So much for a slow summer. The release of Federal Reserve’s meeting notes last week revealed a lot more optimism than Wall Street expected. This “good news” spelled bad news for the stock market as the Dow fell over 300 points Thursday, giving back all the gains of 2014 in one foul swoop – sending the VIX soaring.

Last Thursday’s sell-off sliced through the 40-day moving average like it wasn’t even there (see chart below) and kept going. Previous declines have been met by buying, but not this one. The market got some relief from Friday’s “goldilocks” employment numbers that showed the economy growing fast enough to avoid deflation, but not fast enough to cause the Fed to pull the punch bowl just yet.

Nevertheless, stocks still closed lower on Friday, betraying a weakness that wasn’t there just a few short weeks ago.

The key to near-term fate of the stock market is the intermediate-term trend line, currently crossing around 1870 in the S&P 500 futures. This slope has defined the bull market until now. The 1870 level also represents a 5% decline from recent highs. A drop below it could do enough technical and psychological damage to send stocks even lower.

What really concerns us is the extremely overbought condition of the weekly chart (below). While bull markets can and do stay overbought for long periods of time, this market is way overdue for a serious, cleansing correction. Declines to support at 1770 (a drop roughly 10% from recent closing high) and 1550 (a 20% drop) cannot be ruled out.

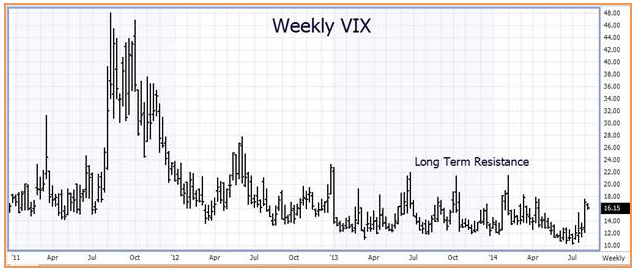

Last week’s action in stocks lit a fire under our long VIX positions. (Click here to review our latest VIX recommendation.) Volatility spiked from 11.5% to 17.5% in just seven days and helped our futures positions make up a lot of ground. Moves in VIX tend to happen quickly, so if you are long more than one contract, it may be time to take a little cash off the table. VIX runs into resistance at 18.22% on the daily chart (below). Weekly resistance doesn’t come into play until 21.50 (second chart below). Consider lifting half of your futures contracts at 17.00 or higher. Kick the other half at 21.00.

Is the Euro (Finally) Breaking Down?

If you’ve been following RMB Big Move Trade Alerts you know that one of our core positions is short the euro. The reasons are many but what concerns us most is deflation. Deflation is destructive because it increases the real burden of outstanding debt. Without growth or the ability to retire debt in cheap currency, Europe’s debt problems can only have one outcome: default.

Mario Draghi and the ECB have done a great job of talking interest rates down and promising to “do whatever it takes”, but talk hasn’t fixed Europe’s growth problem. With no growth and no inflation, Europe is in a bind. It needs inflation to stay solvent. Inflation will probably require a weaker currency. As the chart above suggests, the euro is starting to play along.

May’s break below the euro’s long-standing uptrend line triggered a readily identifiable change in trend. The common currency is oversold so we would not be surprised to see a corrective bounce. Should it materialize, we plan to use it to add to our short positions.

With September option expiration approaching, the time has come to “roll” September put positions into December. Let’s also lower our risk point to two consecutively higher closes over $1.3705 in the front contract – down nearly 250 points from our original suggestions. Our short-term targets remain $1.3250 and $1.3100. Long-term targets are $1.2500 and $1.2200.

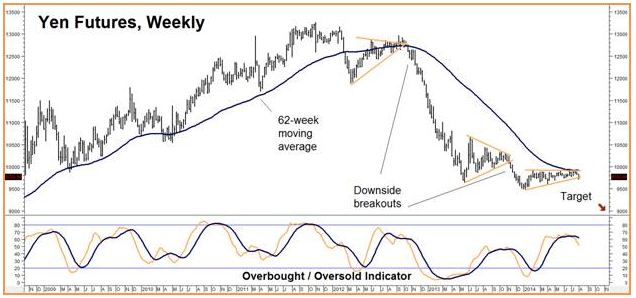

Getting Close in the Yen

Nothing has happened to shake our bearish convictions in the yen. (Click here for our latest report.) The Japanese currency remains below its key 62-week moving average. Unable to mount much of a rally, it worked off its oversold condition by moving sideways. It is now overbought and poised for another leg lower.

We remain patient and actively recommend adding to bearish positions now – especially since yen options are cheaper than we’ve seen in a long time. We are currently looking at December put options with a maximum risk of $600 (plus transaction costs) and the potential to be worth at least $6,000 should our .09000 target be reached prior to option expiration in early December.

RMB trading clients should call their personal broker to find out more about this recommendation. If you don’t have an RMB Group account and would like to know more about this play, give us a call at 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com. Put “yen” in the subject line. Or visit us online at www.rmbgroup.com to open a trading account or learn more about us.