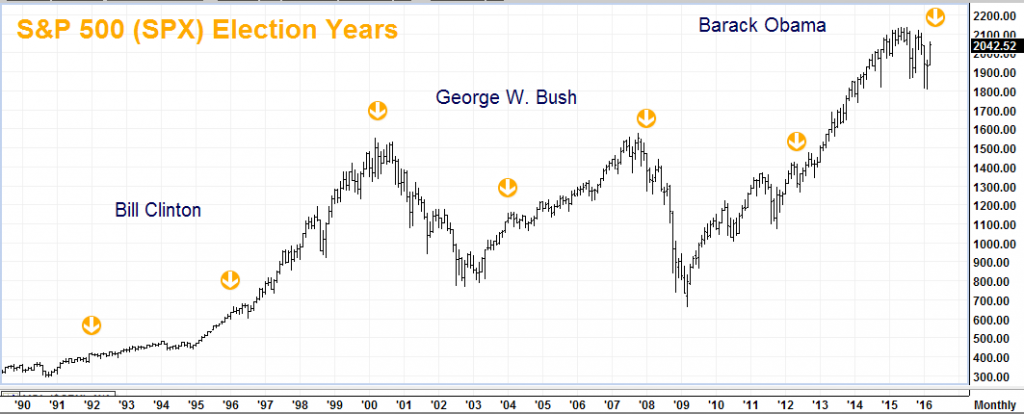

Stock market investors should get ready for a wild ride in the next few months – especially if Donald J. Trump wins it all in November. The last two major stock market crashes occurred during shifts of power involving the American Presidency. The 2001 Dot.com Crash followed the end of Bill Clinton’s two-term reign. The Housing Crash began in August of 2008 – George W. Bush’s final year as Commander in Chief. Both Clinton and Bush were two-term presidents and ultimately replaced by candidates from the opposing party.

Mere coincidence? Perhaps. The S&P chart below is compelling nonetheless. Is the growing political polarization that has plagued the US responsible for the stock swoons which accompanied transitions of power from blue to red and back again? Or is it something else? What happens if Hillary wins and the Democrats retain power for the first time in a generation?

Data source: FutureSource / Interactive Data

The similarity of the current price action to the end of both the Clinton and Bush terms (see chart above) is sobering to say the least. Election year consequences are relatively benign when the incumbent party retains power, but downright nasty when it doesn’t. Does this mean a victory for Secretary Clinton will be good for stocks because she is from the incumbent party? Not necessarily. There are other, more subtle factors at work.

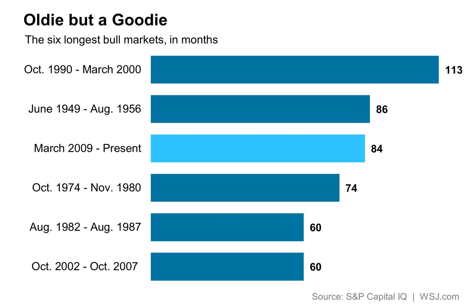

March 10, 2016 marked the seventh year of the current bull market. At 84 months, it is the third longest bull-run in stock market history. The longest occurred during Bill Clinton’s two terms and lasted 113 months or roughly ten years. When you average the six longest bull markets together, you get 80 months or nearly 7 years. Given this shelf life, stocks are already “long in the tooth” and could be in trouble no matter who wins. Yet a Trump victory could be even more damaging.

Trump Victory Could Signal a Collapse

In Part 1 of “Investing in the Age of Trump” we explored the anger and disappointment of the white middle and working class and its role in the unexpected rise of Donald Trump. Mr. Trump’s demeanor and ability to say virtually anything without paying a political price is the very definition of a political “Black Swan.” Stock markets despise “Black Swans.”

In Part 2 of “Investing in the Age of Trump” we explored how The Donald’s trade policies and promises to impose heavy tariffs on goods imported into the US could up-end global trade and lead to another economic crisis, just like the Smoot Hawley Tariff Act of 1930. The Great Depression that began with the 1929 crash was worsened by Smoot Hawley, eventually fueling the flames of nationalism which gave rise to Adolph Hitler and World War II. Did the great recession of 2008 start us down a similar nationalistic path? We certainly hope not.

