Will the fourth time be the charm?

Gold’s mid-June spike over its 200-day moving average was the fourth in a series of attempts to breech resistance and give hope to long-suffering bulls. Unlike other attempts, June’s spike took out two previous swing highs, giving this move more “gravitas.” We write this one day after this bullish spike (illustrated in the chart below) so the jury is still out – at least as far as the short term is concerned. More confirmation is needed.

The long term is another story…

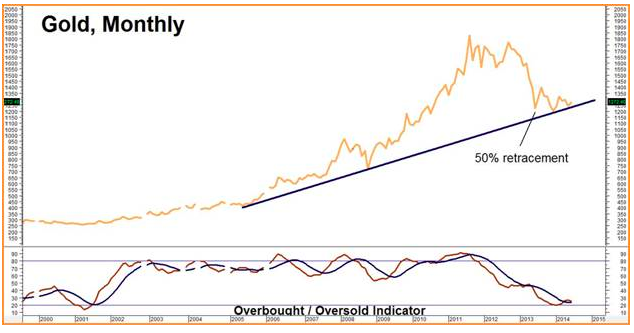

The past three years may have been hard on the hard money crowd but, when viewed through a long lens, gold’s three-year decline – which took prices from $1,911 in August 2011 to December’s $1,082 low – looks like a classic, cyclical correction in a longer term bull market. It has taken this long to reverse the extreme overbought conditions that were in force at the highs, but that reversal is now complete. Gold is currently more oversold long term than it was in 2001at the beginning of the current bull market.

Prices are holding the nine-year uptrend line and appear to be forming a bullish “reverse head and shoulders” formation right around the $1,300 level. The yellow metal will remain in its long-term uptrend as long as the front-month futures contract can hold its $1,082 low on a monthly closing basis.

But the technical picture is not the only reason we like gold. While some bulls have been busily whining throughout this three-year tumble – pointing to soaring Chinese demand and blaming the Midas metal’s inability to muster much of a rally on “manipulation” – we think those frowns will be turning to smiles soon.

Investment Demand Is Key

We like conspiracy theories and easy answers to explain losing positions just as much as the next guy – after all, who doesn’t like a good story? However, we’ve been in this business long enough to know that big money has an advantage in nearly every market. Big money chases big money and, until very recently, gold has been going down.

The increasing quantity of shiny, yellow metal in Chinese vaults hasn’t been enough to change this yet. Gold is not an essential commodity (sorry, hard money folks) like crude oil, grain or water. It does not get consumed. That means it can ignore supply / demand fundamentals a lot longer. Investment is what ultimately drives the price of gold. The shiny, yellow stuff will bottom when the big money runs out of other options; when global instability, the prospect of wide spread chaos, and/or inflation drives investors to value return of capital more than return on capital.

The Russian annexation of Crimea, the growing fight for the South China Sea between China and Japan, the dirty war of attrition in Syria and the current meltdown in Iraq have ratcheted up the former – especially the prospect of an all-out, sectarian world war right in the middle of the oil patch.

“Gasoline Next to the Water Heater”

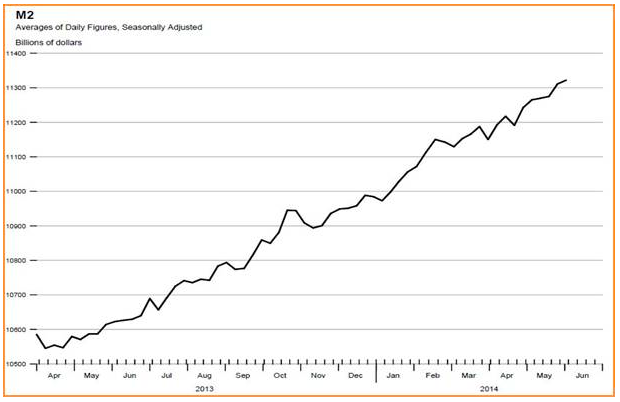

Then there is inflation… Like Rodney Dangerfield, inflation doesn’t get any respect – at least not anymore. Deflation is the big, bad monster in the mind of the market and is getting all of the attention. But don’t count inflation out yet… Not only is inflation being actively encouraged by nearly every major central bank, the money needed to fuel it is already in circulation.

