2024 is shaping up to be another volatile year. We expect global climate change will continue to deliver more “historic” weather events, some of which could impact food supplies. Wars in Ukraine and Gaza could escalate further, involve more of Europe and Mideast. Markets are ignoring the war for now, but this could change at the drop of a hat.

Here in the US, political dysfunction threatens the Covid recovery as Congress moves from the threat of one government shutdown to another. Bond-rating agency Fitch downgraded sovereign American debt in August – the first time since S&P did it in response to a similar threat in 2011. We expect American political dysfunction to grow worse now that the presidential primary season has kicked into gear, especially given the indictments looming over leading Republican candidate Donald Trump. Petty resentments continue to take the place of legislating in the US Congress, rendering it unable to properly function at all.

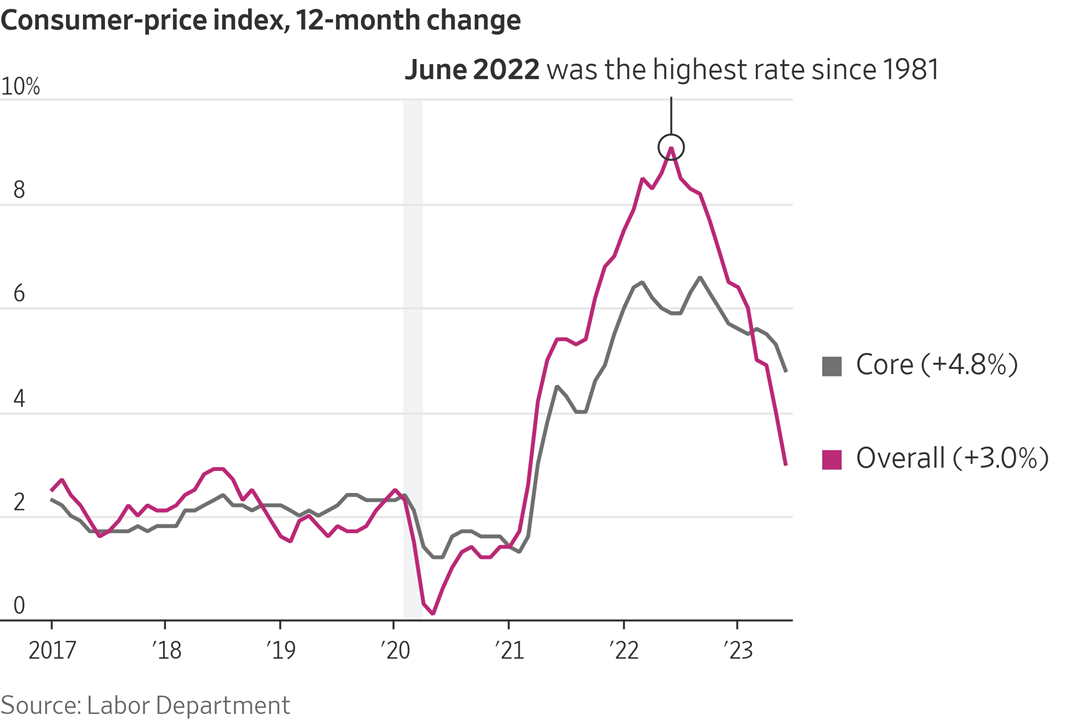

Despite big progress – squashing inflation from a high of 9 percent to 3 percent in less than a year — the Fed seems determined to keep interest rates elevated. Stocks continue to perform surprising well, fully pricing out the risk of a recession, despite the Fed’s seeming desire to create one by keeping rates elevated. Up nearly 22% from its late October low, the S&P 500 is overbought. The high-flying NASDAQ 100 (up 27%) is even more so.

