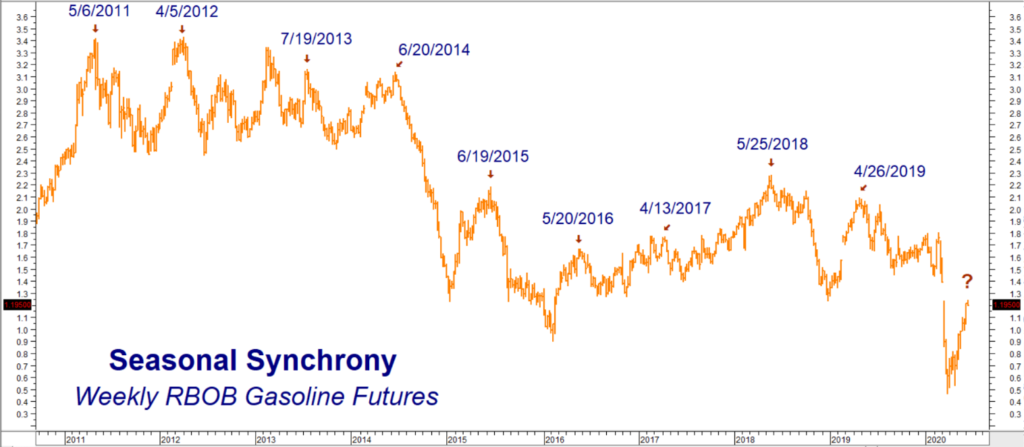

Commodity markets often have seasonal tendencies due to planting cycles, weather and/or demand. Hog and cattle prices tend to peak in mid-summer during prime grilling season. Gasoline futures tend to peak in late spring or early summer right before the onset of summer driving. They fall once driving season is in full swing. This is largely due to gasoline distributors who tend to buy futures contracts to lock in prices prior to summer demand and sell these hedges once driving season begins.

“Seasonal Synchrony” (below) illustrates this tendency. Gasoline prices peaked in late spring/early summer in 8 of the past 9 years. The only time this peak occurred after June was in 2013 during the week of July 19. We are well into peak season now which means RMB Group trading customers should consider exiting the long futures positions we suggested purchasing in our blog post of March 16. Holders of bullish option strategies should consider exiting as well.

Data Source: Reuters/Datastream

The July 42,000 gallon gasoline futures contract was trading for roughly 91 cents per gallon ($38,220 per contract) when we posted our March recommendation. July futures are currently bid at $1.21 per gallon ($50,820 per contract) in the overnight market as we write this. We had to endure a big down-move courtesy of below-zero crude oil prices, so let’s not look this gift horse in the mouth. Current price action in RBOB Gasoline is worryingly similar to that of June 2015 which saw prices fall for the rest of the year. We are late in the seasonal cycle and need to ramble on. “The time has come to be gone.”

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.