Deflation Fears & Chart Set-up Say “Short Euro”

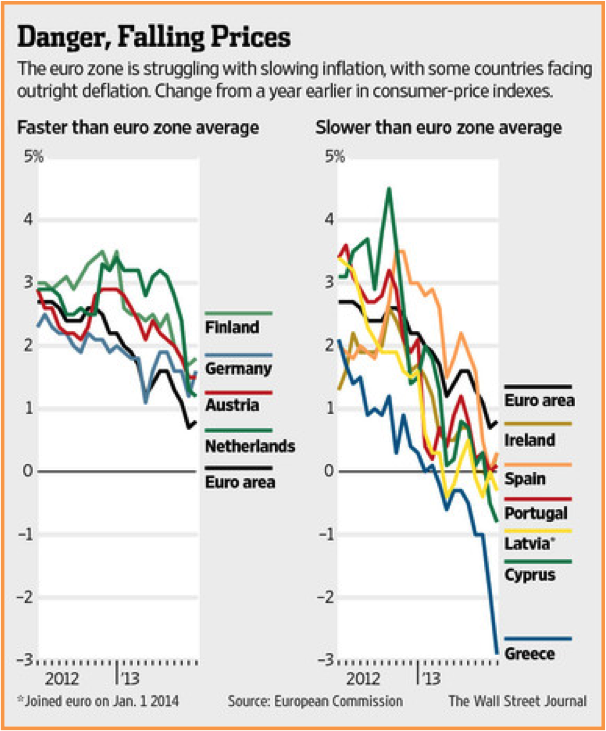

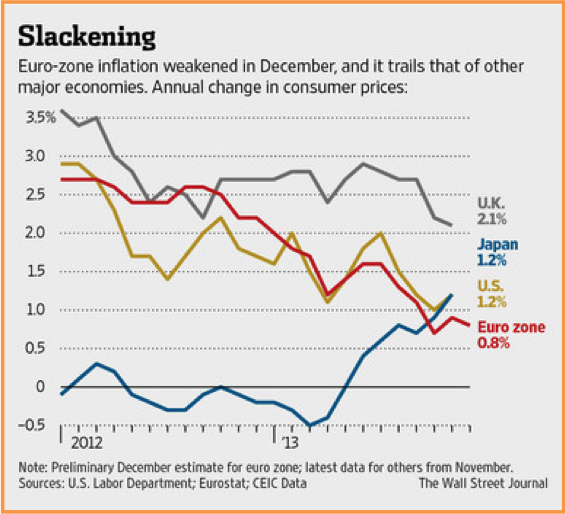

Europe is in trouble. Eighteen months after European Central Bank President Mario Draghi halted a collapse in the euro by promising to do “whatever it takes” the common currency is facing a whole new set of problems that could send it tumbling again. The biggest problem is deflation.

Deflation is the bane of modern economies because it threatens the fractional reserve banking system. Banks make their money by borrowing money at a low interest rate – often from a central bank like the Fed – and lending it out at a higher rate. The “spread” between what banks borrow for and what they lend for must come from economic growth, higher prices or in many cases: both.

Barring rapid economic growth, the fractional reserve banking system cannot exist without some measure of inflation. This is why central bankers across the globe are falling all over one another to set inflation targets. They know that the failure to maintain at least a small amount of inflation is a road to default and economic collapse – especially during periods of weak economic growth.

Barring rapid economic growth, the fractional reserve banking system cannot exist without some measure of inflation. This is why central bankers across the globe are falling all over one another to set inflation targets. They know that the failure to maintain at least a small amount of inflation is a road to default and economic collapse – especially during periods of weak economic growth.

Like the arithmetic, the logic is simple: falling prices generally mean stagnant or falling wages. This impedes borrowers’ ability to pay back their loans. Deflation also means the value of the collateral backing banks’ outstanding loans is also falling. This causes some borrowers to walk away from their loans and others to fall behind. This is precisely what happened during the housing collapse of 2008.

Banks respond to deteriorating loan portfolios by tightening credit standards, making cash less available. This, in turn, causes prices to fall further, putting even more of a strain on collateral. Consumers and investors hold onto their wallets, pressuring prices further. Unchecked, this process can quickly lead to economic collapse.

Potential Solvency Problem for European Banks

The European Central Bank will complete its long awaited Comprehensive Assessment of the Eurozone’s 12 biggest banks by November. European banks generally have much looser capital standards than American banks. This means they keep less in reserve against potential loan losses. The problem is Europe – ex Germany – is not growing and inflation is threatening to become deflation. Big problems could arise if it is discovered that the value of the collateral currently backing trillions of euro-based loans and derivatives is found to be not worth as much as assumed.

Money is all about confidence. Since most banks only keep a fraction of their depositors’ cash on hand to meet withdrawals – even less in Europe than in the USA – just a small percentage of customers demanding their money could start a run on the banking system. Banks would be forced to liquidate collateral in order to meet cash demands causing asset markets to fall as well, further threatening solvency.

