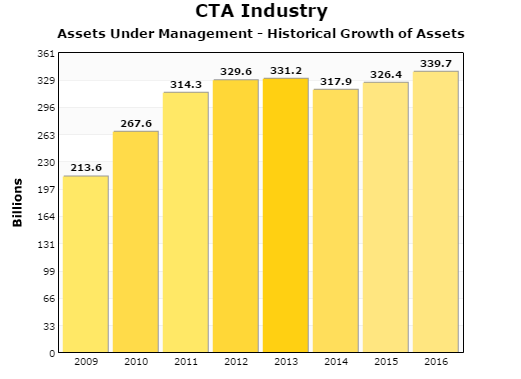

Managed futures are one of the fastest-growing asset classes. Money under management by the Commodity Trading Advisors (CTAs) who direct the trading for this asset class has increased nearly 60% in the past 7 years. Yet very few individual investors have ever heard of managed futures – and most who do find them confusing.

This blog is intended to “cut through the confusion” by comparing managed futures with other well-known asset classes. We hope our readers will better understand them and see for themselves why managed futures programs are so popular with professional investors such as university endowments, pension funds and family offices.

Source: Barclay Hedge

What Are Managed Futures?

Managed futures are similar to mutual funds – but with a few key differences. A mutual fund is an investment geared toward a certain portion of the stock or bond market overseen by a professional manager. For example, a mutual fund may focus on large cap stocks or long-dated Treasury Bonds or Dividend-Paying stocks. Some funds are managed to achieve a goal, such as retirement, by a specific year.

Target-date retirement mutual funds have become extremely popular in the new century. Rather than focusing on a defined market sector, target-date fund managers adjust their mix of stocks and bonds with the goal of reducing portfolio risk as the retirement date comes closer.

In every mutual fund, investor money is pooled together and managed according to the specific dictates of the fund. Each individual share represents a proportional interest in the fund. The vast majority of mutual funds involve ownership of underlying assets. That means most mutual funds are nearly always “long.” Large Cap stock mutual funds are long large cap stocks. Small cap stock mutual funds are long small cap stocks. Bond funds are long bonds. Target date and balanced funds are long both stocks and bonds.

Managed Futures Can Go “Short”

Managed futures are also professionally managed. However, instead of owning a portfolio of specific stocks or bonds, managed futures programs trade futures. Notice how we said “trade” rather than “own.”

Because they trade futures contracts, Commodity Trading Advisors (CTAs) who make the decisions for managed futures programs can go long or short any market at any time. This means managed futures have the ability to make money in both bull and bear markets. Most stock or bond funds cannot make the same claim. This is one reason why managed futures are such a powerful portfolio diversifier.

Managed futures are “pooled” like mutual funds, but instead of shares, managed futures investors buy “units.” The size of a given unit for any managed futures program is decided by the CTA managing that program. Unit sizes can vary from as low as $10,000 per unit all the way up to $1 million per unit or more. Unit size is often the same as the account minimum and varies from program to program.

Like mutual fund shares, managed futures units represent proportional interests in the underlying program. Some CTAs allow “notional funding.” Two hundred percent notional funding means an investor can trade a $25,000 unit for $12,500. Investors trading notionally should be aware that both gains and losses will be magnified. The example above means both gains and losses would be magnified times 2 on a percentage basis. (Click here for last February’s blog on notional funding.)

Managed Futures Are Liquid

Unlike ETFs, most traditional mutual funds are not designed to be actively bought and sold. Some even bar investors from buying again until a certain period of time has elapsed after a sale. An investor wishing to sell can contact his broker during market hours and will be given the closing price of the fund.

Liquidating a managed futures program is similar. Like most open-ended mutual funds, they are not designed to be actively traded by the holder. Instead, the CTA managing the program is responsible for the trading that occurs within the program.

Managed futures programs can be exited much the same way as mutual funds. Investors simply need to call their broker with an instruction to exit the program. The CTA managing the program will then liquidate the positions in the account the next day. Once liquidated, an investor can request a check, wire or ACH transfer of the proceeds. This generally take one to three days.

(Please be advised that the process described above does not apply to commodity pools. Commodity pools are limited partnerships and consequently, are much harder to liquidate.)

Key Differences: Managed Futures, Mutual Funds and ETFs

- Managed futures have the potential to benefit from any market environment – when an investor buys a mutual fund or ETF, he or she is making a commitment to one side of the market. While the introduction of leveraged short and commodity ETFs (or ETNs) has given investors the tools to participate in the commodity sector or on the short side of selected markets, the vast number of ETFs and mutual funds remain “long only.” Managed futures provide exposure to both sides of the market with the added benefit of professional management.

- Exposure to multiple markets – managed futures programs cover nearly every market: precious metals, agricultural commodities, stock indexes, volatility (VIX), energies, interest rates, currencies and much more. Many managed futures programs are diversified, which means they trade multiple markets. More markets means greater diversification in a single program. Most mutual funds and ETFs are sector and market specific, placing the burden of determining market direction and allocation on the investor rather than a professional trader.

- A disciplined trading approach – most managed programs are systematic which means they have specific rules for exit and entry for each market they trade. Many managed futures programs are algorithmic with signals that change with underlying market conditions.

- Managed futures are not correlated to stocks and bonds. This makes them very effective tools for portfolio diversification – especially when today’s interconnected global economy has increased correlations of nearly all financial markets. Managed futures tend to follow an independent path. Managed futures investors don’t buy or sell any given market or markets; instead they buy the skill of the CTA trading those markets.

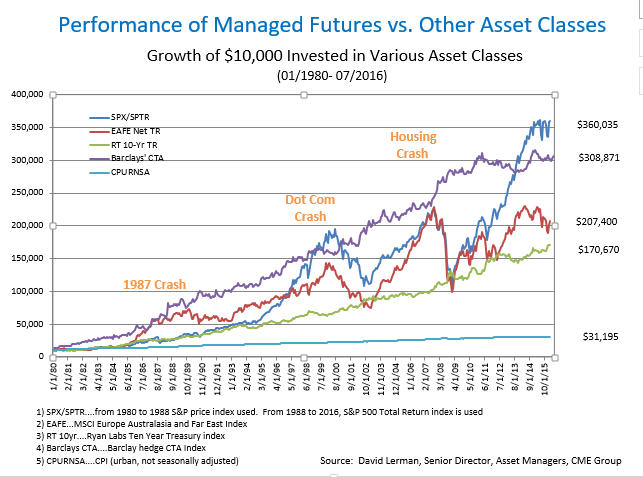

- Managed futures often perform well during periods of high market volatility. The chart below shows the performance of managed futures versus that of stocks and bonds over the past three periods of crisis. The blue line tracks US stocks. The green line tracks 10-year US Treasuries. The purple line tracks Barclay’s CTA Index (managed futures). Note the similarity in relationships between the current market environment and the 2001 “Dot Com” crash.

Investors should consider adding managed futures to their investment portfolios only after carefully reviewing the Disclosure Documents of each CTA they are interested in. A Disclosure Document is to Managed Futures what a prospectus is to stocks. It includes the background, trading style and experience of traders running the program. It also lists risk factors and other information, including the minimum account size each program will accept along with audited track records for the trader or traders running the program or programs.

To find out more about the Managed Futures programs the RMB Group is currently following – or to get more information on Managed Futures in general, give us a call toll-free at 800-345-7026 or 312-373-4970 direct. You can also visit our website at www.rmbgroup.com and download our managed futures primer “Opportunities Outside the Stock Market” along with a companion video.

Editor’s Note: Be sure to look for “Part B” of Managed Futures 101 in a future RMB Group Blog.

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.