Commercial Real Estate Could Be a Big Problem

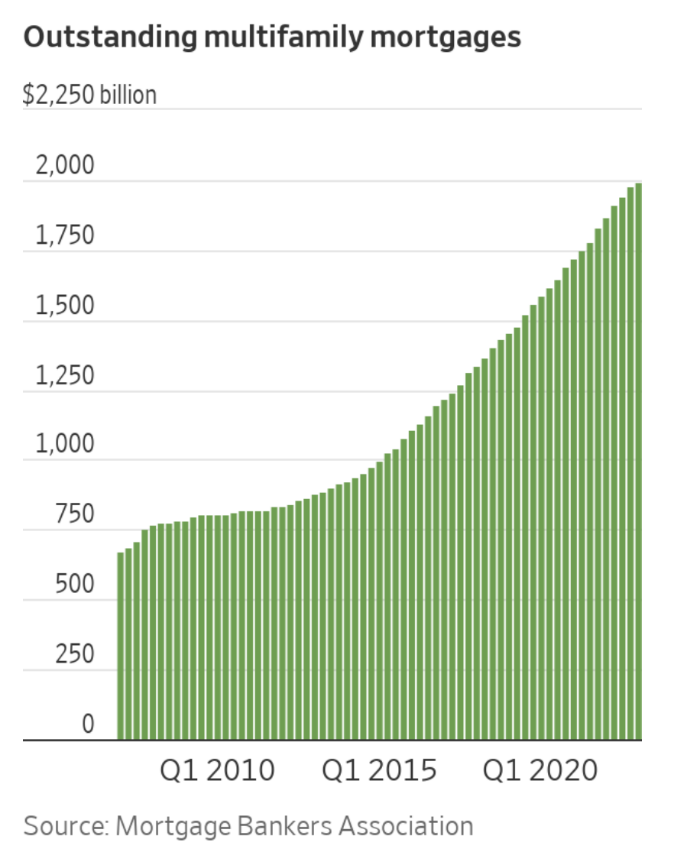

Meanwhile, trouble is brewing in commercial real estate. The work-at-home movement crushed the office space sector during Covid. The consequences are still felt as rates reset and collateral value drops. The era of easy money is over. Mortgage delinquencies in the sector are on the rise. Many commercial loans issued when rates were low are coming due now. Sharply higher interest rates and stricter bank lending standards are forcing borrowers into the lightly regulated private market, increasing the risk of unexpected, market-moving surprises.

Higher Rates Are Working

The Fed’s campaign is working. Inflation has fallen far from its 9% peak in 2022. (See chart below.) It will likely slow even further. The true effects of Fed policy decisions are often not felt for years because it takes time for interest rate changes to work their way into the real economy. We believe the real risk now isn’t inflation, but the potential for one or more major economic dislocations due to an overzealous Fed.

This could be the perfect time to hedge a potential increase in stock and bond market volatility by using an asset class not tied to the performance of either. The investment we are talking about is Managed Futures.

Why Managed Futures?

Managed futures are an asset class with features not found in stock and bond markets. The most prominent of these is the ability to take long or short positions in any widely traded market with relative ease. A managed futures portfolio can capitalize on bull or bear moves in a diverse number of markets. Most investors associate futures with commodities like grains, crude oil and precious metals. Yet futures contracts that cover financials like stock indexes and interest are even more widely traded than traditional commodities.

As the name suggests, managed futures involve professional money management. Managed futures managers are called Commodity Trading Advisors or CTAs. CTAs are required to keep audited track records detailing their performance over time. Each CTA is required to put together a “Disclosure Document”. This functions like a mutual fund prospectus and lists all the programs a particular manager is responsible for, including audited track records for each.

Managed Futures Are Not Correlated with Stocks

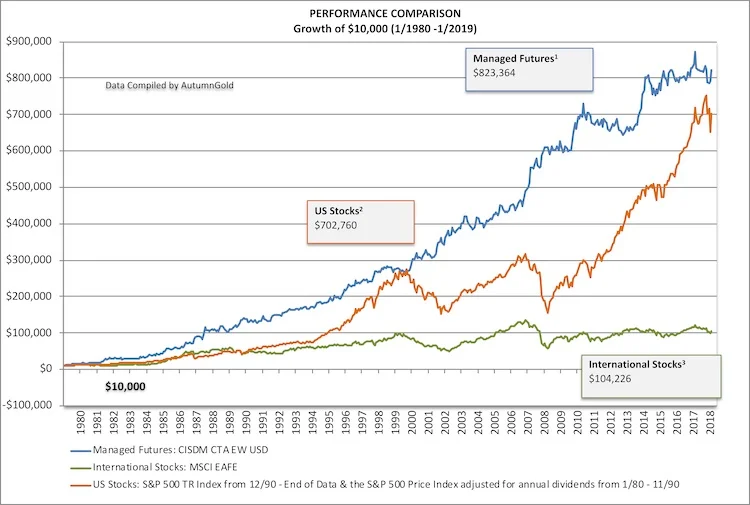

Managed futures are generally not correlated with stocks, bonds and other popular assets. This is what makes them a powerful diversification tool. The chart below illustrates the performance of managed futures versus traditional asset classes from 1980 to 2018.

