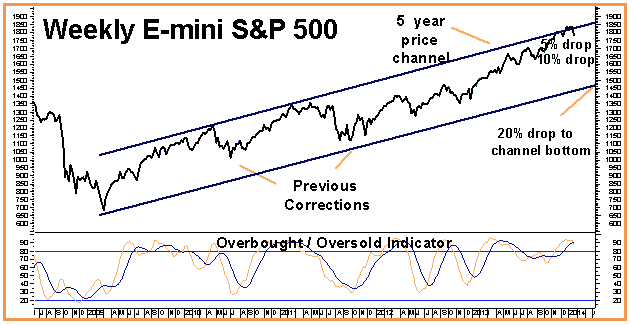

Has the long overdue correction finally begun? Back-to-back sell-offs on Thursday and Friday could be just the beginning. The key is what happens now. Previous declines have been short-lived as investors, convinced that stocks are the “only game in town” by the Fed’s artificially low interest rates, bought every dip. Will they step in front of this dip as well? They haven’t so far. If they don’t soon, the whole psychology of the market will change and the 10% correction we were looking for in Volume 19, Issue #38 could unfold fairly quickly.

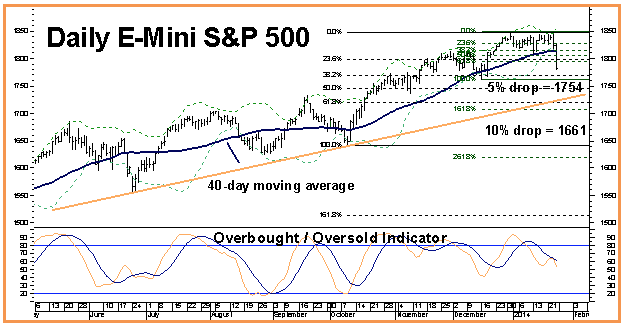

The chart above shows our outlook for the E-mini going forward. Support levels are 1760, 1736 and then short-term uptrend line currently crossing at 1725. A drop below 1725 will not encounter decent support until 1650. Ugly price action today means this market could fall 5% from its high soon – perhaps by the close today.

If you followed our suggestion to buy March bear put spreads, stay with a core position. If you own more than one, consider placing an open order to exit half at twice your original entry level or higher. If filled, you’ll take your original risk “off the table” and can hold the balance of your bear spreads with “house” money.

The daily chart may look precarious but the weekly chart (see below) is what sends chills down our spine. Big resistance at the top of the S&P 500’s bullish channel is what ultimately caused us to recommend a bearish hedge position back in late November. It has taken at little longer than we expected but the downward reaction from this resistance appears to have finally begun. Should the support levels mentioned above fail to hold, the bottom of the E-mini’s five year uptrend channel could be the next stop. We are not necessary predicting this but would not be surprised by it either.

More Information About This Strategy

RMB Group trading customers interested in this strategy should contact their brokers for a specific recommendation. If you are not an RMB Trading Customer, give us a call at 800-345-7026 (toll free) or 312-373-4970 (direct) and we’d be happy to go over this strategy with you. Contact us online or e-mail suerutsen@rmbgroup.com. Put the words “stock hedge” in the subject line and we will contact you about this idea.