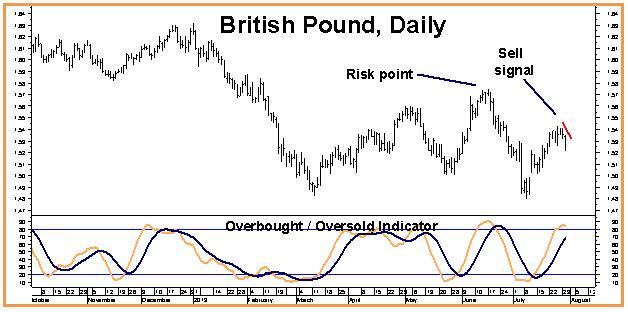

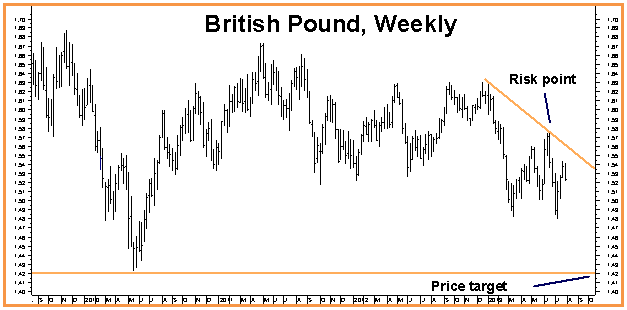

We expect a weak economy and fragile banking system will keep the pressure on British interest rates for the rest of the year and have been patiently waiting for the British pound to give us some indication that it was ready to resume its downtrend. We received that signal yesterday when Sterling managed two consecutively lower closes under Friday’s low.

The pound has eliminated the overbought condition that preceded the recent bounce and appears poised to retest old long term lows just above $1.4200 in the front contract. We’ll use two consecutively higher closes above old swing highs of $1.5710 as a signal to exit and cut losses should the pound lose its downside momentum.

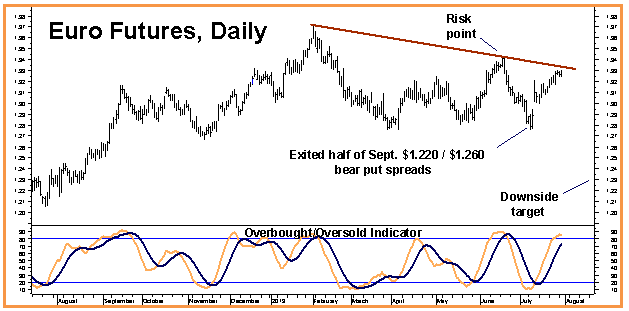

Roll Remaining September $1.220 / $1.260 Put Spreads into December

We made the right call when we suggested exiting half of our September $1.220 and $1.260 put spreads earlier this month. In hindsight, we wish we’d exited all of them. However, that does not mean our long-term bearish stance in the euro has changed. The common currency has rallied because Gentle Ben walked back the threat of reduced bond purchases. That news is now fully in the market with today’s FMOC announcement. We expect the focus will now shift to the economic rot that is eating the Eurozone from within and expect the common currency to resume its downtrend soon.

With barely a month left until expiration, the time has come to “roll” our remaining September positions into December. Our downside target remains the same (see chart below). We will also continue to use two consecutively higher closes over old swing highs of $1.3423 as a signal to exit and limit losses should it occur.