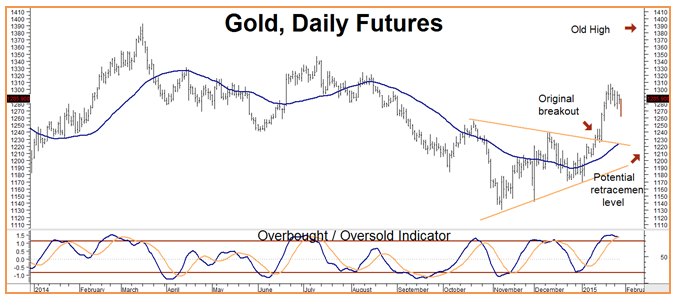

Time waits for no one and, to paraphrase the Rolling Stones, it won’t wait for us. With only 56 days left until expiration, our April bull spreads are entering a period of rapid time decay. Today’s corrective action (gold is down $26 per ounce as we write this) means it will probably take longer for it to reach our objective just short of old highs than we originally thought. (See chart below.)

Consequently, let’s sell the April bull spreads we recommended in Alert #1(we are a little ahead as we write this) and use the proceeds to buy similar spread using the June options with slightly higher strike prices. Right now we can do this for a very small cost.

With the entire world bent on driving down their respective currencies and the opportunity cost of holding gold and silver dropping like a rock, we expect today’s washout to find support somewhere around old breakout levels between $1,240 and $1,220 per ounce. The market is currently overbought on a short term basis so more “backing and filling” won’t surprise us.

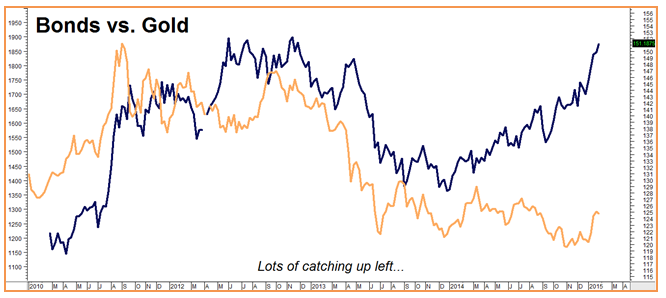

We still like gold (and silver) for all the same reasons we listed in Alerts #1(Click here to read) and #3 (click here to read). Bond prices and gold are still displaying massive divergence that we believe can only be narrowed by higher gold prices, lower bond prices or both. (See chart below.)

Bottom line: we still like gold (and silver) long term. June expiration of the July bull spreads we suggested buying for $800 in Alert # 3 means we’ve got plenty of time here.

Prices can and do change so check with your personal RMB Groupbroker for the latest on this strategy and get up-to-the-minute pricing and advice. They may recommend a similar strategy with different strike prices depending on market action.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.