Not every trade works out the way we expect. This is why we try to establish “risk points” before we enter a trade. While we still believe there are “2.75 billion reasons to buy coffee”, the market is telling us that this may not be the optimum time.

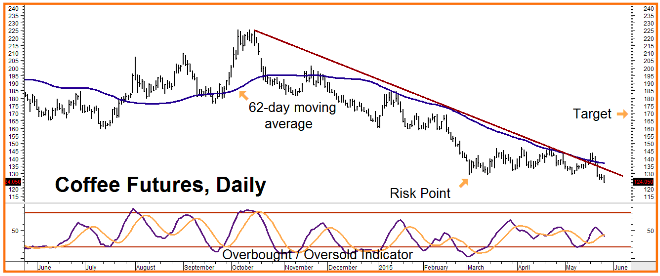

Yesterday’s settlement was the third, consecutive close below old lows and the second below our original risk point of $1.28 per pound. As the chart below suggests, the past three days have changed the near term bias of this market from positive to negative. Prices are now back below the key downtrend line and the 62-day moving average.

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

The proper course of action is to respect our exit signal, take a small loss and wait for the market to dictate the next buying opportunity in this market. Coffee demand continues to grow and supplies are not expected to equal last year’s. The good news is our exit signal has been triggered quickly, saving us a bunch of option “time premium” in the process.

We are advising our trading customers to consider exiting all December bull spreads in coffee immediately. Do not place market orders. Work with your personal RMB Group broker to get the best price you can. Get ready to re-enter this market on the long side under better conditions.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.