“Hit ‘em where they ain’t.” This quote from old-time batting champ and Hall-of-Famer Willie Keeler was the inspiration for our Big Move Trade Alert, “Silver Could Surprise Soon” back in January. Silver has surprised everyone by rallying 42.5 percent since then. Is it too late to buy it now? The answer depends on whether or not the current negative interest rate environment continues. We believe it will – at least until the American presidential election and perhaps as long as it takes Britain to complete its “Brexit.”

Silver and gold pay no interest and generate no return. Holding physical gold and silver actually costs money in terms of storage, insurance, etc. In a “normal” interest rate market, investments in traditionally “safe” assets like government bonds pay interest, making them a preferred alternative to precious metals for stashing “safe” money. But this is not a normal interest rate market.

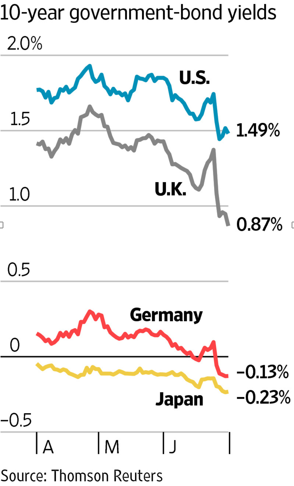

Central banks are buying government securities by the bucketful, driving up their prices and pushing down yields. They are forcing investors to pay for the privilege of lending money to governments. It now costs money to lend funds to Germany, Switzerland and Japan for ten years or less. Other nations are within a few basis points of going negative as well. Gold and silver start to look pretty good when compared to guaranteed losses in government bond investments.

Central banks are buying government securities by the bucketful, driving up their prices and pushing down yields. They are forcing investors to pay for the privilege of lending money to governments. It now costs money to lend funds to Germany, Switzerland and Japan for ten years or less. Other nations are within a few basis points of going negative as well. Gold and silver start to look pretty good when compared to guaranteed losses in government bond investments.

As we noted in our January Alert, “Negative rates send a signal that things are bad and could, in fact, get worse. Safety quickly becomes something that investors are actually willing to pay for – defeating the whole purpose of negative rates in the first place and forcing central banks to make them even more negative to achieve the desired effect.”

By artificially suppressing interest rates, central banks have created a negative feedback loop in which, the stimulative power of lower interest rates is sharply reduced or non-existent. Instead of juicing the economy, lower rates reduce expectations, leading to stagnant growth and even lower rates as central banks futilely “push on a string.”

Silver Tends to Outperform Gold in Bull Markets

Silver is known as “the poor man’s gold” because it is cheaper than gold. Silver nearly always outperforms its yellow cousin in precious metal bull markets. Smaller traders who can’t afford to buy gold, buy silver instead. Silver tends not to be as liquid as gold which means moves can be exaggerated, making silver far more volatile. We expected silver to outperform gold when we issued our January long silver recommendation. This has played out in spades since.

The gold / silver ratio spread tracks how many ounces of silver it takes to buy one ounce of gold. Charting this spread lets us see the relative value of silver to gold over time. This is what it looked like when we issued our bullish recommendation last January.

Date Source: Futuresource / E-Signal

It took roughly 78 ounces of silver to buy one ounce of gold, which meant silver was about as undervalued in relation to gold as it had been since 1995. It now takes only 66.5 ounces of silver to buy one ounce of gold. Silver’s higher intrinsic volatility is working in favor of the bulls right now. This is creating a positive feedback loop in which higher prices lead to more buying and higher prices. A declining gold / silver ratio is bullish for precious metals in general and especially bullish for silver.

This is what the spread looks like now:

Date Source: Futuresource / E-Signal

The spread has narrowed dramatically. Silver has gained substantially on gold in the past six months, confirming the strength of current precious metals bull market. We believe there is plenty of room for silver to gain even more ground. As the chart indicates, past declines in the gold / silver ratio spread have extended as low as 32 ounces of silver to one ounce of gold. Trend changes in this spread tend to be long-lasting, so it wouldn’t surprise us to see a ratio of 55 to 1 – or even 45 to 1 before all is said and done.

Let’s say gold stays right where it is ($1,335 per ounce as we write this) and the gold / silver ratio drops another 10 points to 55, which right in the middle of the spread’s long-term trading range. 55 divided by $1,335 equals a silver price of $24.27 per ounce. A drop to the lower end of this range at 45 per ounce of gold would make silver worth $29.66 per ounce with no help whatsoever from gold.

While the odds of a $7 per ounce rally in silver without some rally in gold are virtually non-existent, the gold/silver ratio indicates that, from a pure trading perspective, silver is where you want it to be in a metals bull market.

Declines Are Opportunities to Buy or Add to Positions

The chart below is another solid visual confirmation that the trend in silver is now bullish. Silver is overbought, so it would not surprise us to see a corrective move lower soon. We believe this correction – if and when it occurs – should be bought.

Data Source: Reuters / Datastream

To say silver is strong right now is an understatement. A move to $30 per ounce or even higher in the next year is not beyond the realm of possibility. Silver has solid support right around old swing highs of $18 per ounce, so we would strongly consider adding to our bullish positions on a decline to that level. That said, there is no guarantee that silver will drop that low or that it will drop at all. If you don’t already have a long position in silver, you may want to consider establishing a partial position soon.

RMB trading customers who already own the $20 / $25 bull call spread and no-cost bull spread silver positions we recommended purchasing in January’s “Alert”, should consider using the next big drop in silver as an opportunity to add to your positions. If you sold the December 2017 $10 puts to pay for the December 2017 bull call spreads we suggested purchasing for roughly $2,000, consider placing an order to buy these puts back now for $300 or less. Get ready to sell another set of puts with higher strike prices and greater dollar value on the next downward correction.

