It’s been a long wait. RMB BMTA Alerts originally suggested buying March 2017 75-cent cotton calls back in July of 2015 as part of a multi-strategy play on the then-developing El Niño. While we didn’t get the pop we wanted from that weather phenomenon, the white, fluffy stuff didn’t falter much either giving us no real signal to exit our bullish position. We were fortunate enough to have purchased our calls during a period of extremely low volatility. This allowed us to hold them long after the El Niño we had counted on for big price gains had faded. This is the beauty of using options to make “big move” market plays; fixed risk means staying power.

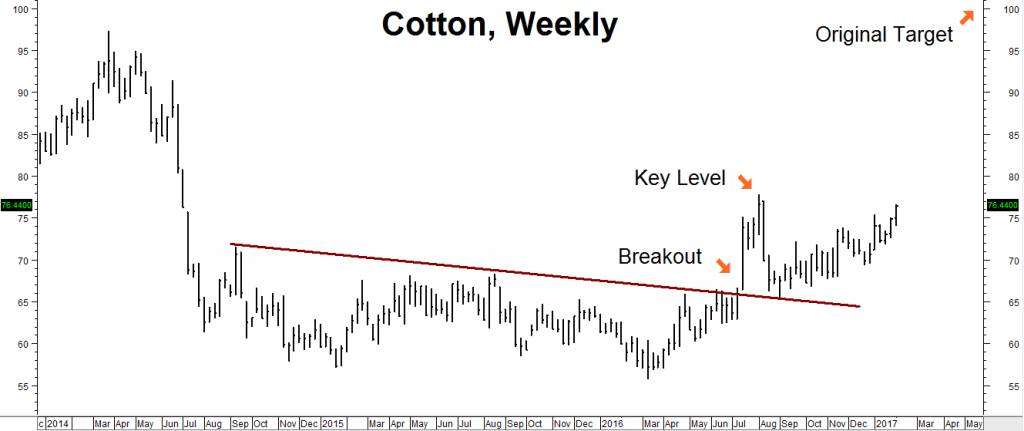

Our patience may be finally paying off. March cotton is currently undergoing a short covering rally. Like most such rallies, it has the potential to rocket big to the upside or to reverse in a hurry. The next few days will be critical. A close over old swing highs at .7780 (marked as “key level” on the chart below) could launch prices to 80 cents or beyond in relatively short order. On the other hand, failure to breech this level quickly could lead to major disappointment.

Data Source: Reuters/DataStream

Our March calls expire next Friday, which is eight days from now. This is definitely not enough time to achieve our original price target of $1.00 per pound. A cotton price of 75 cents or less on February 10 would also mean our 75-cent call options that closed yesterday for $1,015 would expire with no value. Do we dare look this gift horse in the mouth?

The safest play would be to exit immediately and recoup most if not all of the original cost of your options. It all depends on Thursday’s open. The aggressive play would be to give the white, fluffy stuff one or two days more to take out old highs at .7780 and sell into any rally that results from short covering above this level.

Time waits for no one. RMB trading customers that own March 75 cotton calls should considering contacting your personal RMB Group broker to see which of these exit plans best suits your needs.

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find the report.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.