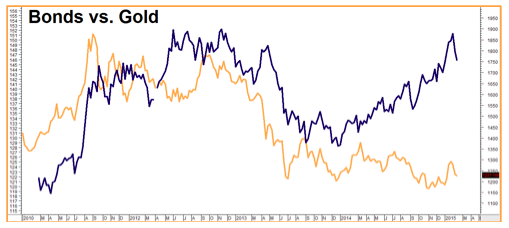

The one thing we’ve learned from our 3 decades in this business is to respect the market’s capacity for surprise. We’ve been exploring the huge gap between gold and bond prices since the beginning of the year (see chart below), and made the argument in our first Alert of 2015 (Click here to read that report) that this gap needed to close. Gold and bonds have moved almost in lockstep since the beginning of the decade. One of three things have to happen to close the current gap between prices: 1) gold needs to rise; 2) bonds need to fall; or 3) both.

A month ago all the odds seemed to favor a gold rally. Virtually no one expected US Treasuries drop – especially since they were yielding far in excess of the sovereign debt nearly every other developed nation. (And still are!) But that’s what happened. While this has not been good for our bullish gold spreads, it has definitely helped the bear bond spreads we suggested purchasing for roughly $875 plus transaction costs in Alert #4. (Click here to read)

These spreads are currently going for $1,875. Exiting half of our positions now allows us to hold the other half with “house money,” taking our original risk “off the table.” T- Bonds have just completed an almost perfect 1.68 Fibonacci extension of the current down move and are approaching oversold territory. (See chart below) Let’s ring up half of our position now and let the other half ride. Our next target is the 2.68 Fibonacci extension at 153-00.

Gold At Critical Level

As we mentioned earlier, the latest decline in bond prices has not been good for gold but we are not ready to dump our bull call spreads yet. Late May expiration of our June spreads means we’ve got time. However, a series of lower closes under $1,167 in the front futures contract would be enough to negate our bullish stance – at least for now. The next few days should be interesting.

Prices can and do change so check with your personal RMB Group broker for the latest on this strategy and get up-to-the-minute pricing and advice.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.