If you didn’t sell the puts, and you own more than one of the December 2017 $20 / $25 bull spreads recommended in our January “Alert” on silver, consider selling enough to cover your initial risk and perhaps lock in some gains in the process. These spreads closed Friday for roughly $7,300 each. Hold the balance for a move to our original objective of $25 per ounce. If things continue go the way they have been and more nations adopt negative interest rates, we believe our $25 per ounce objective could be achieved by the end of the year.

If you don’t own bullish silver positions, waiting for a correction that may not come could leave you standing on the sideline. Consider gaining some fixed risk exposure to this market using the March 2017 silver options traded on COMEX. The strategy we are recommending now has a maximum risk of approximately $1,500. It could be worth as much as $10,000 should silver reach our $25 per ounce target prior to option expiration on February 28, 2017. Prices can and will change so contact your personal RMB Group broker for the latest.

Position Updates: Cotton and Australian Dollar

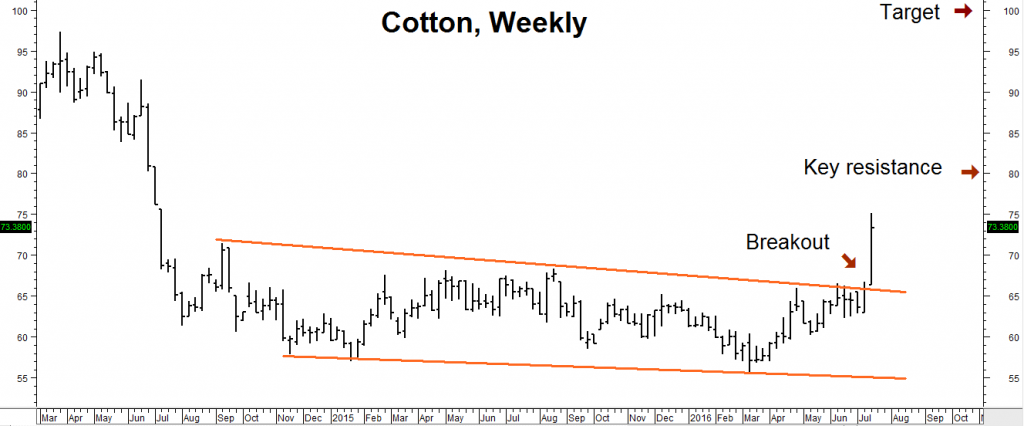

We’ve been extremely patient with the March 75 cent and 80 cent cotton calls we suggested purchasing for roughly $900 and $800 respectively last year in our two Alerts “El Niño Powerpack: How to Play Perhaps the Strongest Weather Event in Years” and “Godzilla El Niño Getting Stronger.” Our patience may be paying off. Cotton did virtually nothing until the past week — but what a week it was.

Data Source: Reuters / Datastream

The white, fluffy stuff exploded out of a nearly two-year trading range, driving the premiums of both call options higher. The March 75 cotton calls closed Friday for $2,610. The March 80 calls closed at $1,435. Will cotton use this breakout for a sprint higher or slip back to the top of its trading range? The next few weeks are critical. Our long-dated options give us the luxury of being able to wait as the market sorts it all out.

Our objective remains $1.00 per pound. We won’t argue with customers who own multiple calls and want to exit part of their position to cover initial risk and perhaps lock-in some gains as well. However, we don’t recommend exiting this market altogether because it could go a lot higher.

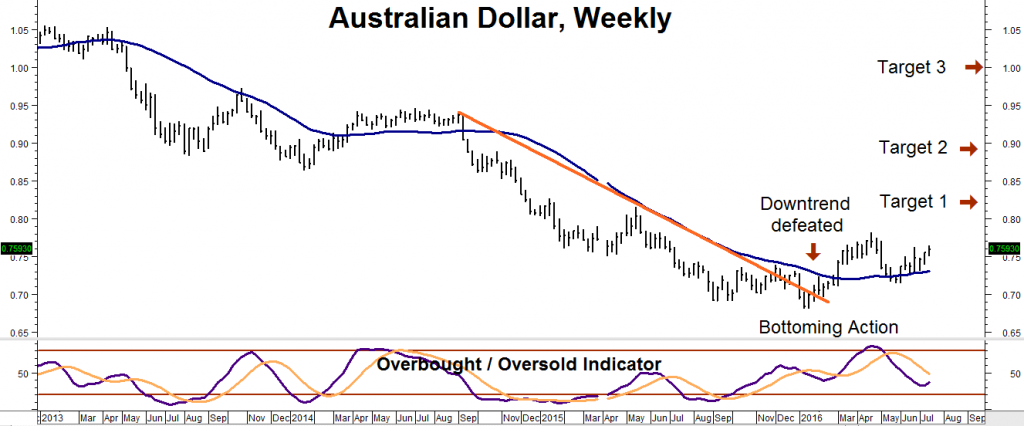

Aussie Dollar Setting Up Well

While not as dramatic as cotton or silver, we like the way the Australian dollar is setting up. While there is no confirmation of a trend change yet, a nice bottom appears to be forming. This market could head as high as 90 cents should our initial target of 82 cents be taken out in a significant way. With Australia sporting some of the highest interest rates in the developed world, parity is possible over the long haul.

Data Source: Reuters / Datastream

RMB trading clients should continue to hold the bull call spreads we suggested purchasing for roughly $900 or less in our recent Big Move Trade Alert: “Aussie Dollar May Be One of the Last Commodity Bargains Left.”

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find the report.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.