Perfect growing weather and expectations of a North American bumper crop have caused the price of corn to collapse. This is bad news for farmers. While they will certainly have more to sell, growers are getting far less for their crop. $3.50 per bushel corn may have been fine a decade ago, but costs have risen. Seed, fertilizer and diesel fuel are more expensive. So is farmland.

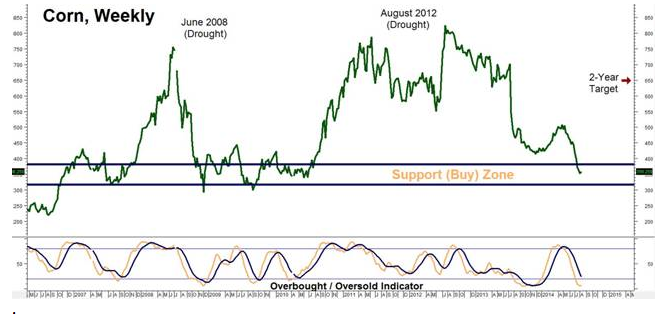

But bad news for farmers this year could spell good news for prices down the road. Corn has dropped a long way and is currently trading at support in our ‘buy zone” – just above $3.50 per bushel in the front contract. We outlined the long-term bullish case for corn in our Special Report, Investing in the New Gold: Protein. (Click here to review.) We still like long-dated July 2016 calls and bull call spreads.

Is Gold for Real?

This is the question traders have been asking for a year. We still don’t have an answer. The Midas metal has been stuck in sideways mode for the past 12 months, frustrating bulls and bears alike. Recent selloffs have been shallower and shorter-lasting than in the past. This tells us that the long drought in gold may soon be over.

We continue to like gold over the long haul – especially since long-dated options are fairly inexpensive due to continued sideways price action. Consequently, we are holding the long-dated, December 2016 bull spreads we suggested purchasing for $800 or less 7 weeks ago. With the geopolitical situation deteriorating by the day, we like the hedge that a low-risk long position in gold can provide. (Click here to see this low-cost strategy.)

RMB trading clients should call their personal broker to find out more about these recommendations. If you don’t have an RMB Group account and would like to know more about this play, give us a call at 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.