What happens when “crowded trades” lose their mojo? We are witnessing two classic examples in both the Euro and US Treasury market. Long bonds and short euro were considered “sure bets” not too long ago but both of these markets have staged dramatic reversals in the past few weeks, creating havoc for late-to-the party trend followers.

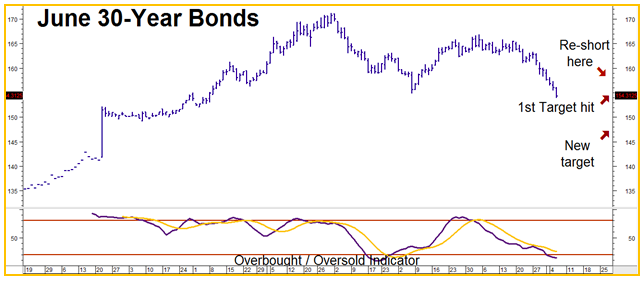

30-Year Treasury futures hit our downside target of 155-00 in the June contract early in the session yesterday, slipping below 154-00 late-day before reversing higher this morning. With support holding and the current oversold condition of this market, the time has come to take some cash off the table. If you didn’t exit the June bear put spreads we suggested purchasing for $844 or less in Alert #9 yesterday (click here to read), do so now.

Can bonds head even lower? Certainly. Get ready to re-establish bearish positions on an upward correction to 159-00 in June options. We’ll have more on the bonds as well as the progress of our long gold / short T-bond macro strategy perhaps as early as next week.

Prices can and do change so check with your personal RMB Group broker for the latest on this or alternative protective strategies and get up-to-the-minute pricing and advice.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.