Is silver finally bottoming? We believe it may be. RMB has been on alert for a bottom in silver since the beginning of the year when we recommended limited risk bullish spread positions using July options. (Click here to re-read.) The process may be taking a bit longer than we expected, but that does not mean it won’t happen. Unless silver can prove to us that it is finished by closing twice consecutively below $15.25, we want to maintain our fixed risk bullish positions for the rest of 2015.

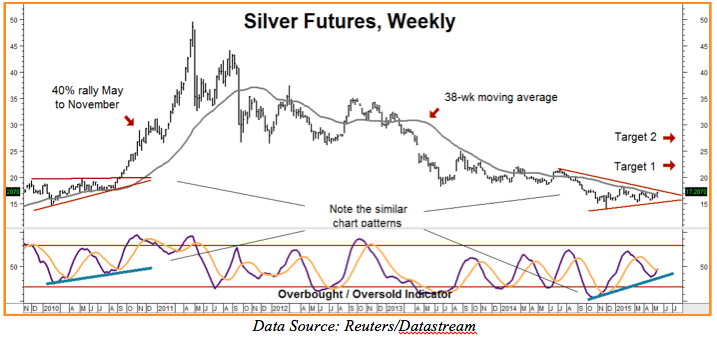

The current price action in silver is eerily similar to that which preceded the beginning of its last big rally. Silver jumped 40% from May to mid-November 2010 after displaying characteristics very similar to those it is displaying right now: 1) extended sideways (flagging) price action, 2) a surprising bullish turn in its overbought / oversold indicator and 3) extremely bearish sentiment.

Silver triggered a buy signal by closing above previous day’s highs for three days in a row (see daily chart below), and has negated the powerful downtrend in place for the past ten months. But what’s most impressive about silver is its ability to rally big despite a spike in long-term bond yields. Like gold, silver does not pay interest. Higher interest rates increase the opportunity cost of holding silver, making the rally of the past three days very bullish.

While it is important to remember that past performance is not necessarily indicative of future performance, it is also interesting to note that the 40% May-to-November 2010 rally we spoke of earlier coincided with a period of rising interest rates on the long end of the yield curve as well. Could history be repeating? It is too early to tell. Nevertheless, we are willing to make a small bet that it will – at least – rhyme.

Are Metals and Yield Curve Signaling Higher Inflation?

What’s going on? We believe both silver and gold are getting wise to something happening in the bond market. The consensus view on bonds – up until a few weeks ago at least – was that slow economic growth would hold the prices on the longer end of the yield curve fairly steady despite the long awaited first increase in the Fed funds rate. This would decrease the difference between short and long term interest rates, resulting in a flattening yield curve. Flat yield curves are typically associated with extremely low inflation.

The big selloff in German Bunds that began in April blew that consensus to smithereens, sparking a corresponding collapse in the US bond market that pushed the yield curve to its steepest point in 5 months. Steep yield curves are typically associated with inflationary economic environments. That fact that gold and silver are rallying despite the carnage in the bond market could be an early sign that inflation – not the big economic collapse many are looking for – will be the next stop on the economic highway.

Bottom line? The charts are telling us not to give up on silver – or gold – yet. And while recent price action may be a little too late to help our bullish June call spreads in gold, we do want to maintain a low-risk bullish position in the precious metals by replacing our June bull spreads in gold with December bull spreads in silver.

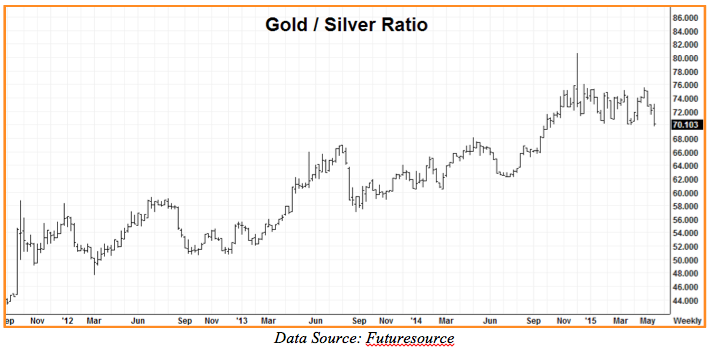

Why silver? Because it is performing better. The chart below shows the gold / silver ratio spread. Silver is stronger than gold when this ratio is moving lower. Today’s close is the lowest since last November and could be the beginning of a big downside breakout favoring silver.

We are advising our trading customers to consider buying December bull spreads in silver targeting our first target of $22.00 per ounce. The strategy we are recommending is currently going for roughly $900 plus transaction costs and has the potential to be worth as much as $7,500 at our $22.00 per ounce objective. Your maximum risk on this position is the net price you pay.

Consider doing this this trade either, 1) as a replacement of the June bull spreads in gold we suggested purchasing in January, 2) as part of “rolling” your existing July silver positions into December or 3) in order to establish a new bullish position in the precious metals complex.

Prices can and do change so check with your personal RMB Group broker for the latest on this or alternative bullish strategies and get up-to-the-minute pricing and advice.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.