Copper prices are considered by many analysts to be a key measure of economic strength. Growing economies require a lot of copper; it is used in construction, electronics, power transmission and many other applications too numerous to mention here. Traders call the red metal “Doctor Copper” because rising and falling demand for copper often precedes similar turns in the global economy – giving it a de-facto “PhD” in Economics.

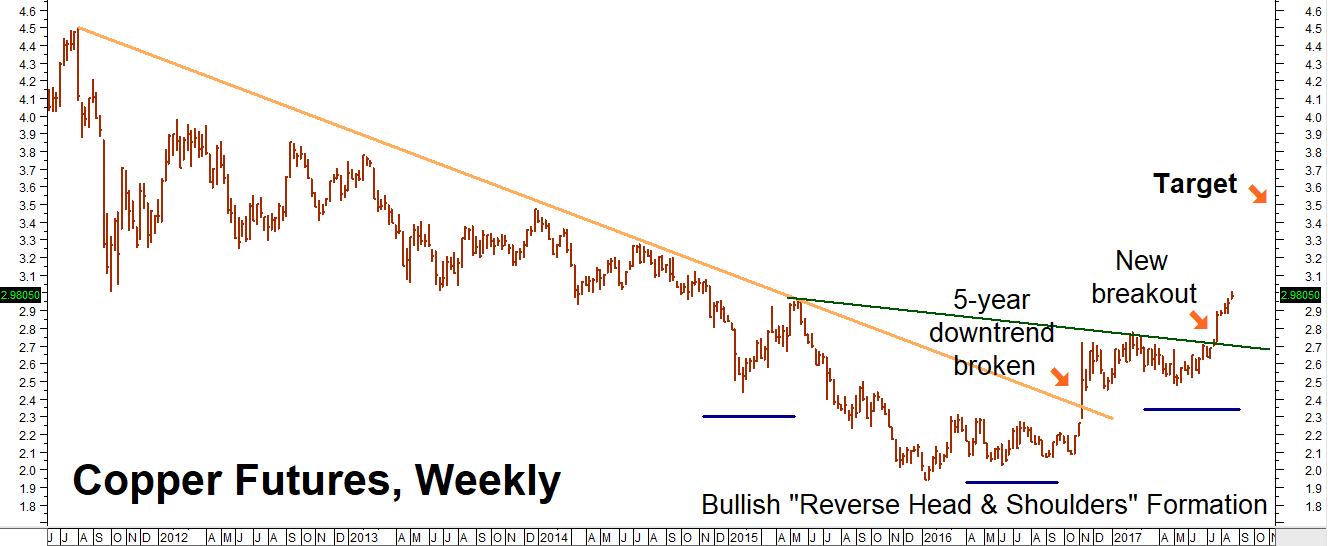

After five years of a punishing bear market that took prices from $4.50 to $2.00 per pound, copper is back. Price action over the past few months has negated the bear market and appears to be setting the stage for an emerging bull market. What the “good doctor” appears to be telling us now is that the global economy – especially Asia – could be setting up for another growth spurt.

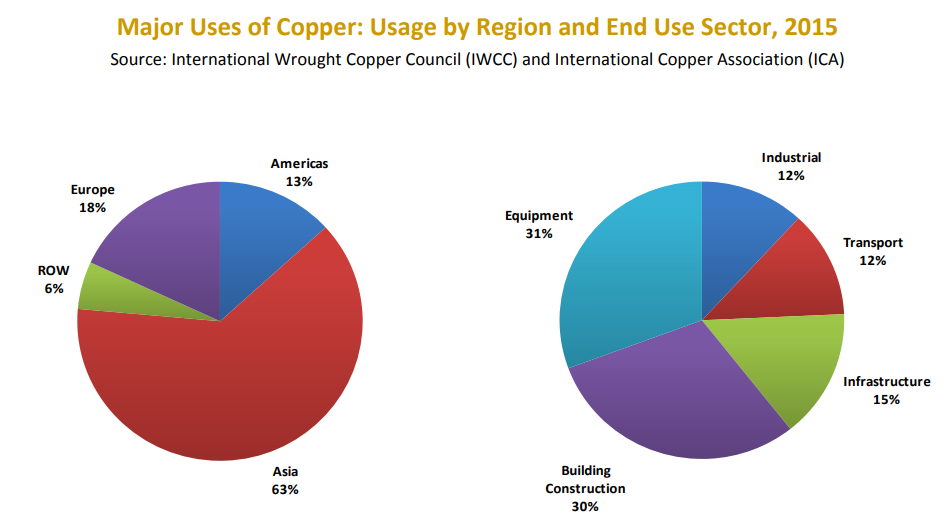

The need to improve their power grids makes China and India key players in the copper market. Asia alone accounts for 63% of copper usage. 75% of newly-mined copper demand is associated with electrical wiring, something that the emerging economies of Asia require a lot of. Nearly half of China’s consumption goes to grid infrastructure. Power deficient India is trying to catch up, potentially increasing demand there as well. The Chinese also have a history of using industrial metals, like zinc and copper, as stores of value — especially during inflationary periods.

The International Copper Study Group (ICSG) expects China to continue to be the biggest factor in global copper demand in 2017 and projects an increase in Chinese demand of 2.5% to 3.5%. At the same time the ICSG projects a supply deficit of 150,000 metric tons in 2017 and 170,000 metric tons in 2018 due partially to supply disruptions earlier this year.

Price Action Points to Higher Prices

But what really makes copper interesting right now is how it sets up technically (chart-wise). The election of Donald Trump led to expectations of massive infrastructure spending in the US which caused to price of the red metal to jump, effectively ending the bear market that began back in 2011. The market has chopped sideways since then, creating the right “shoulder” of a classic, bullish “Reverse Head and Shoulders” formation. We consider the latest breakout over resistance at the “neckline” of this pattern to be extremely bullish. That copper was able to do this despite fading hopes for a US infrastructure bill is even more impressive.

How to Play It

It appears that we are not the only ones interested in copper right now. A year ago we would have probably skipped the copper market altogether due to almost impossible illiquidity in copper options. And while we certainly wouldn’t call copper options a liquid market, getting a trade done at a reasonable price is no longer impossible.

We suggest trading clients consider buying March 3.30 copper calls while simultaneously selling an equal number of Mach $3.50 copper calls for $900 or less, looking for March copper futures to hit our $3.50 per ounce target prior to option expiration on February 22, 2018.

If we are wrong and copper does not rally, the most we can lose is the $900 we’ve paid for our $3.30 / $3.50 “bull call spreads”, plus transaction costs. Our spreads could be worth as much as $5,000 should copper rally to $3.50 per pound or higher on or prior to option expiration.

Please be advised that you need a futures account to trade the recommendation in this report. The RMB Group has been helping clients trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more about this trade.

If you are new to futures and options and simply want to learn more about them, you are welcome to download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free hard copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find a downloadable PDF. There is no obligation.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.