Most analysts will agree that the “gas” or fuel behind the incredible 6-year rally in bonds (and equities!) is the Fed’s zero interest rate policy or ZIRP. ZIRP means that any cash invested in safe, short-term monetary instruments like T-bills and FDIC-insured Bank CDs earns virtually nothing. Factoring in taxes and inflation means these “safe” investments are guaranteed losers.

ZIRP forced yield-starved investors into long term bonds, fueled a massive rally that took the yield on the 10-year note lower than it was during the Great Depression. ZIRP is the reason bonds remain the only supposedly “safe” game in town. What happens when the Fed finally abandons ZIRP and removes the “gas”? The chart below provides a clue.

Janet Yellen’s next move will be to hike short-term interest rates. The only question being debated by the market right now is “when?’ Most analysts don’t expect the Fed to act until the end of the year but Friday’s strong Non-Farm Payroll number — showing a gain of 280,000 jobs versus estimates of 235,000 — may have moved Janet Yellen’s time frame up a bit.

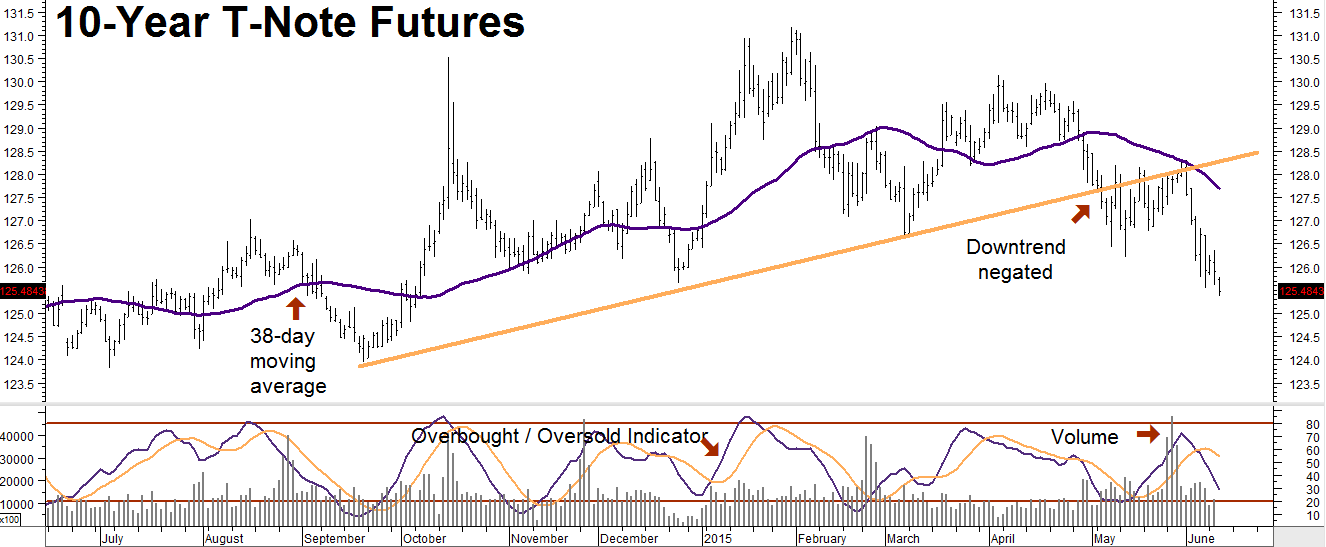

Treasury notes and bonds seem to think so. 10-year US Treasury futures have completely negated the uptrend stretching back to late-September 2014 after re-testing and failing against the critical 38-day moving average.

Extremely low (and in some cases negative!) interest rates in Europe turned out to be telltales of a global bond mania that had traveled too far. We are seeing the snap-back now. German Bund yields have jumped from 7 to nearly 100 basis points since mid-April (see chart below) as lack of willing buyers left sellers with no one to sell to. Bund yields are still historically low. Heavy selling in Europe continues to cause a sympathetic reaction on this side of the Atlantic; US Treasury bonds and notes have now given up all of this year’s gains.

Peter Singer, billionaire fund manager and one of the few who got the 2007 “Big Short” in structured credit right is forecasting an even “Bigger Short” for bonds and notes. With most analysts and nearly all central banks focused on deflation, Mr. Singer goes against the grain: Here’s a quote from his investment letter:

“…But central bankers are completely focused on erasing any chance of deflation, and the tool to do so – currency debasement – is certainly near to hand. Therefore, the likelihood of deflation is highly remote. By contrast, the central bankers’ universal belief that inflation is easy to deal with if it accidentally overheats is arrogant and not supported by the historical record.”