The bubble in dot.com stocks in 2000 made temporary millionaires of thousands of Johnny-come-lately day traders convinced the Internet would always go up. In 2007, the exploding housing market provided an easily-tapped cash machine for millions of Americans convinced the price of their homes could only rise in value. Seven years apart, both expectations were wrong. Stocks collapsed as a result.

Stocks Are Betting on Hillary

The stock market hates uncertainty of any type because it is a discounting mechanism. It doesn’t price in “what is”, but what it believes the future will bring. As we witnessed in 2001 and 2008, any event or series of events that disrupts future expectations can be devastating to the stock market. Donald Trump is the very definition of uncertainty, making him far more potentially destabilizing than Hillary Clinton.

Declining volatility means the current market not only expects the Fed to refrain from stomping on the interest rate brake, it also expects a Hillary Clinton victory in November. Hillary may not be gung-ho on free trade – having recently moved into the Bernie Sanders anti-Trans Pacific Partnership (TPP) trade deal camp – but she is not promising to build a border wall or slap 40% tariffs on foreign imports either.

…But Trump Could Still Win

Secretary Clinton is part of the political establishment. She is stable, relatively predictable and expected to win against The Donald. However, her establishment bona fides and party line predictability could work against her in the general election – especially given the angry electorate on both sides. Trump might actually win, especially if he picks John Kasich as his running mate and angry Bernie supporters stay home.

Combine a “Black Swan” Trump victory with the recent tendency of the S&P 500 to decline dramatically following a transfer of power and stocks could swoon big between now and election day – especially if Clinton’s victory narrative is threatened in any significant way.

A Trump / Kasich ticket would threaten the Clinton victory narrative because it softens The Donald and gives him a shot at Ohio. So would a major terrorist attack in the continental United States. A Clinton / Warren ticket would likely increase the turn-out of frustrated Bernie supporters, bolstering Hillary’s chance of getting elected.

Because we are very late in this bull market’s 7-year cycle, we will probably recommend selling into news of the former and holding fire in the case of the latter. Of course, nobody really knows what the future will bring, which is why diversification is so important.

What to Do Now

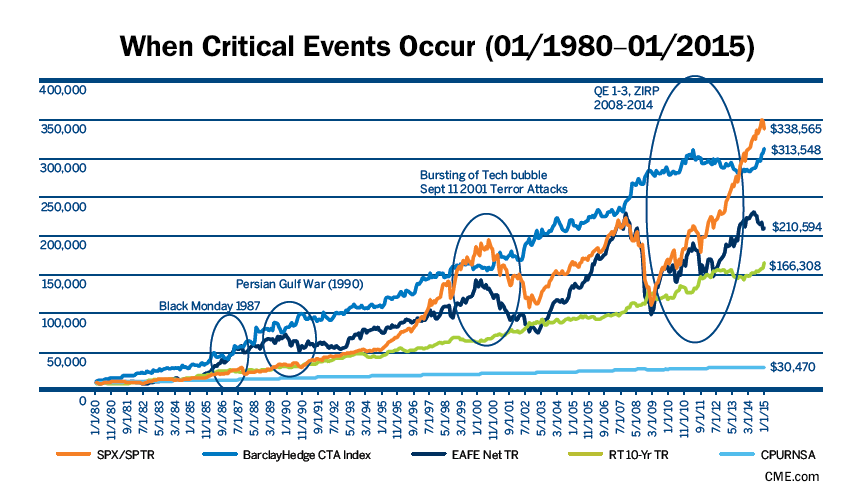

Individually managed futures accounts run by Commodity Trading Advisors (CTAs) have a solid history of providing investors with performance-smoothing diversification – especially during times of crisis. The chart below shows the performance of Barclay Hedge CTA Index during a periods of crises going back to 1980 compared against stocks and US treasuries.

Give RMB Group a call at 800-345-7026 or 312-373-4970 if you would like to learn more about the CTAs we are following right now. To find out how individually managed futures accounts can work for you, download our free booklet and accompanying video – Opportunities Outside the Stock Market – now.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.