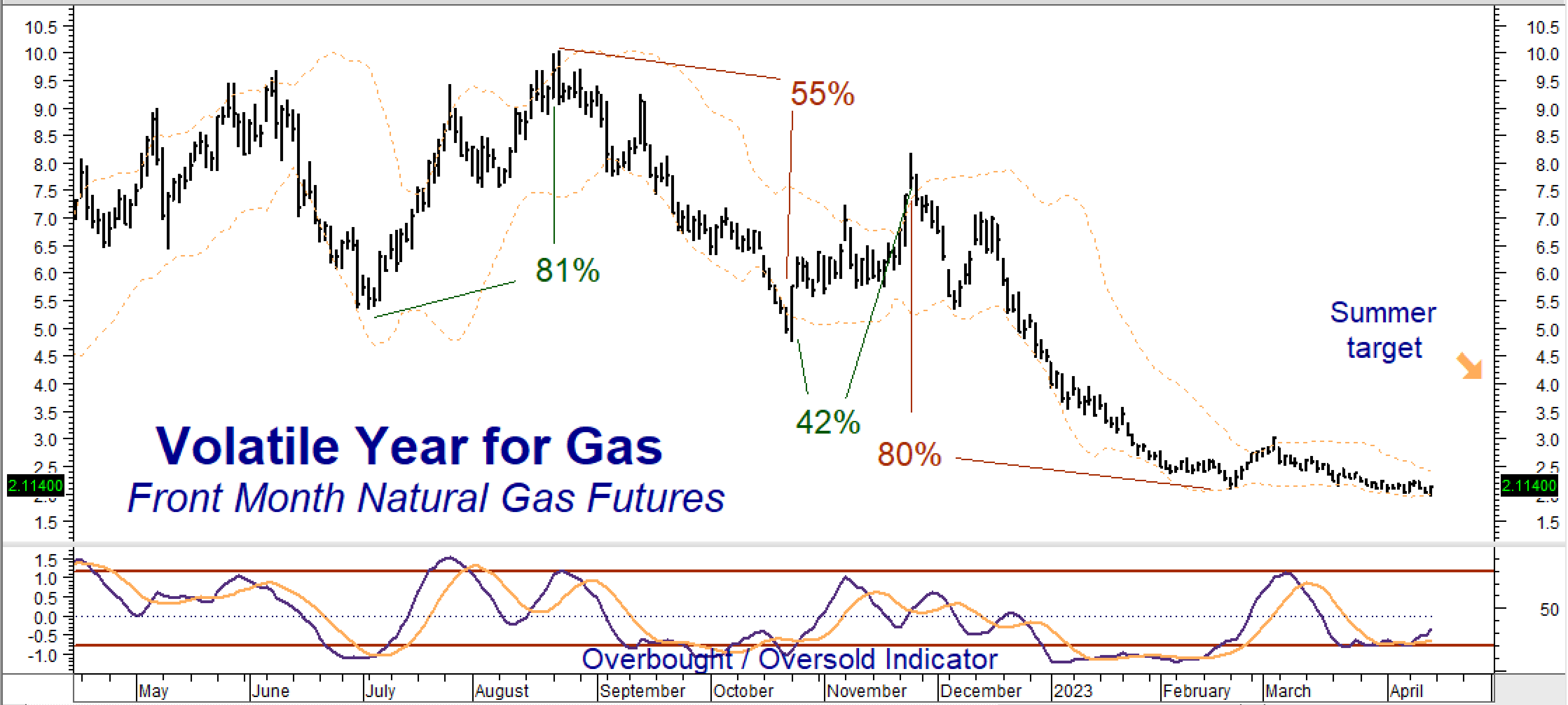

Volatility is the natural state for natural gas. Gas rallied 81%, declined 55%, rebounded 41%, and then declined another 80% in just nine months (June 2022 to February 2023). Its failure to do much in the past three months is a rare break from the wild up-and-down swings that often define this market. Burgeoning supplies on both sides of the Atlantic weigh on both price and volatility. They are forcing natural gas into the unnaturally tight trading range it finds itself in right now. We do not expect the current calm to last.

