The El Niño weather event BMTA examined in our last Alert (click here to re-read) is getting even stronger. Some scientists have increased the probability of a strong El Niño this year to 90%. Other are calling it a “Godzilla” event, with the potential to rival or even exceed the record-setting El Niño of 1997-1998.

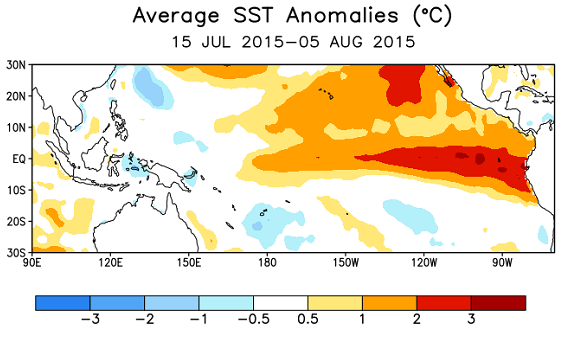

The National Oceanic and Atmospheric Administration (NOAA) image below shows abnormally warm water stacking up against the western shores of Central and South America. El Niño is associated with heavy rains in the American Southwest, heat waves in Brazil and dangerous drought conditions in Southern Australia. It can also mean drier-than-normal conditions for monsoon-dependent growing areas in Asia.

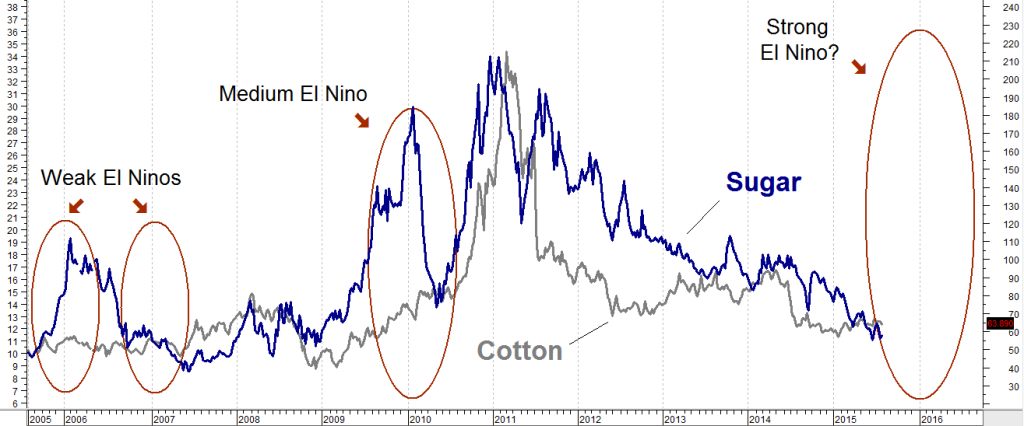

As we discussed in our last Alert, El Niño is a tropical phenomenon. Not surprisingly, its biggest effects tend to be on tropical agricultural markets like sugar, coffee, cotton and palm oil. Readers should have been filled on our suggestion to buy long-dated March 2017 sugar calls. These calls are currently trading for $762 – a price we believe is a pretty good deal.

We haven’t had as much luck with our cotton order due to thin market conditions, so we are going to modify it just a bit by using a different strike price. RMB trading customers should consider canceling orders from our July 31 Alert to buy March 2017 75-cent cotton calls for $900 or less and replace it with an order to buy March 2017, 80-cent cotton calls for $800 or less.

The chart below – from our last “Alert” – shows what cotton and soybeans did during and after the last three El Niño events. If cotton reaches our objective of $1.00 per pound prior to option expiration, each of the 80-cent calls suggested above will be worth at least $12,500. A rally to 2011 highs over $2.00 per pound would make each call worth at least $67,500. Like the sugar play, the February 10, 2017 expiration of the calls keeps traders long well after the current El Niño is expected to fade.

Trading customers should call their personal RMB Group broker for the details of this trade. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com to get more information, or visit us online at www.rmbgroup.com.

Three Other El Niño Markets

Three other markets with the potential to be affected by the “Godzilla” El Niño are 1) coffee – Brazil is the world’s largest producer, 2) wheat – drought in Australia has the potential to undermine their crop, and 3) soybean oil. Soybean oil competes with palm oil. The bulk of the globe’s palm oil is produced by Malaysia and Indonesia – two countries that could also be impacted by drier-than-normal conditions during the current El Niño cycle. We’ll have more on these in a follow-up Alert.