Strong Chinese demand, deteriorating crop conditions in the US, and a weak US dollar have helped to push the prices of corn and soybeans above key resistance levels. This is setting the stage for a continuation of the counter-seasonal rallies that could power both markets to our upside targets faster than we originally expected.

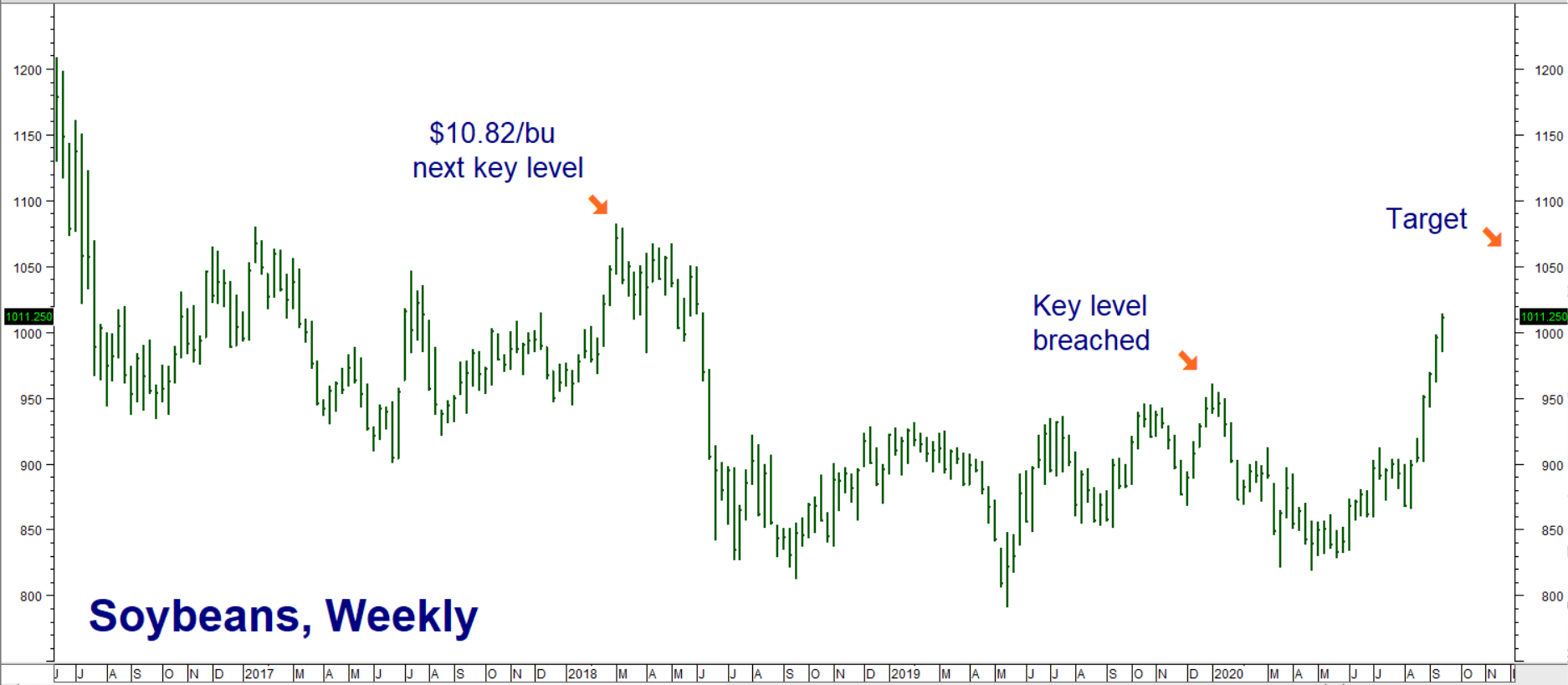

The speed and scope of the rally in soybeans is particularly surprising. “Beans” hit our original $9.60 per bushel target two weeks ago. We expected them to run into resistance at old swing highs at $9.61 per bushel. But instead of stalling, soybeans soared, cutting through this key level with ease to their highest levels since 2018. Have they rallied too far, too fast?

Data Source: Reuters/Datastream

The market will give us its verdict soon. Soybeans are already in striking distance of our next upside target of $10.60 per bushel. A continuation of the current surge could get us there faster than we expected. Conversely, a loss of momentum over the next week could signal a temporary top, setting the stage for a correction that could take prices back to old breakout levels around $9.60 per bushel.

RMB trading customers who took the suggestion in our last blog post to buy July 2021 $9.80 / $10.60 bull call spreads in soybeans should consider exiting half of their positions at this spread’s current price level of roughly $1,600 each, taking your initial risk off the table in the process. Continue to hold the balance of your spreads in anticipation of an eventual rally to our $10.60 target.

Deteriorating crop conditions due to crazy weather, strong Chinese demand resulting from the trade deal – and a big resurgence in Chinese hog production following the African Swine Flu disaster – should help keep a floor under soybean prices into harvest and beyond.

