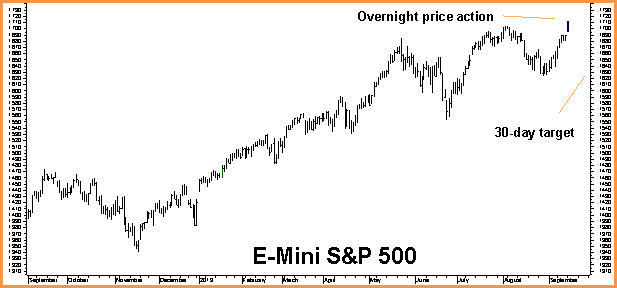

The decision by Larry Summers – announced yesterday – to remove his name from consideration for the job of Federal Reserve Chairmen has sent the overnight markets into a bullish tizzy. E-mini S&P 500 futures are 18.00 full points higher as we write this 2 ½ hours prior to the Wall Street open – making new all-time highs in the process.. The dollar is weaker and both T- bonds and notes are up big.

And all because Mr. Summers – considered more of an inflation hawk than his competitors for the position – has decide to pack it in.

Seriously?

The potential for a softening of the dreaded “taper” is sucking all the oxygen from the room and depriving the bulls of the luxury of clear thought. Not only is the Fed going to cut back on bond purchases – with or without Mr. Summers – it absolutely MUST if it wants the US Treasury market to remain viable and freely-traded over the long term.

Why?

Because the Fed is already responsible for 32% of the massive US Treasury market. The Sequester in combination with last year’s tax increase have cut US borrowing needs to just short of half of 2012’s. That means the US government is issuing fewer bonds.

If the Fed continues to buy Treasuries at its current pace – for any reason — it will own an even bigger percentage of the market, making its eventual exit from that market for more challenging. Therefore, it has no real choice.

As long as austerity rules Fiscal Policy, the Fed must taper or risk disrupting a market counted on by the entire global economy. US Treasuries are considered the world’s safest collateral – rightly or wrongly. A disruption in this market caused by a Fed-induced liquidity event would be a disaster.

The stock market is up because it believes big, bad Larry won’t be around to take the punch bowl away. We think it will respond differently once cooler heads prevail and traders sober up to the notion that — barring another recession — their happy bowl is eventually going away no matter who is Fed Chairman and what the monthly economic tea leaves may say.

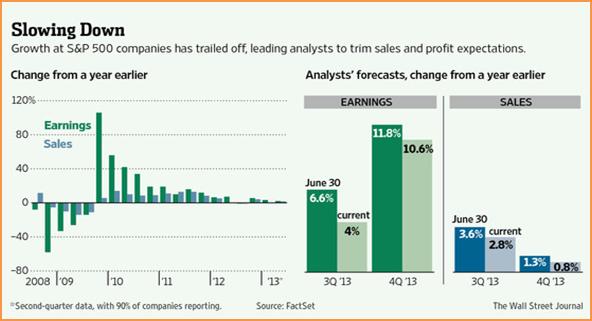

Stocks are not cheap and haven’t been for awhile. Meanwhile, expectations for earnings, sales and profit margins are all falling. The market is assuming coming debt ceiling fight won’t be an issue. We believe it has the potential to be an even greater issue than last time.

Bottom Line: We believe stocks are a market perfectly primed for a big, disappointing failure. Last night’s price action is providing us with a great opportunity to take a low cost short position that is very close to the market.

SUGGESTED ACTION: Subscribers to the RMB Group Big Move Trades newsletter receive the actual trades or contact the RMB Group for more information.

Lindsay Hall is Chief Market Strategist with commodities specialists RMB Group. Get the latest futures and commodities commentary from Lindsay and the RMB Group on our Big Move Trades–an online report offering trading ideas backed by research.

Questions about this report or trading futures? Contact us online or at 1-800-345-7026. Follow us on Twitter @RMBGroupFutures