Data Source: Reuters/Datastream

Mother Nature came to the rescue this winter, countering supply issues caused by the war in Ukraine with warmer-than-expected winters in both Europe and North America. But she could also cause a lot of mischief this summer. A hotter-than-normal summer in either Europe or North America would increase electricity demand, potentially drawing down supplies and inviting volatility back into the market. We believe global climate change increases the chance of extreme weather behavior – potentially leading to higher natural gas prices as the demand for air conditioning soars.

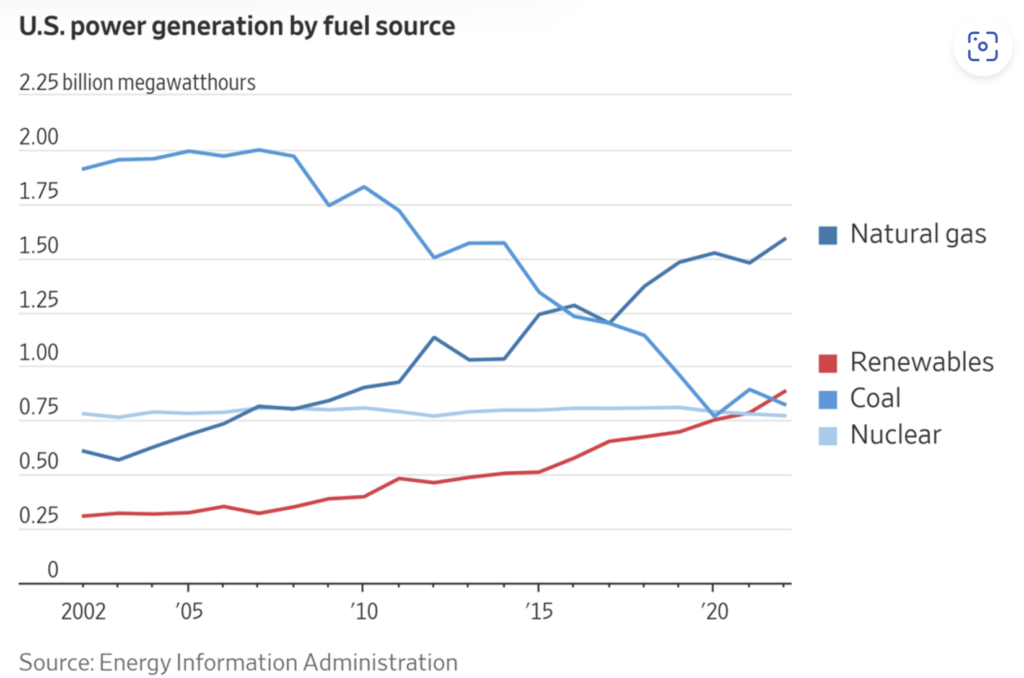

The US is particularly vulnerable to summertime weather disruptions given its increasing reliance on natural gas to power the electrical grid. While there is a lot of talk about renewable energy, as the chart below illustrates, it has a long way to go to fill in the hole left by coal and nuclear power.