Corn Fundamentals Improving

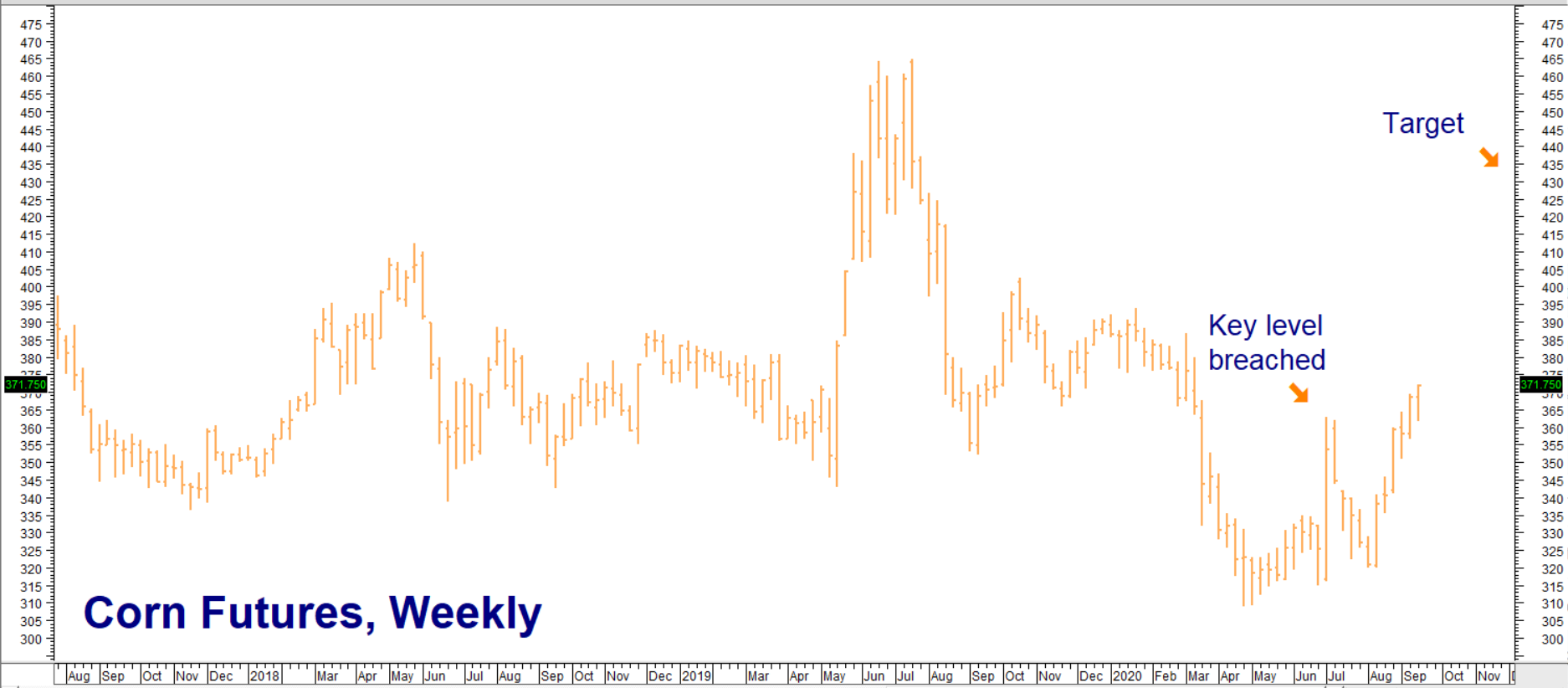

Corn has been the weakest of the grains for nearly the entire growing season. But one could make the argument that its fundamentals have improved enough over the last month to rival those of soybeans. This year’s weather has severely impacted corn – including damage due to the late-summer Derecho which flattened many thousands of acres across the American breadbasket, and soaking rains that followed.

The USDA has been gradually reducing estimates of this year’s crop size. But the biggest news is coming from China. Mother Nature is the culprit there as well. China is fairly self-sufficient when it comes to corn, but not this year. Three closely-spaced typhoons have taken their toll. China could be short 19 million metric tons according to recent USDA estimates. This has sent the Chinese into the global market in search of supplies. Extra demand due to ramped-up hog production is not helping. China has already purchased 11 million metric tons of corn from the US, and appears to be ready to buy more.

Data Source: Reuters/Datastream

Like soybeans, corn has breached a key level to the upside. However, unlike soybeans, it has a lot more work left to do to. Corn will encounter resistance from here all the way up to $4.00 per bushel. A series of closes above $4.00 could propel the yellow grain to our $4.35 objective in short order.

RMB Group trading customers who followed our suggestion in our last post to purchase December 2020 $3.60 corn calls for $650 should continue to hold them. However, consider exiting half of your positions should price reach double your original entry level. These calls are currently bid at 22 cents or $1,100.

A fill will allow you to take your original risk off the table. Hold the balance for a move to our $4.35 objective in the December futures contract. Prices can and will change. Please contact your RMB Group broker for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.