Futures Outlook: 11/8/13

It May Be Time to Re-enter T-Notes Short

I have written on this topic a few times this year already, but after a bit of retracement and the seeming reprieve that the debt ceiling extension discussion lent us, it may now be time to re-enter T-Notes to the short side.

10 Year T-Notes

Let’s start off by looking at the Daily chart:

Per the Daily chart, you can see the latest bullish push has been going on since September and rallied just a bit more after the October 17th deadline cleared and the government “re-opened”. What I want you to notice is the voracity with which we have seen a decline in these markets just today. Any inkling of potential Fed taper causes drastic shift in this market. The Fed hasn’t even started to taper and this morning, in one fell swoop we were able to push more than a full point of price failure. This is truly where I ask you once again: Were you involved in the play? Have you protected yourself from potential failure in bonds and/or fixed income exposure? Pay particular attention if we are able to break down 125. That being said, we still have a full point worth of potential before we get there. Are you involved?

As we move forward to our Weekly chart:

This type of momentum is what I believe is just the tip of the iceberg and please recall that this summer we were in the 130’s. I have highlighted in red the area around 136 which is where we stood in May. We failed all the way down to 123 and change. Did you take advantage of it? Since September as mentioned above, we have seen a slight retracement of that failure. I look at this retracement as a healthy move that allows those who weren’t involved a new opportunity for the next round. It also offers those who were involved, a secondary potential for entry at a price point better than the lows coming into summer’s end. We have never regained the 130+ territory and I believe that today’s momentum may be a good place to evaluate another entry. You can see on the Weekly chart that the retracement trend line following the lows was quite steep, but our push today has pushed a bit beyond where you would want to see the lows if we were to continue higher.

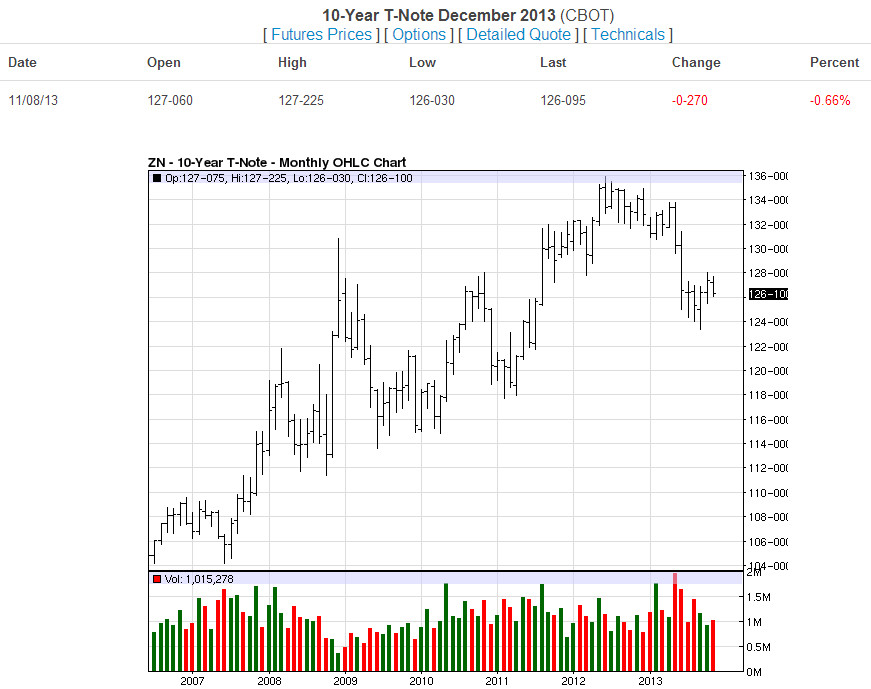

Moving to the Monthly chart:

The Monthly chart illustrates the summer failure and our brief retracement period. When you look at this chart though, the story it seems to be telling is one of weakening power. It looks as if it cannot bear the strain any longer. This small rally has provided all of us a second chance to think about our portfolios, review our positions, protect ourselves, and enter speculative positions that could potentially capitalize on the next round of failure here.

Using Options is a great way to be involved in the pure play, utilize lesser capital and employ a fixed risk scenario. Allow us to help you design the strategy that suits you best so that you can participate in what may be a generational opportunity. This type of market opportunity doesn’t show up all that often and I want all of you to decide how it fits best for you. Contact us directly and we will be happy to assist you in this aim.

Remember, that we are here to keep your options clear.

Questions about this report or trading futures? Contact us online or at 1-800-345-7026. Follow us on Twitter @RMBGroupFutures

T