Is gold dead? It sure acts like it. The “barbarous relic,” once counted on as the “hedge of last resort,” has done nothing but move sideways during the first half of 2017, despite the political tumult in Washington and the post-Trump decline of the US dollar. Gold may be flat as a pancake, but Bitcoin is exploding.

Many believe Bitcoin is on its way to becoming the new chaos currency, unseating the metal of King Midas as the world’s ultimate source of value. How long will Bitcoin’s dominance last? Time will tell whether it is a real hedge or just the latest shooting star among a dwindling number of markets that are moving at all, thereby drawing interest solely because it has momentum in an environment largely bereft of any.

Compared to Bitcoin, gold is virtually comatose. The former has soared in this year of Trump – rallying 289% from mid-January lows to early-June highs. It is drawing so much attention that a New York-based exchange called Ledger X just won approval of the CFTC to trade options on Bitcoin, catering to the desire of traders for a vehicle to cash in on potentially sky-high option premiums resulting from Bitcoin’s incredible volatility and providing Bitcoin holders the opportunity to sell inflated premium in exchange for dollars while still holding their Bitcoins.

All this action in the cyber-currency space has left gold a mere afterthought for those looking for market action. Consequently, gold option traders have stripped away much of the volatility premium of both puts and calls, expecting the price of gold to move no more that 2.4% in the next 34 days.

2.4% represents a mere $30 per ounce move in either direction. Not so long ago market swings of $30 or on a weekly basis were the rule, not the exception. Of course, option premiums reflected this increased volatility, making profiting from volatility more difficult – especially for option buyers. It is a different story now.

Volatility in gold has been collapsing for the past six months, driving option premium to historical lows in the process. Gold’s price history is full of extended periods in which weekly moves of 2.4% or more were considered “normal.” Consequently, we view today’s low volatility in gold as a big opportunity to position ourselves for future fireworks.

Using Straddles to Play Gold “Both Sides from the Middle”

Today’s somnolent gold market means both put and call options are historically cheap. To find out just how inexpensive gold options currently are, let’s take a look at September gold “straddles.” A “long straddle” is a technique used by traders to profit from an increase in market volatility. It is created by buying both a put option and a call option with identical strike prices at or close to where the market is trading.

Gold is trading just above $1,250 per ounce as we write this so the straddle we are using as our example involves buying 1 put and 1 call both with a strike price of $1,250 per ounce. The options we are using are the 100-ounce futures options traded on the Comex. Each option is based on the gold futures contract which covers 100 ounces in gold. That makes each $1.00 move in the futures or options worth $100.

$1,250 gold calls gives the buyer the right but not the obligation to be long 100 ounces of gold for a $1,250 per ounce. Since the call buyer does not have the obligation to purchase gold, he or she can only lose the amount paid for the option plus transaction cost. $1,250 gold puts give the buyer the right but not the obligation to be short gold at $1,250 per ounce. Like the call buyer, all he or she can lose is the option price plus transaction cost.

Right now it costs roughly $3,000 to buy a $1,250 gold straddle with 32 days left until expiration. To find out how much this is percentage-wise divide the cost of at the $1,250 straddle by the value of the 100 ounce futures contract. $3,000 divided by $125,000 equals 2.4%. That means a $1,250 gold straddle will show gain on any move greater than 2.4% for the life of the option contracts. It doesn’t matter in which direction.

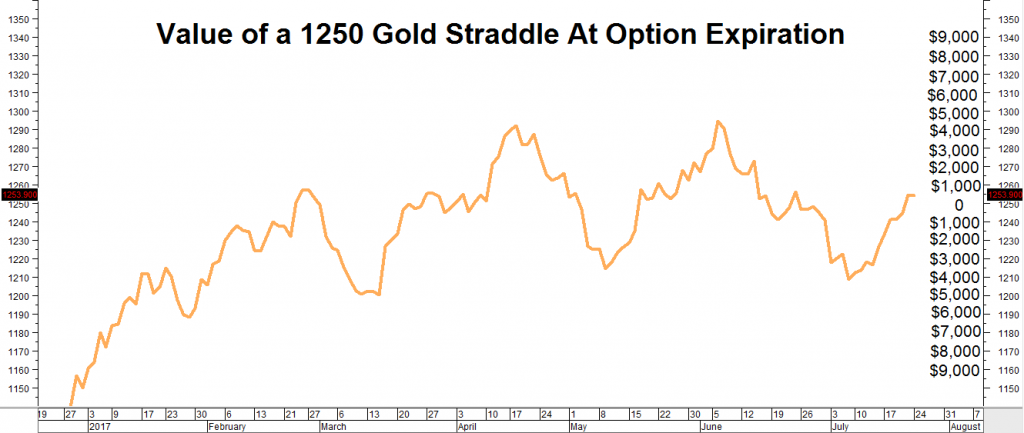

This chart below shows how much a $3,000 straddle would be worth given moves, either up or down, in the 100-ounce Comex gold futures contract:

The only way the straddle holder could lose the entire amount of the premium paid is if gold closed exactly a $1,250 at the close, on the day of option expiration. Odds are good that the strangle holder could salvage a fair amount of value by exiting this straddle prior to expiration. Gains would be realized if increased volatility caused gold to move above $1,280 per ounce or below $1,220 per ounce.

Gold will eventually break out of the range it has been trading in for the past seven months. The only question is when. But straddles are not the only way to play this market. While they are extremely cheap, straddles require the purchase of two options. Those with strong opinions one way or the other can also take advantage the cheap options resulting from gold’s low volatility.

Bullish gold? “At” and slightly “in-the-money” calls typically trade at a big premium to similar gold puts because the there is always the potential for big rallies caused by catastrophic economic or political events. This premium has declined to a point where is makes sense to look at calls. Bearish gold? We’ve never seen put options this cheap.

Bottom Line: RMB trading clients should consider using options to position themselves in gold. Overlooked and under-loved, gold will not stay sideways forever. Your personal RMB Group broker can help you with both trade entry and exit.

If Bitcoin and its other cyber-competitors are indeed for real, then the failure of gold to rally in what should be the perfect environment for such a rally may be a sign of a big decline ahead. However, if Bitcoin and its ilk prove to be just today’s version of tulip bulbs, then gold should eventually return to its status as the “ultimate hedge” that is has laid claim to for over a thousand years.

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find the report.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.