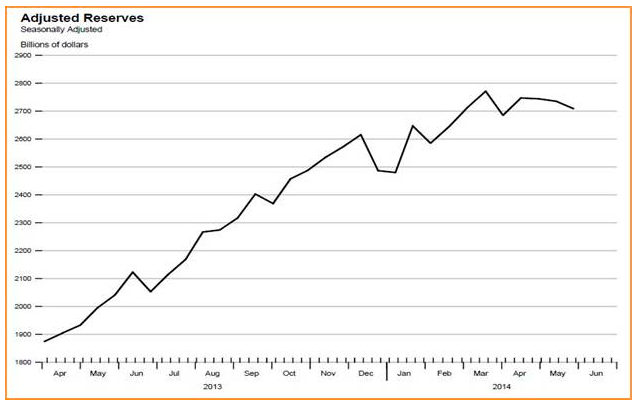

Brian Westbury, Chief Economist at 1st Trust Portfolios, likens the amount of dormant cash in the system to “gasoline next to the water heater.” This cash can stay dormant as long as short term rates remain low and banks can earn a decent relative return by either keeping their cash on deposit at the Fed, earning a risk-free 25 basis points or engaging in reverse repos. This appeals to banks when the alternative is making 0 basis points lending to the government short-term.

(Note: A reverse repo is when the Fed exchanges government bonds for cash with a promise to buy the bonds back later at a higher price, thereby removing this cash from circulation.)

When short-term rates rise and short-term government paper pays 50 basis points, or 100, or 200 basis points, those basis points being earned by keeping money at the Fed and out of circulation don’t look so appealing anymore. Mr. Westbury estimates that there is potentially $26 trillion in usable excess reserves that could get put to work in the real economy once short term rates begin to rise. Given that the US economy amounts to only $17 trillion – that’s an awful lot of gasoline sitting by the water heater awaiting a spark.

Things Are Heating Up

Things may be starting to heat up already. The 0.4% jump in the Consumer Price Index for May was the highest in over a year – kicking headline inflation to 2.1% annualized. Food prices rose at the fastest rate in three years.

Stocks may have cheered when Janet Yellen suggested that rates would remain at zero for the rest of the year, but gold exploded. The yellow metal rallied nearly $50 per ounce in a matter of hours the day following her press conference.

During the same press conference, the Fed projected its funds rate would hit 1.2% by the end of 2015 and 2.5% by the end of 2016. Could the big money be looking ahead a year or two when rising short-term rates cause the trillions on deposit with the Fed to start looking for a new home? Is gold beginning to smell the fumes?

What to Do Now

We don’t know when inflation will become a problem, but using the Fed’s own estimates, we expect things will heat up within two years. Add growing global instability and today’s nice chart-based set up, and a cheap insurance policy could be in order.

Many of our trading customers already own physical gold. With gold bouncing from its long term trend line, it may not be a bad idea to pick up additional exposure on the cheap. It you don’t own any gold, the trade suggested below could be an inexpensive way to gain exposure to it. If we do get a spark that sets off inflation, we think it is reasonable to expect the Midas Metal to test old highs just above $1,900 per ounce.

We are suggesting trading customers consider buying December 2016 COMEX $1,800 gold calls while simultaneously selling an equal number of December 2016 $1,900 gold calls for a total cost and risk of $800 or less, looking for gold to hit our $1,900 objective prior to option expiration on November 22, 2016.

The technical term for this trade is a “bull call spread.” Our net potential is $10,000 for each “spread” we buy. We have well over two years to be right.

If you would like to know more about this strategy or see our latest recommendations in other key markets, please call your personal RMB Group broker. If you do not have an account with us, contact us or call toll-free 800-345-7026 or 312-373-4970 direct and we will go over this trade with you – and we will send you everything you need to get started.

Visit us at www.rmbgroup.com to open an account online and/or see some of our other “big move” trading ideas. E-mail us with any questions atsuerutsen@rmbgroup.com.