Money is all about confidence. Since most banks only keep a fraction of their depositors’ cash on hand to meet withdrawals – even less in Europe than in the USA – just a small percentage of customers demanding their money could start a run on the banking system. Banks would be forced to liquidate collateral in order to meet cash demands causing asset markets to fall as well, further threatening solvency.

The banking system works only if depositors believe it is working. Your money is in the bank only if you – and everyone else – believe it is. Test this belief just a little and you run the risk of financial Armageddon. It is a house of cards built mostly on confidence. This reliance on confidence is the Achilles’ heel of the fractional reserve banking system. It’s what keeps central bankers up at night. It is also the reason we believe the ECB, IMF and OECD will do everything in their power to halt the current deflationary slide in Europe. Deflation not only makes it harder for banks to make money, it also threatens confidence.

Some analysts believe that the comprehensive stress test of European banks scheduled to be completed by November could reveal a massive shortfall of over 770 billion euros (US $1 trillion). Not surprisingly there has been talk about setting up a fund to backstop the banking system should it get in trouble. The problem is the European Union has agreed to staking this fund with only 55 billion euros and taking as many four years to fund it.

Germany’s Bundesbank doesn’t want a bailout fund and is talking about relying on capital confiscation – a Cyprus-like “haircut” on depositors in the case of a bank run. Depositors would be on the hook for any shortfall. Not exactly confidence-inducing, is it? Should this start to get taken seriously it could actually cause a run as depositors flee.

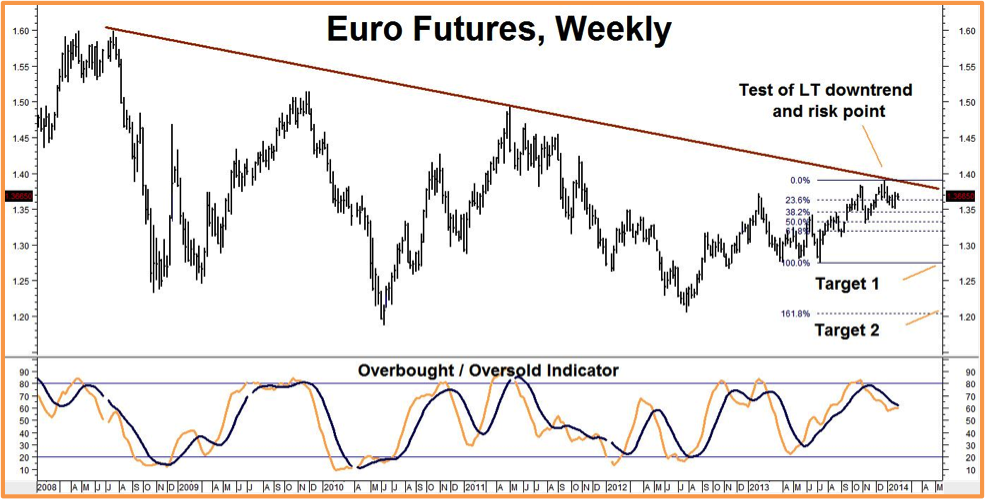

Euro Looks Poised For another Leg Down

The decline in the euro that began in early 2011 and ended in July 2012 with Mario Draghi’s promise to do “whatever it takes” to prop up bond prices (see chart below) was caused by crisis in the sovereign debt market. We believe the next leg down in the euro – if it occurs – will be caused by problems in the banking system and/or by actions taken by the ECB and others to forestall these problems.

There are two things the ECB could do right now to stop or at least slow Europe’s slide into deflation: 1) take a page from Ben Bernanke’s playbook and reduce interest rates from .25% to zero and/or 2) take another page from the same playbook and start buying bonds and injecting cash directly into the system. We believe both actions will weigh on the common currency, especially coming at the same time the Fed is tapering its bond purchases. A reduction in European short term interest rates to zero also removes the last of the euro’s yield advantages versus the dollar.

We like this trade from a technical perspective as well. The recent rally in the euro tested its long term downtrend line before failing. Our weekly overbought / oversold indicator has also rolled over. We believe the euro could decline as low as its old swing lows at $1.2755 in the front month futures contract in the next five months and perhaps as low as it 2010 lows around $1.20 before all is said and done. The fact that these targets also happen to line up beautifully with Fibonacci – a 100% retracement in the case of Target 1 and a 161.8 projection in the case of Target 2 – is just icing on the cake.

What to Do Now

We are currently recommending a bearish option play in the euro options trading on the CME with a total cost and risk of $900 plus transaction costs. This play has a gross potential of $6,250 per unit should our first target be reached.

If you would like to know more about this strategy or see our detailed latest real-time recommendations and trading plans in other key markets, please call your personal RMB Group broker. If you do not have an account with us feel free to give us a call toll-free at 800-345-7026 or 312-373-4970 direct and we will go over this trade with you and send you everything you need to get started.

You can also visit us at www.rmbgroup.com to open an account online and/or see some of our other “big move” trading ideas. You can also e-mail us with any questions at suerutsen@rmbgroup.com.