Both T-bonds and T-notes are taking it on the chin again this morning, exhibiting the same kind of Katy-bar-the-door panic we’ve been warning readers about in our “Defusing the Bond Bomb Special Report” and subsequent updates for the past year. T-notes are down a full point as we write this and, as hard as it may be to believe right now, could go a lot lower before it is all said and done as frightened investors all try to head for the exit at the same time.

The interest rate market has taken the wheel and become the driving force behind the moves in nearly all the macro markets. While this is great news for our bearish “Bond Bomb” and E-mini S&P 500 positions, it is not so good for our bull put spreads in RBOB.

Let’s start with the good news…

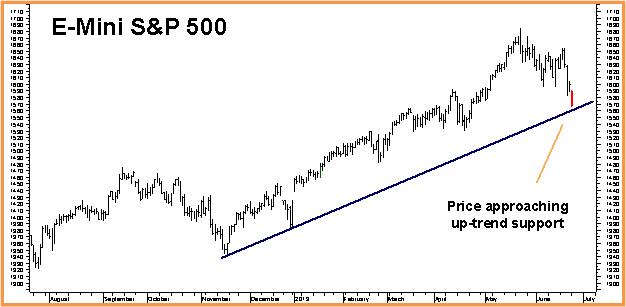

This morning’s decline mean’s the E-mini S&P 500 is now approaching support at the uptrend line currently crossing at 1562.00 in the September contract. Let’s go ahead and use this decline as an opportunity to take some cash off the table and position ourselves to get even more aggressive on a bounce. The July 1600 / 1550 bear put spreads we suggested rolling into Alert #17 for around 10 points ($500) are currently trading for 22 points ($1,110). Let’s lift this position now.

Risk Watch for RBOB Gasoline

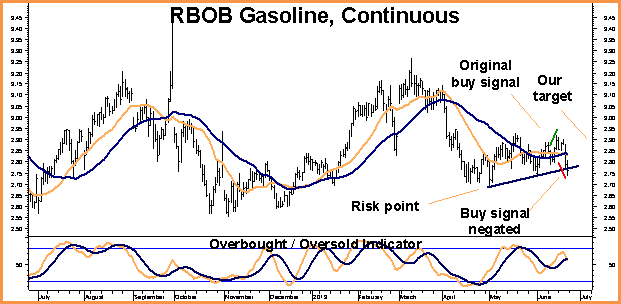

Yesterday’s second consecutively lower close below Wednesday’s low has negated the buy signal that got us into this market in the first place and driven price close to our risk point of $2.6870 in the spot contract.

While we are tempted to exit here, an examination of last December’s bottom formation shows a number of instances in which similar signals got crossed before RBOB was finally able to rebound.

Unleaded gasoline is also entering a seasonally friendly period that extends through the end of July. For these reasons we will stick with our original risk parameter of two consecutively lower closes below old swing lows at $2.6870 with the knowledge that it may cost us an extra $150 – $200 per spread.