Unloved and oversold, cocoa is cheap again.

Data Source: Reuters/Datastream

Cheapness, in and of itself, is never a good reason to buy anything. However, there are certain characteristics of cocoa production that make it very sensitive to price. 60% of cocoa comes from two sources in West Africa: the Ivory Coast and Ghana. Both countries have a history of political and social instability. Climate change has impacted both countries, creating hotter and drier growing seasons which negatively impact yields. The Ghanaian government estimates that roughly 40% of its producing trees are either too old or too diseased to generate maximum production.

More than 90% of the global cocoa crop is produced by subsistence farmers using antiquated and inefficient growing techniques. Most of these farmers do not have ready access to credit. When prices are high, they can afford fertilizer and labor. When prices are low, they cannot. The result can be seen in the cyclical, multi-year swings in price on the chart above.

Two years of elevated prices meant cocoa farmers could afford to invest in methods to increase their yields. The result was more supply. At the same time, high prices for cocoa reduced the demand for chocolate. Now that prices are low, we expect farmers to cut back, beginning the cycle anew. It may take a while, but we believe we are close to a cyclical bottom.

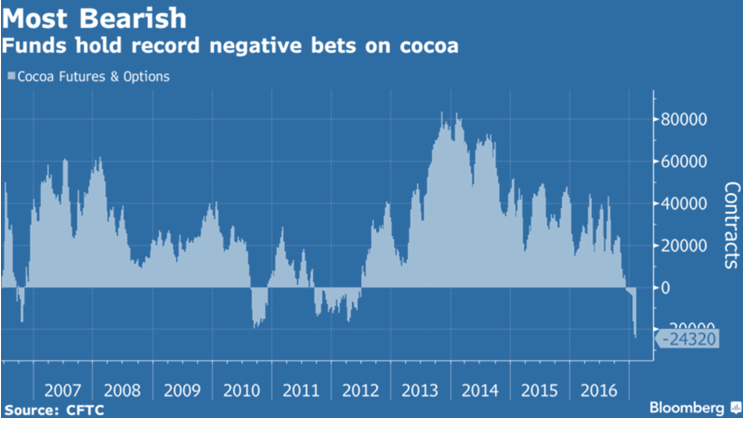

Add in selling by commodity funds eager to capitalize on falling prices and you get today’s cocoa market. Commodity funds are more bearish on cocoa than they have ever been. This could provide the fuel for a wicked short-covering rally.

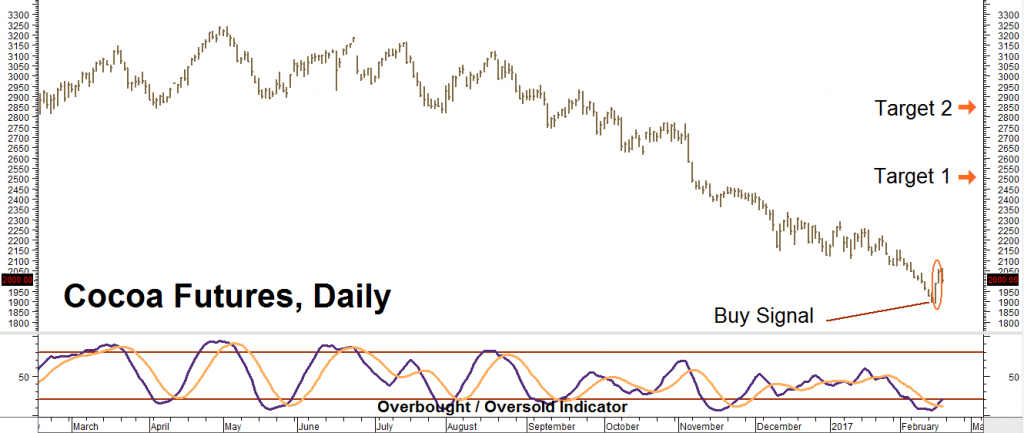

Cocoa closed higher than its previous-day high twice consecutively last Thursday, providing us with a buy signal. Virtually no one expects cocoa to go higher anytime soon, and this is reflected in the price of its call options. Consequently, we suggest that RMB trading customers consider using cocoa calls to construct a position with the potential to pay off from a multi-month bounce from current levels.

Data Source: Reuters/Datastream

Our first target is $2,500, our second is $2,850. We are currently recommending buying a bull call spread using December options. This spread closed today at a price of $650. We recommend paying no more than $680 each. This plus your transaction cost is the most you can lose. Our spread has the potential to be worth as much as $3,000 should cocoa reach our $2,500 target by option expiration on November 3rd, 2017.

RMB trading customers should call their personal broker for details of this trade. Your broker may suggest other ways to take advantage of a bounce in the chocolatey stuff as well. Cocoa options are relatively thin so market orders should be avoided. Patience may be required to get the $680 price we suggest above.

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find the report.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.