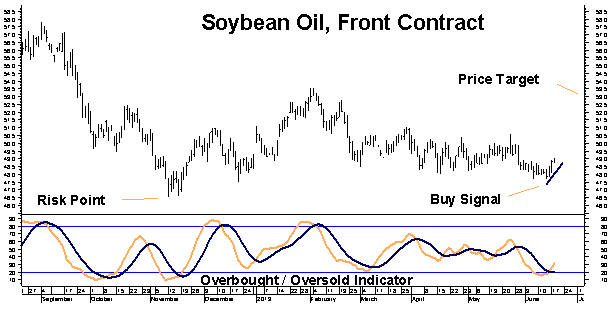

The same market forces generating today’s rally in corn are also at work in soybean oil. However, unlike the more volatile corn market, soybean oil has been trading sideways since February. Sideways markets lead to reduced volatility. Low volatility tends to breed cheap options. Cheap options are rare. When we find a market with both cheap options and a solid entry signal we sit up and take notice.

Soybeans have rallied smartly (roughly 11%) over the past five weeks. Soybean oil has not participated. Yesterday’s “buy” signal leads us to believe this will change. Our upside target is the top of this spring’s trading range at 53 cents – a rally of approximately 10% from current levels.

Inexpensive call options mean we can go all the way out to December for a very reasonable cost and risk. Two consecutively lower closes below old lows at 47.70 in the front contract would negate our bullish signal. We will use this as a risk point for now.