Source: Autumn Gold

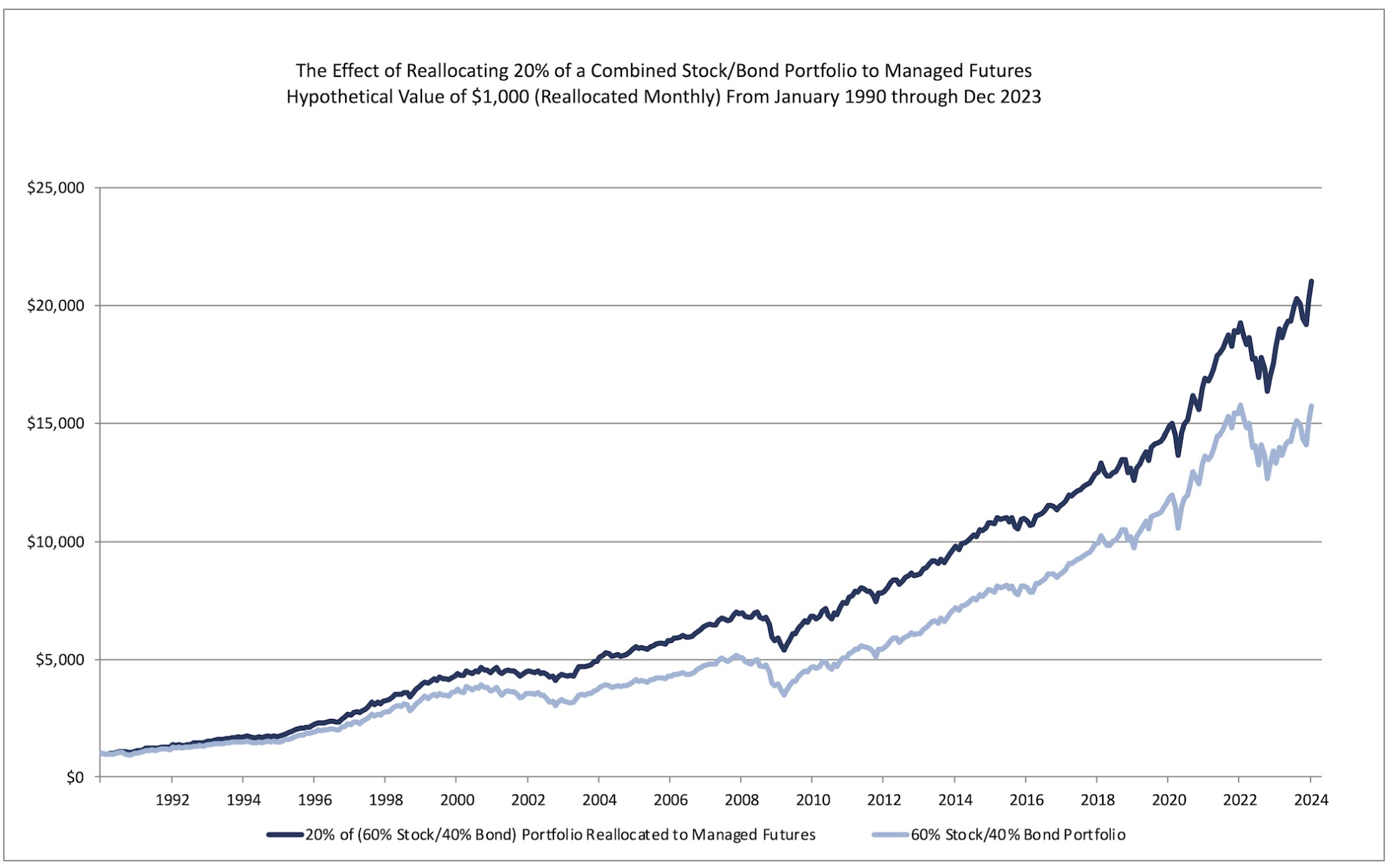

The graphic below illustrates the difference adding 20 Managed Futures to a traditional 60/40 stocks to bond portfolio mix can make.