We think Treasury bonds and notes are going even lower. Rallies should be sold. Banks have reduced their inventory of bonds from $146 billion to just $23 billion since October 2013 – dramatically reducing liquidity. Reduced liquidity increases the potential that a relatively small bond market emergency could become a big one in a hurry. It may also mean a big short covering rally will give us another opportunity to sell.

Treasury bonds and note are heavily oversold so we need to wait for a correction to re-short them. However, we don’t need to wait to take a short position in the interest rate market. If Peter Singer’s contrarian view is right, the Fed could wind up raising rates faster than the market is expecting in order to keep pace with declining prices and soaring yields on the long end of the yield curve. This would negatively impact Eurodollars futures.

The yield curve measures the difference in yield between long and short term interest rate instruments. Flat to inverted yield curves typically precede recessions. Steep yield curves typically precede periods of growth or inflation. The current selloff on the long end of the yield curve means it is steepening at the same time that nearly every analyst is predicted slow growth or outright deflation.

This means that either 1) the analysts calling for a slow-growth, deflationary environment are all wrong and Peter Singer is right; 2) bonds have declined too far, too fast and need to rally big time or 3) the Fed is way behind the curve and will need to raise short-term interest rates faster than the market expects. A short Eurodollar position using put options is a cheap way to take advantage of scenarios number one and three.

… And Eurodollars Could Follow Bonds Into the Tank

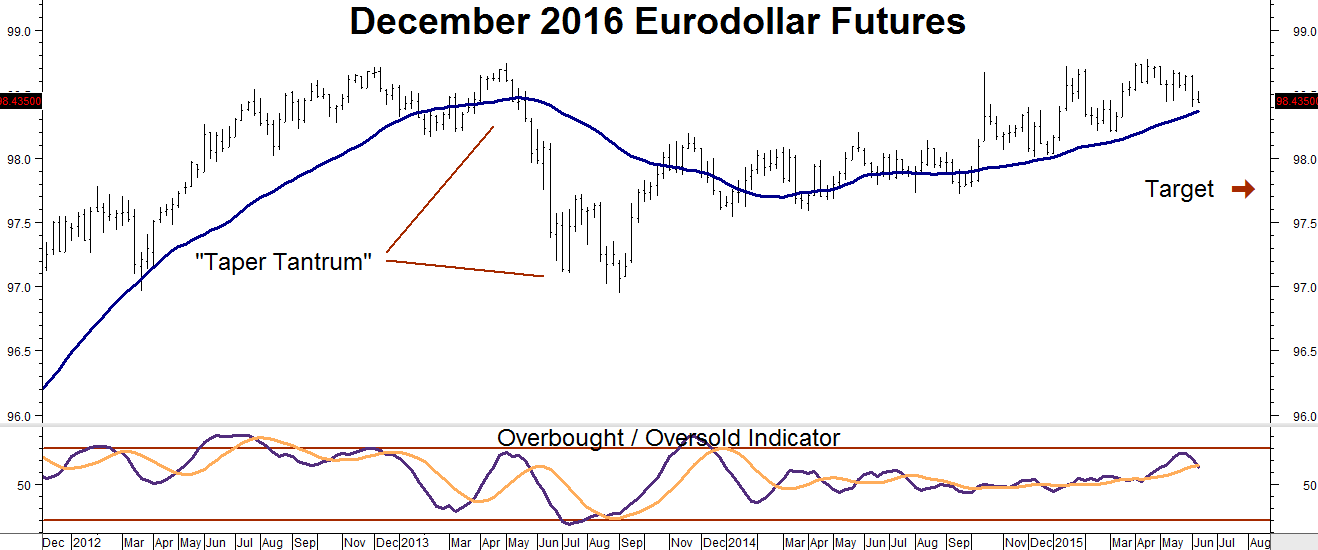

Eurodollar futures reflect short-term interest rates. Like bonds and notes, the price of Eurodollars declines as interest rates rise. While the market has already priced in a gradual tightening, it has not factored in emotion. Everybody knows that Janet Yellen’s next move will be to raise interest rates but she still hasn’t come right out and said it.

Remember the “Taper Tantrum” of 2013? Everyone knew that the Fed was eventually going to end its bond-buying program but when they actually came out and said it the entire interest rate market threw a “tantrum” – including Eurodollars. (See chart above.) The resulting decline was steep.

Will the same thing happen again? We don’t know but are willing to make a small, contrarian bet that it will. That’s why we are advising our trading customers to establish low cost, fixed risk short positions using December 2016 put options on Eurodollars. We recommend paying no more than $350 for a bearish position that has the potential to be worth as much as $1,250 should December 2016 Eurodollars hit our .9775 target on or prior to option expiration, 557 days from now.

Trading customers should call their personal RMB Group broker for all of the details of this trade. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com to get more information or visit us online at www.rmbgroup.com.