Combine the populations of China, India and Indonesia and you get more than 2.75 billion reasons to be bullish coffee. Add in Vietnam, Bangladesh, Sri Lanka and the rest of Asia and the numbers easily surpass 3 billion. Having just returned from an-all-too-short visit of Malaysia and Singapore, your editor was surprised by the number of Asians in café’s and food courts drinking coffee of both the hot and iced varieties. Tea drinkers were mostly European and older.

Granted, this was a non-scientific, casual observation but it does jibe with what the International Coffee Organization (ICO) has been predicting. ICO estimates global coffee demand will rise 25% over the next five years from 141.6 million bags to 175 million bags mostly due to growing demand in Asia. Coffee is a notoriously volatile market that has been under pressure for most of the year due to two factors: big supplies in Brazil and the collapsing Brazilian Real. Brazil in the globe’s largest coffee producer and is responsible for one half of the world’s Arabica beans.

Coffee is priced in dollars which means Brazilian coffee sellers are receiving more Reals for each bag sold, helping to encourage even more price-depressing sales. Brazil exported 36.8 million bags of coffee in the current crop year, setting a new record in the process. This has kept the market under pressure but has also reduced burdensome stockpiles. Not surprisingly, ICO expects “Export availability to be significant reduced…” going forward. Fewer bags for export should help lift the lid on prices.

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

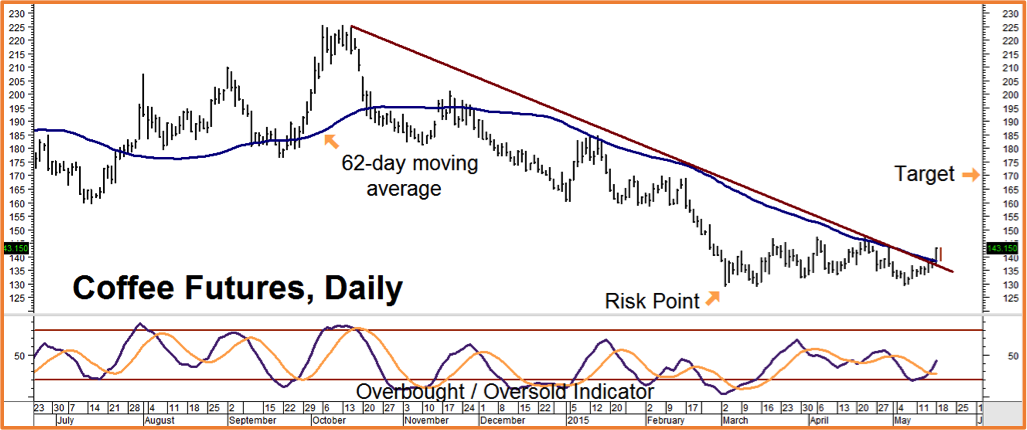

Coffee’s chart appears to be telling the same story. The market has stabilized, moving sideways for the past 8 weeks and appear to be establishing a base for an eventual move higher. Coffee closed yesterday above its intermediate-term downtrend and its key, 62-day moving average for the first time since the current slide began in late October. Today’s weakness – due almost entirely to this morning’s big rally in the dollar – is providing us with an opportunity to take a low risk long position.

We are advising our trading customers to consider buying December bull spreads in coffee targeting $170.00 per pound. The strategy we are recommending is currently going for roughly $862.50 plus transaction costs and has the potential to be worth as much as $3,750 at our $1.70 per pound objective. We do not want to pay more than $862.50 for this spread so some patience may be required.

Our maximum risk net price we pay. We have until option expiration on November 12, 2015 for coffee to hit our objective. We’ll use two consecutively lower closes below $1.28 as a signal to exit and cut losses. Prices can and do change so check with your personal RMB Group broker for the latest on this or alternative bullish strategies and get up-to-the-minute pricing and advice.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.