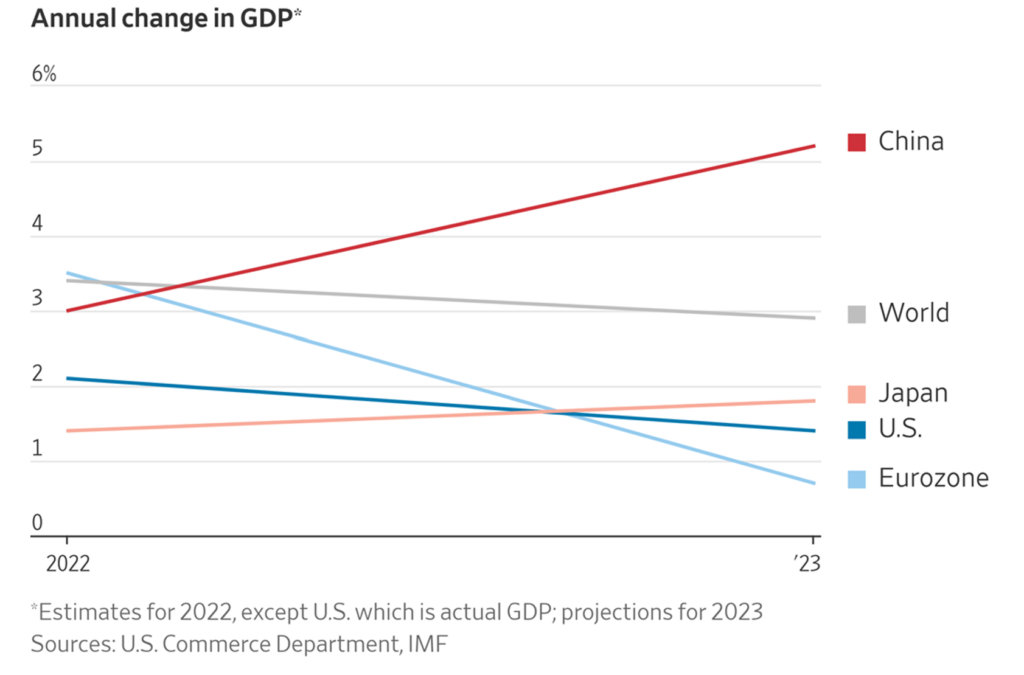

China’s Recovery Should Help Boost Demand

The decision by the Chinese government to end Covid lockdowns removed the foot from the throat of the world’s second largest economy. Despite its troubles, the Middle Kingdom remains one of the fastest-growing modern economies. China is a manufacturing economy that requires a lot of energy.

Russia may be sending China some of the gas not going to Europe because of sanctions, but China cannot rely solely on Russian energy due to political and economic factors. China does not want to repeat Germany’s mistake and become over-reliant on an unreliable partner. Even if it did, the pipeline capacity necessary to supply China’s vast natural gas requirements does not exist and would take years to develop. China will still need non-Russian gas. This should help keep a floor under the market.

Use NYMEX Call Options to “Rent” Natural Gas for Pennies on the Dollar

The strategy below is designed to give RMB Group trading customers upside exposure to natural gas for a lower cost and risk than purchasing futures (or an equivalent amount of energy stocks) outright. This frees up capital to generate a return somewhere else. We believe that today’s relatively high yields on safe and/or insured debt instruments like T-bills or CDs favor this type of approach.

We will use NYMEX natural gas options to create our “pennies on the dollar” strategy. Each option covers 10,000 million BTUs (British Thermal Units) of natural gas. Prices are quoted in dollar and cent per each million BTU. This makes each 1/100th of a cent move worth $10 and each $1.00 move worth $10,000. Buyers of natural gas call options pay money, known as a “premium,” for the right but not the obligation to be long natural gas futures at a specific price for a specific time period.

Call option buyers do not buy the market; they buy the right but not the obligation to be long that market. The key phrase is “but not the obligation.” Should natural gas decline or fail to rally before the option expires, the option buyer will simply not exercise the right to buy the futures contract. The maximum risk for the buyer of a natural gas call option is the premium paid, plus any transaction costs.

Sellers of natural gas call options receive money in exchange for the obligation to sell natural gas futures for a specific price for a certain timeframe. Notice how this definition is the exact opposite of call option buyers. Think of it this way: if you are an employer, you pay money to your employees. This gives you the right to tell them what to do. As an employee, you receive money from your employer, obligating you to do what your employer tells you. Options work the same way.

Combine Long and Short Positions to Reduce Risk

We can lower the cost and risk of our bullish position by combining long natural gas call options with short gas options. Our upside target for crude is $4.00 per barrel. RMB Group trading customers may want to consider buying September NYMEX natural gas options with a strike price of $3.50 per MMBtu, while simultaneously selling an equal number September options with a strike price of $4.00 per MMBtu.

This “bull call spread” pairs the right to buy natural gas at $3.50 with the obligation to sell natural gas at $4.00. This “spread” settled April 17, 2023, for 7.9 cents or $790. RMB trading customers may want to consider placing an order to purchase these spreads for $750 or less, looking for natural gas to return to its naturally volatile state with a big, upside bounce sometime this summer. Our target is $4.00.

The maximum risk if filled at $750 is the price paid plus transaction cost. Failure of natural gas to rally above $3.50 prior to option expiration on August 28, 2023, would result in this loss. The August 28th expiration of September NYMEX natural gas options keeps us exposed to the upside for nearly the entire summer. This bull spread has the potential to be worth as much $5,000. Consider exiting all positions if our target price is hit prior to expiration.

Prices can and will change, so contact your RMB Group broker for the latest. Your RMB Group broker will work with you to match a strategy to your risk tolerance and market conditions.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.