Source: Autumn Gold

While there is no guarantee the results illustrated above will be duplicated in future years, the ability of managed futures to add stability to traditional portfolios has been studied extensively. They remain an important diversification tool for pension funds, family offices and other money managers. Individual investors can use them as well.

Four Styles of Managed Futures Trading

Markets change personality depending on the underlying emotions guiding them. At any given time, every single market is doing one of three things: going up in response to greed, going down due to fear, or moving sideways due to the lack of an overriding sense of fear or greed. Since big, market-moving events don’t happen every day, most markets move sideways most of the time.

Different trading styles work best in different market conditions. Trading techniques that work well in directional markets tend not to work in sideways markets. The reverse is true as well. This is why knowing a Commodity Trading Advisor’s trading style can be helpful when putting together a managed futures portfolio.

Commodity Trading Advisors (CTAs) can be grouped into four basic categories:

Trend followers attempt to identify a market trend, trade in the direction of that trend, and ride it as long as possible. Trend followers do best when the markets they trade are moving in one direction – either up or down. Most trend followers are “technical traders”, which means they rely mainly on charts and price movement to determine exit and entry levels. Many trend followers are systematic, which may mean trading signals are generated by a formula or computer algorithm.

Trend faders try to identify market turns, switching bias at support and resistance levels. Trend faders tend to do better in sideways markets – jumping in and out as price chops sideways. Like trend followers, trend faders use charts, technical analysis and computer algorithms to generate their signals. Unlike trend followers, they monitor markets for trend reversals.

Fundamental / Discretionary traders make trades based on the supply and demand “fundamentals” of the markets they follow. They may incorporate some chart-based analysis as well. Discretionary traders rely more on experience and market knowledge than a systematic approach. They may use systems in their research but the decision to trade comes from the trader, not the system.

Fundamental traders base their trading decisions on supply and demand. Many CTAs specializing in agricultural markets are fundamental traders. Some of the more successful ones have a background in farming or ranching and access to information not easily available to those outside the industry. Fundamental traders are constantly monitoring crop conditions, import and export levels and the weather, among other factors.

Option premium sellers attempt to capitalize on time decay. Options are “wasting assets” that lose value over time. Option sellers are like insurance companies. They bet on the probability they will keep the vast majority of premiums they receive for selling options and hope these premiums will be enough to cover any losses and generate a profit. Like insurance companies, premium sellers can be on the hook for big losses – especially during “Black Swan” market events.

Risk Management is the Key

Successful CTAs make money over the long term no matter their preferred style. What separates successful CTAs from the rest is not how good they are when market conditions match their trading style, but how well they manage risk when their trading styles and market conditions don’t match.

That’s why it is important to examine a CTA’s track record and pay special attention to the “drawdowns” or losing periods. All traders have losses. It is how these losses are managed that counts. CTA track records can be found in their “Disclosure Documents”, which are similar to stock prospectuses.

Some successful money managers have more losing trades than winning trades but keep the losers small enough to be successful. This pattern is characteristic of trend followers and some fundamental / discretionary traders. Others have track records showing more (usually smaller) winning trades with a few bigger losing periods mixed in. This pattern is often characteristic of option premium sellers and some trend faders.

Mix Different Trading Styles

When you add an individually managed futures account to your portfolio, you are not necessarily buying or selling a given market; you are investing in the talent of that money manager. CTAs with different styles make money under different market conditions. This is why it may make sense to consider building a portfolio of CTAs that employ different trading styles — perhaps matching a successful trend follower with a successful trend fader or combining both with a fundamental/discretionary trader. This can help smooth out overall performance over time.

Want to know more about individually managed futures? Click here to download our 30-page booklet, Opportunities Outside the Stock Market, which will teach you all the basics of this fast-growing asset class in an easy-to-read format. We would be happy to put together a sample portfolio of the some of the CTAs we are currently using and help you track them. This will help give you to get a real-world feel for this powerful diversification tool, without having to commit a single dollar. You can contact us toll-free at 800-644-1013, direct at 312-373-4974 (country code 001) or send an email to neil@rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.